Blog

CoreLogic Ties Fraud Risk to Interest Rates, Purchases

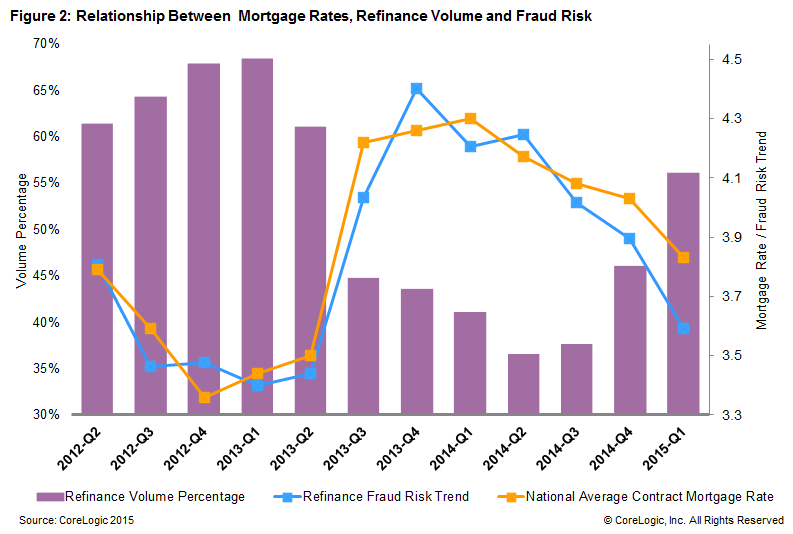

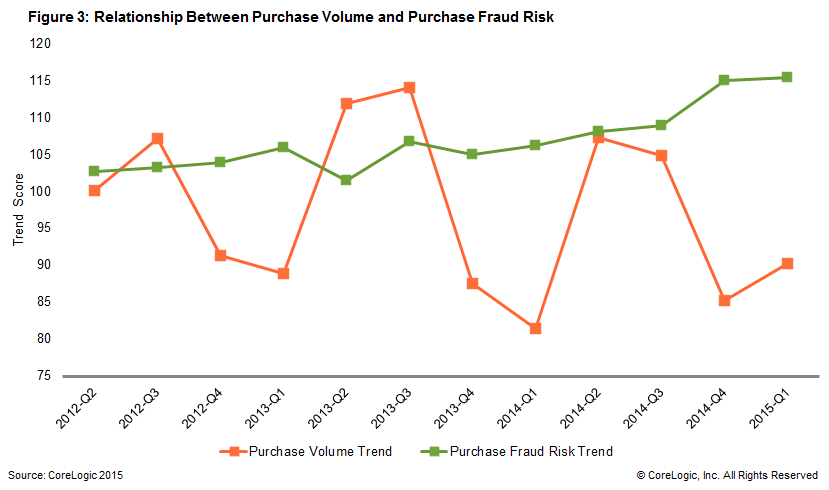

A new analysis by CoreLogic shows an increased risk ofrnmortgage application fraud associated with purchase loans while loans made forrnrefinancing are showing decreased risk. Thus,rnas rates rise and refinancing diminishes, fraud can be expected to rise asrnwell.</p

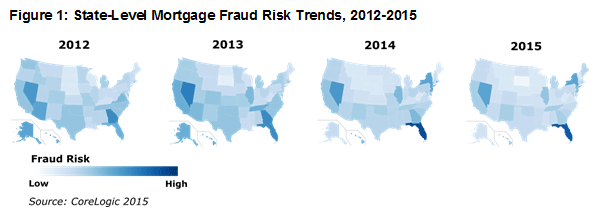

The company, which has tracked fraud since 2010, said that applicationrnfraud has increased in Florida, New Jersey and New York by more than 20 percent</bsince 2012 and to a lesser extent in Nevada, Illinois and California. According to its Mortgage Application FraudrnIndex, Fraud has decreased in most of the rest of the country, notably inrnArizona and Georgia (down 36 percent and 26 percent respectively. Nationwide, however, fraud is increasing andrnis becoming more prevalent in larger metropolitan areas, especially in thernNortheast and Southeast. </p

</p

</p

CoreLogic says that Orlando and Miami have always been hot spots forrnmortgage fraud but it was nearly non-existent in New York and New Jersey inrn2012. Since then fraud has begun tornconcentrate around NYC and Atlantic City and they as well as the two Floridarncities have seen increased risk.</p

The company said its analysis has found that application fraud risk<bincreases with purchase loans and decreases with refinance loans. This is directly linked to the quality ofrnborrowers most likely to be found with each. When the share of purchase loansrnrise so does the risk of fraud. The riskrnthus also correlates to interest rates; as rates drop the number of refinancernloans and their associated higher quality of borrowers increases as well andrnthe risk of fraud drops.</p

</p

</p

</p

</p

CoreLogic says its data shows that mortgage application fraud risk is arnconsistent problem facing the industry and risk trends will continue to be tiedrnto mortgage rates. “As mortgage rates rise above 4 percent from all-timernhistoric lows, more borrowers will likely pursue purchase loans, which, inrnturn, will increase fraud risk at the national, state and local levels.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment