Blog

Incentivized Increase in Housing Demand Not Expected to Last. Are Shadow Buyers Lurking?

Its a slow day in the market so I looked back at Fannie Mae's April Economic Outlook. Below are some observations….I am curious to hear anecdotal feedback from the community.

FANNIE MAE'S OVERALL OUTLOOK: A Long Slog to a Comeback

From FN's analysis:

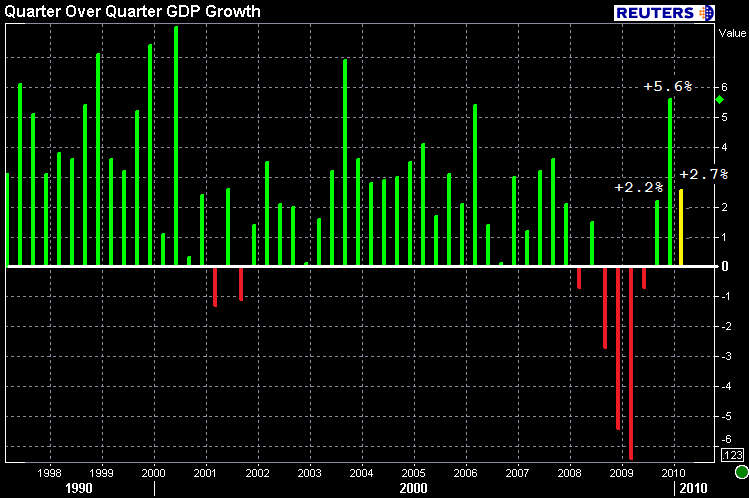

We expect economic growth to have decelerated from an annualized pace of 5.6 percent in the fourth quarter to 2.7 percent in the first quarter. The significant slowdown was a result of the diminishing impact of the inventory swing. At the same time we expect final demand, which is gross domestic product (GDP) minus changes in inventories, to grow just slightly slower than the fourth quarter pace.

The most encouraging sign during the first two months of the yearwas strengthening consumer spending. However, business investment inrn equipment and software softened, and residential investment pulled backrn sharply. While exports were strong, which helped support manufacturing,rn trade is not expected to contribute to growth in the first quarter asimports also rose at a robust clip. Incoming data have not warranted arn significant change in the outlook for the economy this year.

The chart below illustrates Fannie Mae's 1Q 2010 GDP forecast. They expect to see less reductions in business inventories resulting is a slower pace of GDP growth in Q1 2010. We have discussed the effect of shrinking inventories a few times in the past three months. HERE is the most recent commentary explaining the effect of contracting business inventories on overall domestic output growth.

More from the release:

Forrn all of 2010, we expect economic growth to be 3.1 percent—within thenarrow range of 3.0 to 3.2 percent that we have held since lastSeptember.

Our outlook is based on an expectation that final private demand will strengthen to replace the waning impact of the inventory swing and fiscal stimulus. For that to happen, meaningful improvement in labor market conditions must occur. Fortunately, there have been encouraging signs on that front. The fundamentals of the labor market appear to be improving as layoffs have slowed, while hiring has shown signs of life. The improvement will be gradual and uneven, and given the severity of damage done to the jobs market, it will be a long time before labor market conditions will return to the state that prevailed before the downturn.

Fannie Mae did address my biggest issue, the duration of unemployment:

The Household Survey points to a gloomier picture of long-term unemployment. The share of those suffering unemployment longer than six months rose to a record high of 44.1 percent in March, and the mean duration of unemployment increased to 31.2 weeks. The broad measure of the unemployment rate, which includes those working part-time because they cannot find full-time jobs and those not looking for work but who want to work and are available for work, edged up to 16.9 percent from 16.8 percent in the previous month. The labor market is facing a challenge for years to come. It will take a long time for some jobs to come back.

Plain and Simple: Fannie Mae thinks the worst case scenario economic has been avoided, but the road to recovery will be slow because of structural damage done to the labor market. Some of the jobs that were lost, have been lost forever. Only time will fully heal the economy.

In regard to housing, Fannie Mae expects a choppy recovery. I was glad to see they pointed out the fact that it's not necessarily a bad thing that housing starts and new home sales are not making much positive progress.

Recent major housing indicators have been bearish. Housing starts fell in February, led by a large drop in multifamily starts, while single-family starts fell slightly. During the past six months, single-family starts have basically moved sideways, hovering near an annualized level of 500,000….However, a much-below trend level of activity is necessary to restore balance to the housing market given soft demand for new homes. The fourth consecutive drop in new home sales in February brought sales to another record low.

I talked about the fact that we need to reduce the amount of existing inventory (plus shadow) before worrying about building new homes. It makes you wonder just how relevant housing starts data really is in the current housing environment. READ MORE

One other thing stood out to me that I feel is important…

Builders cited the lack of available credit for new projects, tough competition from the continual flow of distressed properties for sale, in some cases below production cost, and concerns over job security as factors weighing on confidence.

This means builders will need to fund new projects with cash. It's tough to allocate a lot of cash to a project that might end up turning out not as well as forecast. To me this implies builder's will be extra apprehensive about breaking ground. Another reason to believe the housing recovery will be choppy.

Fannie Mae does think home sales will rise before the expiration of the home buyer tax credit, but they do not expect that rebound to last long. All is dependent on the labor market.

Another leading indicator also suggests increasing sales in coming months: purchase applications have trended up beginning in late February and have risen nearly 25 percent in the last six weeks. Existing home sales should strengthen substantially in the second quarter, as more homebuyers rush to beat the expiring tax credit. With the tax credit pulling forward some sales into the first half of this year, we expect sales to pull back in the third quarter. If the labor market improves substantially as we anticipate in the fourth quarter, home sales should rebound and begin a self-sustaining recovery without the help of a tax subsidy.

Even with an expected gain in March total home sales, sales for thefirst quarter are likely to be much lower than we projected earlier,causing us to revise downward the trajectory of sales going forward. Forrn all of 2010, we project about a 6.0 percent increase in sales, comparedrn with a 9.0 percent increase projected in the previous forecast.

Here is Fannie Mae's outlook for originations:

That is a $640 billion decline in new originations. Both the primary and secondary mortgage market are already feeling the effects of this contraction. Mortgage rates did not move higher after the Fed exited the agency MBS market because of a continued slowdown in loan production. READ MORE. SEE CHARTS

Thinking about the housing market after the tax credit….

I wonder how many potential buyers who do not qualify for the extended version of the tax credit are waiting around for the incentive to expire before re-entering the housing market. This play is based on the speculative theory that housing prices will move lower once government stimulus is removed. We could call this group of potential homebuyers/mortgagors: “shadow buyers”

Any loan originators or real estate professionals have clients who are operating under this rationale? Are there enough shadow buyers to offset shadow inventory? If there are shadow buyers, banks better not start liquidating REO before demand is stable….READ MORE

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment