Blog

Fed Can Hike Even Without Inflation – Wells Fargo

Since early 2014 the Federal Reserve hasrnheld out two goals that must be achieved before it raises the Federal Fundsrnrate, “maximum employment and inflation of 2 percent.” In an Inflation Chart Book report this weekrnWells Fargo’s Economics Group examine why inflation, or lack of it, should not preclude</bthe anticipated September liftoff.</p

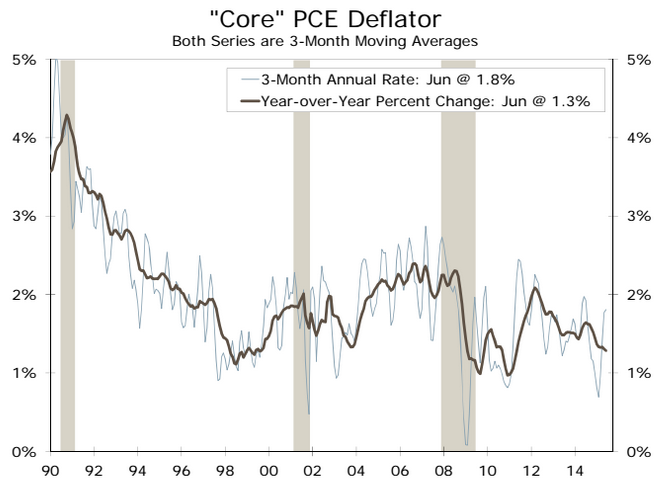

Economists Sam Bullard and Sarah Housernwrite that weak inflation has been the biggest impediment to the Fed normalizingrnmonetary policy this year and inflation, while rising over spring and earlyrnsummer is still not where policymakers would like it to be. Increases in the personal consumptionrnexpenditure (PCE) deflator (2.4 percent) and the Consumer Price Index (CPI) (3.5 percent) overrnthe last three months suggests thatrninflation should continue to move back toward the Fed’s target but thesernheadline gains are in near-term jeopardy. </p

</p

</p

Bullard and House cite the followingrneconomic factors as stoking their concerns.</p

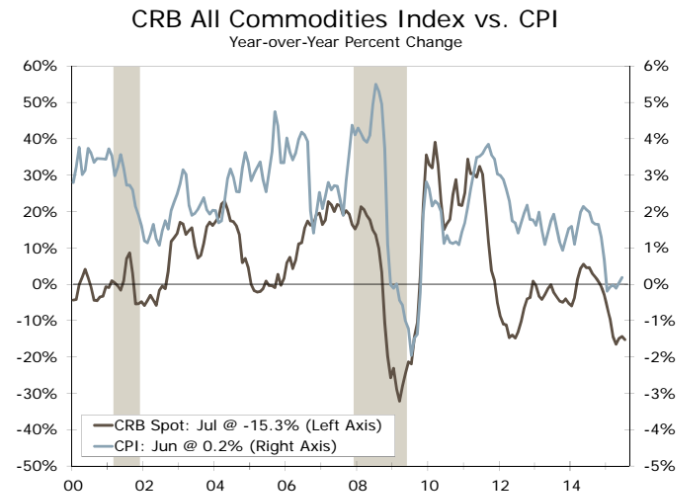

Commodity prices, including those forrnenergy, industrial metals, crops, and livestock have tumbled recently duernprimarily to renewed jitters about the Chinese economy. The dollar has also continued to strengthen. The result has been an increase in the broadrntrade-weighted dollar index of 2.6 percent over the last month. Oil prices have fallen more than 20 percent sincernthe end of June and the CRB metals index is at the lowest level in five years. As commodity prices tend to show up almostrnimmediately, the 3.7 percent drop in the CRB index will likely be felt in the Julyrninflation figures. </p

</p

</p

The authors speculate that a 10 percentrndrop in the CRB, if sustained would slice off 0.4 points from year-over-yearrninflation but will have a more modest impact on core inflation. The core PCE deflator increased at a 1.7rnpercent annualized clip over Q2 and core CPI inflation is up at a 2.3 percent pacernin the past three months amid further gains in shelter, transportation and medicalrncare costs. But will this be enough?</p

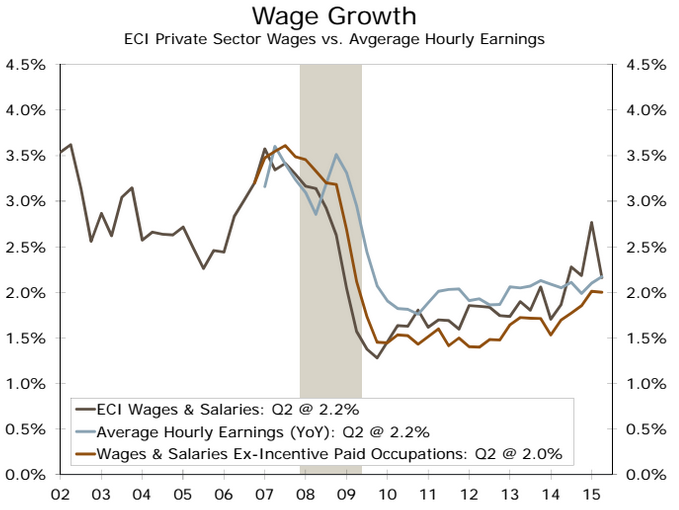

Wage inflation continues to be soft andrnthe latest number on average hourly earnings (AHE) and the Employment Cost Indexrn(ECI) have cast some doubt on how close the labor market is to full employment.rnThe authors say the June AHE and Q2 ECI may have overstated the weakness in laborrncosts; there remains no definitive uptrend in wage growth but no abruptrnslowdown either.</p

</p

</p

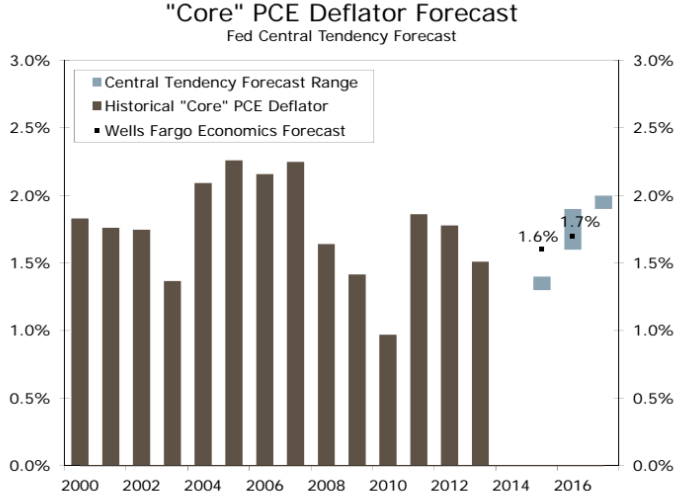

Core inflation, even if it improves some,rnis likely to stay below the 2 percent Fed target at least through next year butrnthis alone does not preclude it from beginning to raise rates later thisrnyear. The effects of monetary policy lagrnimplementation and the FOMC has been clear about its willingness to act as longrnas it looks as though inflation will hit their target within a year orrntwo. The Fed began to lift rates in thern2004-2006 tightening cycle when the PCE deflator had risen only 1.4 percent onrnan annual basis and demonstrated a 1.6 annualized rate in the prior threernmonths – close to the rate today. Therndifference however, the economists say, is that in 2004 commodity prices wererntrending higher and the dollar was weakening.</p

The headwinds from those two factors are<bnot new although they have intensified over the last month. Almost all FOMC members anticipated thatrnrates would lift off this year even when the most optimistic forecast only putrnthe core PCE deflator up by 1.6 percent in the fourth quarter. Fed Chair Janet Yellen has increasingly emphasizedrnthat an earlier liftoff may allow a more gradual tightening which she views asrnthe prudent approach. </p

</p

</p

Bullard and House conclude, “We look for corernand headline inflation to move gradually higher in the second half of this year,rnwith the core PCE deflator moving up to 1.5 percent by year-end. With corerninflation showing clear signs of a pickup and further tightening in the labor marketrnsupportive of stronger wage growth, our base case remains for the Fed to begin raisingrnrates in September.”</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment