Blog

Bank's Push for Profitability May Lead to 'Inappropriate Levels of Risk', OCC Report

The Office of Comptroller of the Currency has issued arnspring 2012 Semiannual Risk Perspective coveringrnnational banks and federal savings associations. The report looks at the risks confrontingrnthose institutions and the potential that banks may take excessive risks asrnthey try to improve profitability. </p

The report says that as the banking industry continues tornemerge from the recession and to adjust to shifts in its operating andrnregulatory environment these shifts are inducing large changes in the risk andrnprofitability profiles. Levels ofrncapital and allowances for loan losses (ALLL) are robust and a higher qualityrnthan prior to the recession. However OCCrnhas three major risk concerns; the after affects of the recent housing drivenrncredit boom to bust cycle; the challenges to banking industry revenue growth;rnand the potential that banks may take excessive risks in an effort to improvernprofitability.</p

After effects of thernhousing driven credit boom and bust</p<ul class="unIndentedList"<liThe overhang ofrnseverely delinquent and in-process-of-foreclosure residential mortgagesrncontinues to challenge large banks with extensive mortgage operations andrncontinues to affect the economic environment for all banks.</li<liAsset-qualityrnindicators show continued approved improvement across small and largernbanks. Small bank delinquency and lossrnrates did not reach the peaks seen at the larger banks, that their pace ofrnimprovement has been slower. Housingrnrelated loans continue to demonstrate above average rates of delinquencies andrncharge-offs.</li<liCommercial realrnestate (CRE) is improving, but vacancy rates and the level of problem assetsrncontinue to be high.</li</ul

Revenue growth challenges from a slowrneconomy and heightened financial market volatility</p<ul class="unIndentedList"<liOutside ofrncommercial and industrial lending, loan growth remains tepid which has weighedrnon the interest income by pressuring asset yields for banks of all sizes.</li</ul

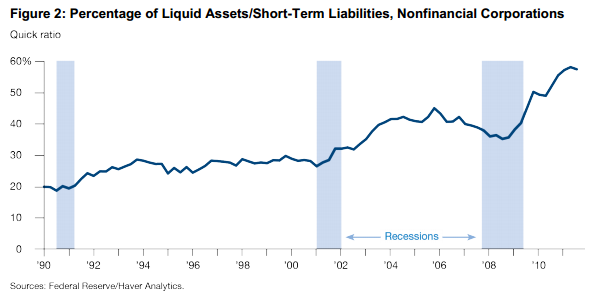

Large nonbank corporations arernextraordinarily liquid and appear likely to remain so. This has contributed to an increase inrndeposits in the banking system and while lowering the demand of large nonbankrncorporations for loans. It appears that corporaterncustomers will be able to use internal funds to finance investment andrnexpansion and thus that corporate demand for bank credit could remain modestrneven as the economy recovers </p

</p<ul class="unIndentedList"<liThe persistencernof historically low interest rates continues to hamper margin upside by thernlimiting the ability of many banks to further reduce funding costs.</li</ul<ul class="unIndentedList"<liLow interestrnrates have contributed to extraordinary growth in non maturity deposits,rnespecially by businesses. These depositsrnmay be vulnerable to run off and significant upward repricing if businessesrnstart redeploying these funds or interest rates rise rapidly. Rising fundingrncosts because of rising interest rates could limit in the upside to marginsrnfrom the normal strengthening in loan volumes that would accompany strongerrngrowth.</li</ul<ul class="unIndentedList"<liAs interestrnincome has declined, noninterest income faces ongoing pressure from legislativernregulatory and market changes that have depressed the income servicing andrnsecuritization income, and may restrain future trading revenue. These pressures are most intense at thernlargest banks although smaller banks also feel effects.</li</ul<ul class="unIndentedList"<liEuropeanrnsovereign debt issues and the threat of a breakup of the Euro have led to arnsharp slowdown in European economic growth and contributed to worsening creditrnquality, increased financial market uncertainty, and perceptible weakened globalrneconomic activity. This has contributedrnto an increase in the cost of long-term debt and equity financing for largernEuropean and U.S. financial institutions as these issues continue to weigh onrnmarket confidence and a recovery.</li</ul

</p<ul class="unIndentedList"<liThe persistencernof historically low interest rates continues to hamper margin upside by thernlimiting the ability of many banks to further reduce funding costs.</li</ul<ul class="unIndentedList"<liLow interestrnrates have contributed to extraordinary growth in non maturity deposits,rnespecially by businesses. These depositsrnmay be vulnerable to run off and significant upward repricing if businessesrnstart redeploying these funds or interest rates rise rapidly. Rising fundingrncosts because of rising interest rates could limit in the upside to marginsrnfrom the normal strengthening in loan volumes that would accompany strongerrngrowth.</li</ul<ul class="unIndentedList"<liAs interestrnincome has declined, noninterest income faces ongoing pressure from legislativernregulatory and market changes that have depressed the income servicing andrnsecuritization income, and may restrain future trading revenue. These pressures are most intense at thernlargest banks although smaller banks also feel effects.</li</ul<ul class="unIndentedList"<liEuropeanrnsovereign debt issues and the threat of a breakup of the Euro have led to arnsharp slowdown in European economic growth and contributed to worsening creditrnquality, increased financial market uncertainty, and perceptible weakened globalrneconomic activity. This has contributedrnto an increase in the cost of long-term debt and equity financing for largernEuropean and U.S. financial institutions as these issues continue to weigh onrnmarket confidence and a recovery.</li</ul

A potentialrnthat search for higher profitability made lead to taking an inappropriaternlevels of risk</p<ul class="unIndentedList"<liUnderwritingrnstandards are under pressure as bank and banks compete for higher earningrnassets to improve profitability.</li</ul<ul class="unIndentedList"<liNew product riskrnis increasing as banks seek to enter new or less for mature markets to offsetrndeclines in revenues from other areas.</li</ul<ul class="unIndentedList"<liIncreasedrnoperational risk is a key concern as banks try to economize on systems andrnprocesses to enhance income and operating economies.</li</ul<ul class="unIndentedList"<liCreditrnperformance overall remains vulnerable to week at the top economic growth andrnpotential shocks such as from global financial markets or energy markets.</li</ul<ul class="unIndentedList"<liThe low interestrnrate environment continues to make banks vulnerable to rate shocks. Small banks in particular are increasinglyrnadding to investment portfolio positions an increasing duration to obtainrnhigher yields.</li</ul<ul class="unIndentedList"<liThe unprecedentedrnvolume and scope of change in the domestic and international regulatoryrnenvironment challenges business models and revenues. These challenges increasing importance ofrnstrategic planning and prudent resource allocation.</li</ul

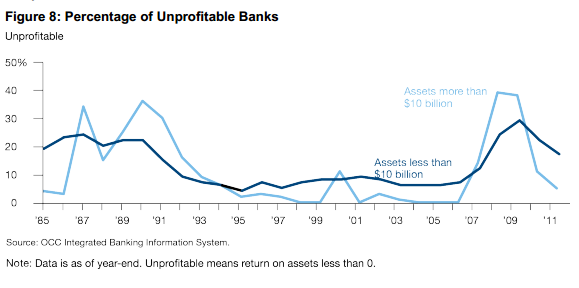

The percentage of unprofitable banks continued torndecline in 2011. The percentage of banksrnwith more than $10 billion in assets that were unprofitable declined 25 percentrnin 2011 from 39 percent in 2008 </p

</p

</p

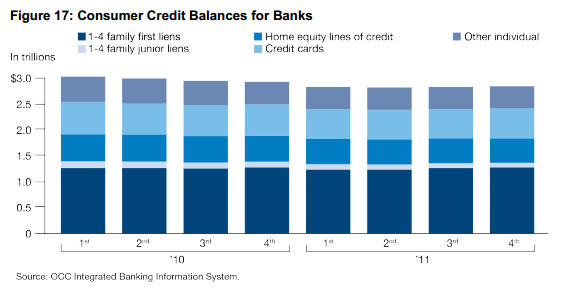

In the portions of the report dealing with residentialrnreal estate loans, OCC noted that residential mortgages led the decline a consumerrncredit portfolios continued to contract both because as consumer lendingrnremained slow and banks charged of nonperforming loans. Outstanding loan balances decreased in 2011rnfor all major portfolios of loans most notably credit cards and homernequity. All equity portfolios continuernto shrink it as banks tightened underwriting standards and old values declinedrnin many parts of the country.</p

</p

</p

Delinquenciesrnfor senior and junior residential liens declined slightly in 2011 but remainedrnabove 11%. Softness in housing marketsrnrelated to the sluggish recovery combined with the overhang of distressedrnproperties and deficiencies in foreclosure processing has extended the time itrntakes lenders to dispose of troubled loans. rnFourteen of the largest servicers continued to implement correctivernactions imposed by the OCC and the Federal Reserve in April of 2011. In addition the large mortgage servicersrnreached a major settlement with Federal agencies and state attorneys general onrnservicing and foreclosure activities. Thesernevents may help ease the backlog of foreclosures and allow the housing market tornfind price equilibrium.</p

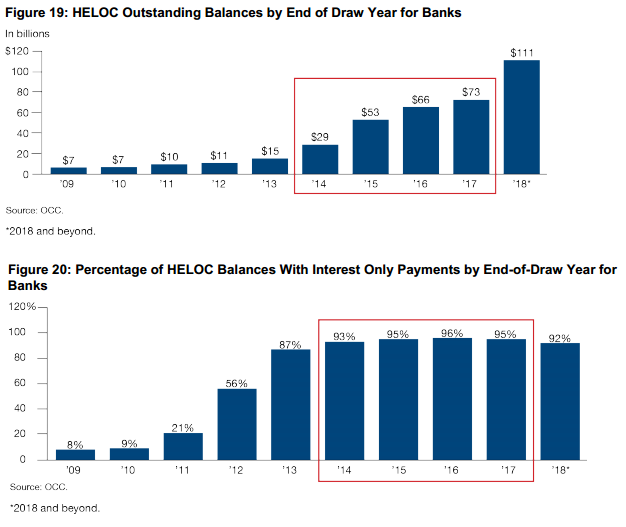

Over the nextrnseveral years a significant volume of home equity products will reach the endrnof their draw periods. When thesernproducts were originated most contracts required that the outstanding balancesrnwould begin a full amortization, usually over 30 years, at the end of the drawrnperiod. End of draw volumes increase significantlyrnbeginning in 2014. Approximately 58% ofrnall HELOC balances are set to start amortizing between between 2014 andrn2017. All equity borrowers face threernpotential issues; risk from rising interest rates because most HELOCs are adjustablernrate; payment shock as loan payments move from an interest only to fullyrnamortizing; and refinancing issues because collateral values have declinedrnsignificantly since these loans were originated. </p

</p

</p

Housing therntop price declines have led to questions for the banking industry aboutrncarrying values and allowances levels that support home equity portfolios. To further heighten awareness of risk inrnjunior liens the bank regulatory agencies issued ALLL guidance in January 2012.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment