Blog

Housing Attitudes Reverse Course in Fannie Mae Survey

Negativity was pervasive in the results of Fannie Mae’s JulyrnNational Housing Survey (NHS). rnRespondents indicated falling expectations about the economy, housing,rnand their own personal financial situation. rnThey did however feel that home prices would continue to rise – which couldrnbe either positive or negative depending on the perspective – as well as interestrnrates.</p

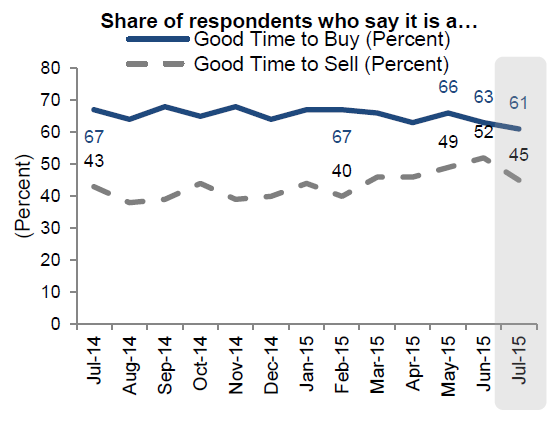

After climbing fairly steadily earlier in the year, July sawrna huge 7 percentage point drop in the percentage of respondents who believe nowrnis a good time to sell a house. Those who believernit is a good time to buy dropped to 61 percent-an all-time survey low. </p

</p

</p

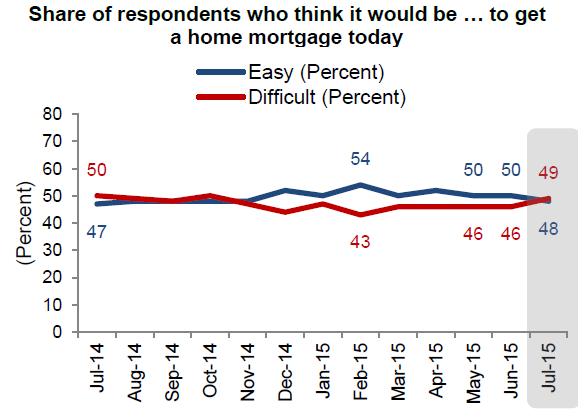

Forty-nine percent ofrnrespondents expect home prices to increase over the next 12 months, 2rnpercentage points more than in June, with an average expectation of a 3 percentrngain. Just over half of respondentsrnexpect mortgages rates to go up over the next year, an uptick of 1 point. Those who feel it would be difficult for themrnto obtain a mortgage rose from 46 to 49 percent with a slightly smallerrncorrespondent fall in those who expect no problems. It was the first survey since October inrnwhich more respondents expected a difficult time with financing than did not.</p

</p

</p

“Consumer attitudes toward housing slidrnback this month,” said Doug Duncan, senior vice president and chief economistrnat Fannie Mae. “The share of consumers who think it’s a good time to sell arnhome posted a sizable decrease from a record high in the prior month, even asrnhome price change expectations strengthened. Deteriorating consumer assessmentsrnof income growth over the past year as well as increased caution around therndirection of the economy and personal financial expectations may berncontributing to the pullback in sentiment. Still, it is premature to read toornmuch into this month’s results as the survey was taken around the time ofrnincreased global turmoil, including Greece’s potential default and China’srnstock market plunge, which has receded somewhat. Most of our key indicators arernas strong or stronger than they were at this time last year, which isrnindicative of an improving housing market this year.”</p

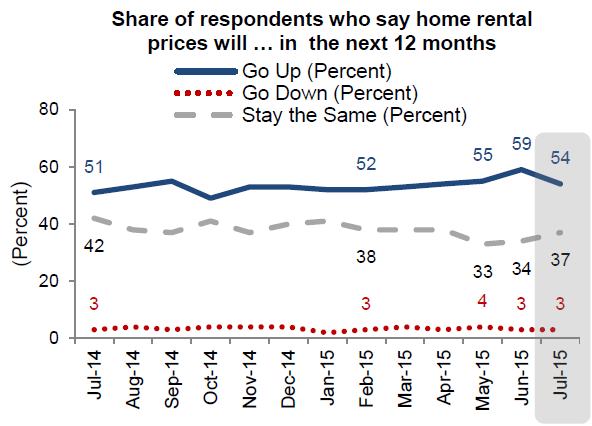

The share ofrnconsumers saying the economy is on the wrong track rose by 3 percentage pointsrnto 54 percent in July. This laggingrnconfidence in the economy may be behind a 5 percentage point drop in those whornthink rents will continue to increase over the next year. The 54 percent who do expect increases havernraised their expectations slightly, from 4.2 to 4.5 percent. </p

</p

</p

Those who expectrntheir personal financial situation to improve over the next year fell to 44rnpercent, while those reporting a significantly lower income compared to 12rnmonths ago increased to 15 percent-marking the first change in this indicatorrnin three months. Those who say theirrnhousehold expenses are significantly higher than they were 12 months agornremained at 31 percent.</p

The Fannie Mae survey polls 1,000rnAmericans by phone each month. rnRespondents include both homeowners and renters and the more than 100rnquestions asked are designed to assess attitudes toward owning and renting arnhome, home and rental price changes, homeownership distress, the economy,rnhousehold finances, and overall consumer confidence. The survey has beenrnconducted monthly since June 2010.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment