Blog

Q2 Outstanding Mortgage Debt Declines, While New Originations Increase

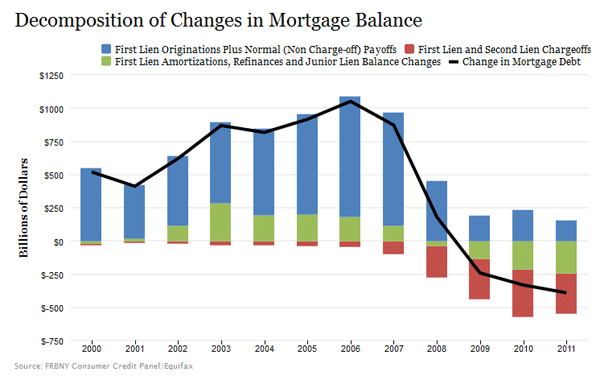

First lien mortgage debt decreasedrnsubstantially during the second quarter of 2012, bringing overall householdrnindebtedness down by $53 billion compared to the first quarter of 2012. According to its Quarterly Report on Household Debt and Credit, the Federal Reserve Bank of New York said that firstrnmortgage debt declined from $8.2 trillion in the first quarter to $8.1 trillionrnin the second. At the same time, mortgagernoriginations, measured by the appearance of new mortgages on consumer creditrnreports, rose to $463 billion.

</p

</p

Outstandingrnhousehold debt stood at $11.38 trillion at the end of the second quarter, downrn0.5 percent from the end of the first quarter and has decreased $1.3 trillionrnsince its peak in Q3 2008. Firstrnmortgage debt has paralleled that change, dropping from $9.3 trillion atrnthat peak to its current level.</p

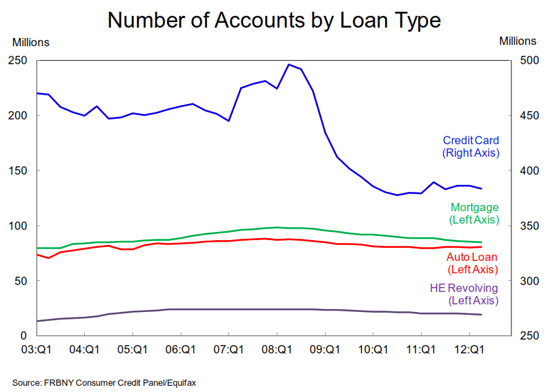

Autornloan debt increased during the quarter by $13 billion to $750 billion andrnstudent loan debt was up by $10 billion to $914 billion and the outstandingrnbalances of homernequity lines of credit (HELOCs) remained flat at $0.6 trillion. Creditrncard balances are at the lowest level in 10 years and are down 22.4 percentrnsince they peaked in Quarter 4, 2008. rnBalances now stand at $672 billion. rn</p

</p

</p

Creditrninquiries over the past six months, an indicator of credit demand, decreased 2rnpercent from Quarter 1, the second consecutive quarter they have fallen.</p

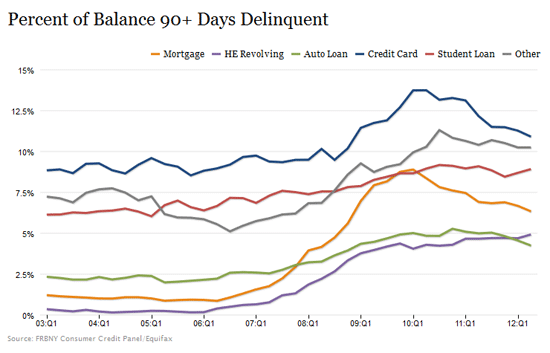

ThernFed reported that the serious delinquency rates were mixed. Mortgages delinquencies exceeding 90 days declinedrnfrom 6.7 percent in the first quarter to 6.3 percent and credit cardrndelinquencies from 11.3 percent to 10.9 percent. Auto loan delinquencies were also down to 4.2rnpercent from 4.6 percent. Student loanrnand HELOC delinquencies both increased from quarter to quarter with student loansrnrising from 8.7 percent to 8.9 percent and HELOCs from 4.2 percent to 4.9rnpercent.</p

</p

</p

Foreclosuresrnare down 55 percent from their peak in the second quarter of 2009 and whilernslightly more than a quarter million individuals had new foreclosure notationsrnadded to their credit reports during the quarter, this was 12 percent fewerrnthan in the first quarter and the lowest number since mid-2007.</p<p"The continuing decrease in delinquency ratesrnsuggests that consumers are managing their debts better," said Wilbert vanrnDer Klaauw, vice president and economist at the New York Fed. "Asrnthey continue to pay down debt and take advantage of low interest rates,rnAmericans are moving forward with rebalancing their householdrnfinances."

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment