Blog

Foreclosures Rise From 75-Month Low, Quickly in Some States

<pRealtyTrac reportedrntoday that an increase in bank repossessions in May boostedrnforeclosure activity by 2 percent compared to April when foreclosurernactivity had reached a 75-month low. There were foreclosure filingsrn- default notices, schedules auctions, and bank repossessions orrnREO – reported on 148,054 U.S. properties during the month which,rnwhile a higher number than April was down 28 percent from the Mayrn2012 total of 205,990 filings. One in every 885 U.S. Housing unitsrnwas the subject of a foreclosure filing in May compared to or one inrnevery 639 a year earlier.. </p

RealtyTrac,rnin its U.S. Foreclosure Report saidrnthe foreclosure problem continued to shift away from non-judicialrnstates and toward judicial states which accounted for five of the toprnsix foreclosure rates nationwide: Florida, Ohio, Maryland, SouthrnCarolina and Illinois. At No. 2, Nevada’s foreclosure rate was thernhighest ranked among non-judicial states.</p

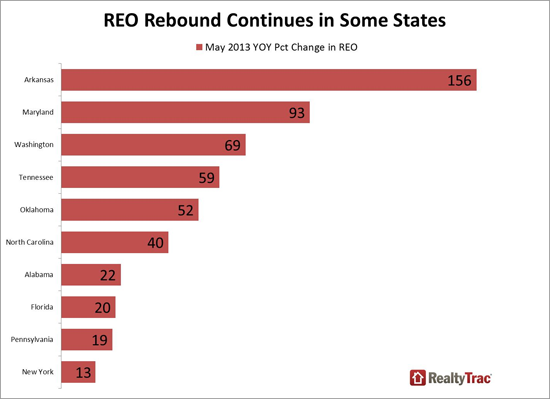

Foreclosurernor REO activity increased by 11 percent in May with 38,946 propertiesrntaken into bank inventories, down 29 percent from a year earlier. Thirty-three states noted increases in REO activity from April, somernsubstantial. North Carolina was up 60 percent, Oregon 57 percent, and Wisconsin and Illinois both increased 44 percent. REO activityrnincreased 9 percent month-over-month in non-judicial states and 13rnpercent in judicial states.</p

</p

</p

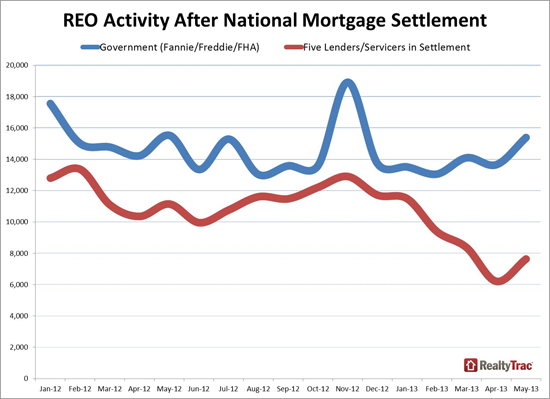

Amongrnthe five lenders involved in last year’s national mortgagernsettlement, all but one (Citi) posted monthly increases in REOrnactivity, indicating that temporary stoppages of foreclosure salesrnannounced during the month by some of the lenders involved in thernsettlement had little lasting impact on the number of completedrnforeclosures for the month.</p

</p

</p

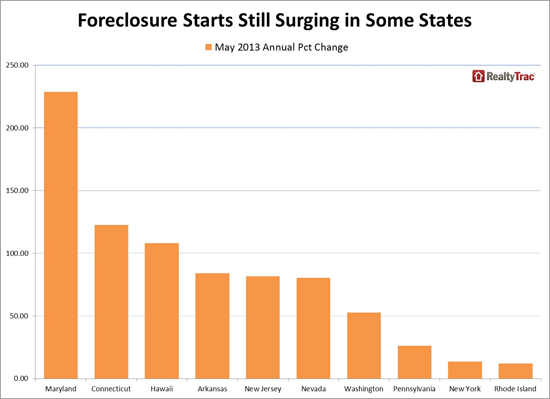

Therernwere 60,311 foreclosure starts in May, a 4 percent increasernmonth-over-month but 33 percent below the 109,051 filings one yearrnearlier. Foreclosure starts increased from the previous month in 26rnstates and were up from a year ago in 14 states. Large annualrnincreases occurred in Maryland (+229 percent), Connecticut (+122rnpercent), Hawaii (+108 percent), Arkansas (+84 percent), New Jerseyrn(+82 percent) and Nevada (up 81 percent).</p

</p

</p

Foreclosurernfilings increased 20 percent in Florida in May, pushing the state tornthe top in total foreclosure activity, up from the number two rankingrnin April. One in every 302 Florida housing units received a filingrnduring the month, nearly three times the national average. Foreclosure starts were up 39 percent and scheduled foreclosurernauctions increased 6 percent from April and were up 79 percent from arnyear earlier. Bank repossessions increased 14 percent month overrnmonth and 20 percent on an annual basis.</p

Nevadarnsaw its first annual increase in foreclosure activity in 27 monthsrnbut still slipped from first to second place among the states. Onernin every 305 housing units was the subject of a foreclosure filingrnwith foreclosure starts jumping 81 percent compared to May 2012. </p

Ohiornposted the nation’s third highest state foreclosure rate for thernsecond month in a row in May, with a total of 8.770 properties or onernin every 584 housing units with a foreclosure filing during thernmonth. Maryland’s overall activity increased 11 percent from Aprilrnand 134 percent from a year earlier and the state now ranks fourthrnnationally South Carolina foreclosure activity decreased 2 percent from the previous month and was down 11 percentrnfrom a year ago, but the state still posted the nation’s fifthrnhighest activity rate in May with a foreclosure filing for one inrnevery 600 housing units. </p

“Foreclosurernactivity continued to bounce back in some markets where it may havernappeared the foreclosure problem had been knocked out by anrnaggressive combination of foreclosure prevention efforts over thernpast two years,” said Daren Blomquist, vice president atrnRealtyTrac. “Places like Nevada, where foreclosure starts increasedrnto a 20-month high, and Maryland, where overall foreclosure activityrnincreased to a 33-month high. Still, the emerging housing recoveryrnhas strengthened most local markets enough to quickly shake off a fewrnmore blows from these nagging foreclosures.”</p

Amongrnthe nation’s 20 largest metros, those with the biggest increases inrnmedian home prices tended to be in states where a non-judicialrnforeclosure process has allowed foreclosures to be absorbed by thernmarket more quickly. Seven of the 10 metros with the biggest jumps inrnmedian home prices from a year ago were in non-judicial states, whilernall five metros with flat or declining median prices were in statesrnwith a judicial foreclosure process.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment