Blog

Easing Credit Access Tilted by Jumbo Products

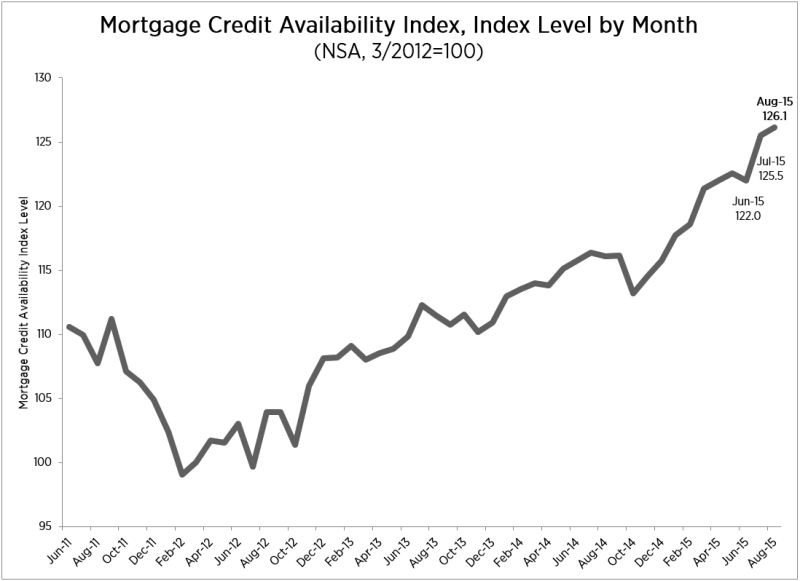

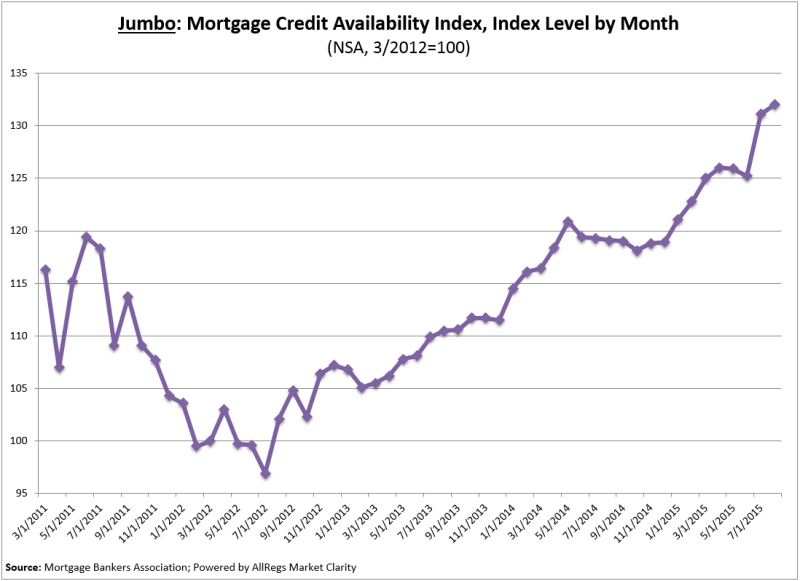

Mortgage credit access continued to improve again in Augustrnthe Mortgage Bankers Association (MBA) said on Thursday. The trade group’s Mortgage CreditrnAvailability Index (MCAI) gained 0.5 percent compared to July and is up morernthan four points since June. MBA saidrnAugust was the eighth month out of the last nine that the index has posted anrnincrease. A declinernin the MCAI indicates that lending standards are tightening, while increases inrnthe index are indicative of loosening credit. </p

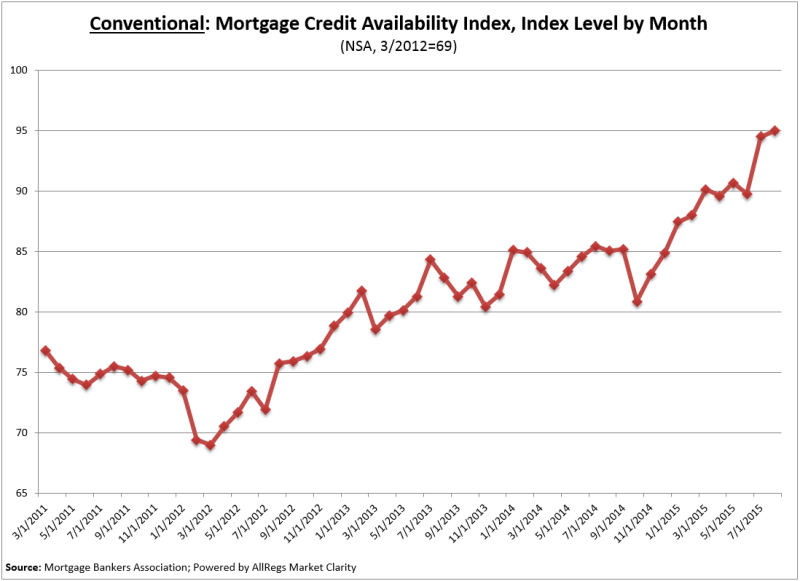

Mike Fratantoni, MBA’s chief economist said the jumbo loansrnhave been the source of most of the loosening credit. He added “The availability of conformingrnconventional mortgage credit has also somewhat increased, including forrnmortgages with higher loan-to-value ratios and borrowers with lower creditrnscores. Fannie Mae recently announcedrnchanges to their affordability suite of products, but those changes have notrnyet impacted the MCAI.”</p

</p

</p

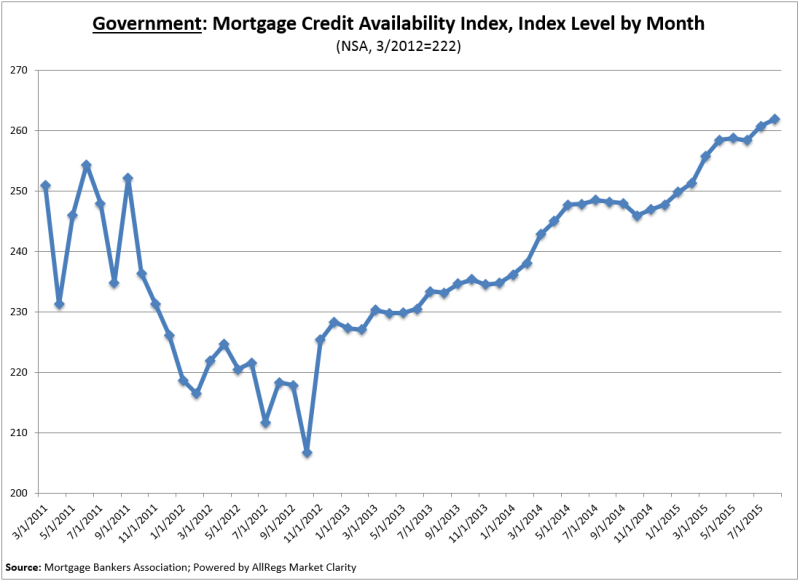

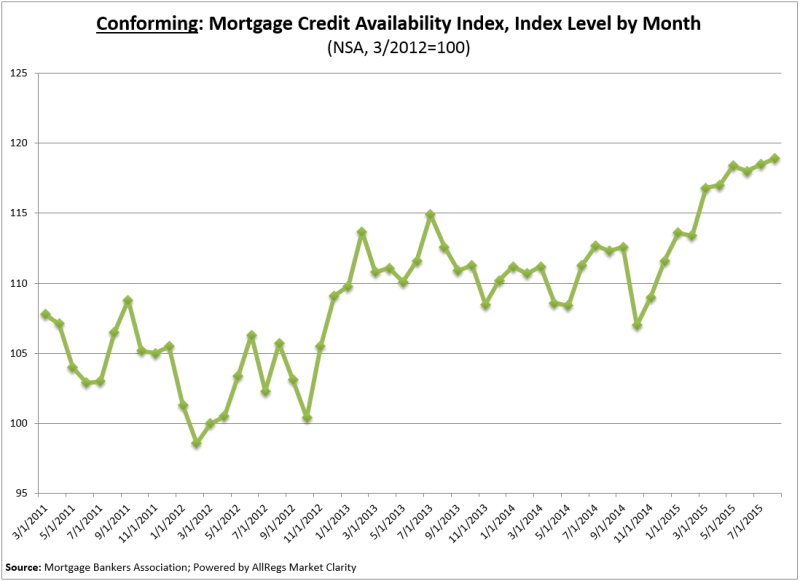

All of the MCAI’s component indices also gained ground with,rnas Fratantoni indicated, the Jumbo MCAI loosening the most, up 0.7rnpercent. The Conventional MCAI rose 0.5rnpercent, the Government index was up by 0.4 percent and the Conforming MCAI byrn0.3 percent.</p

</p

</p

</p

</p

</p

</p

</p

</p

The composite MCAI and the Conforming and Jumbo indices have arnbase period and value of March 31, 2012=100. rnThe base for the Conventional MCAI March 31, 2012=69 and the Government MCAI is March 31, 2012=222.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment