Blog

ABA Breaks Down Mortgage Lending in 2011

The American Banking Association (ABA) has found that real estate lendingrnconditions at the end of 2011 were little changed from those at the end of 2010rndespite increasing regulations, compliance costs and a lack of clarity aboutrnrules. ABA reported the results of itsrn19th annual Real Estate Lending Survey on Tuesday.</p

The survey involved 185 banks, 86 percent of which were smaller communityrnbanks with assets under $1 billion. rnFifty-six percent of the participants were commercial banks and 68rnpercent were stockholder-owned.</p

The banks reported that refinancing made up 63 percent of mortgagernactivity in 2011 compared to 66 percent in 2010 but about the same percentagernas in 2009. Fixed rate loans representedrn80 percent or originations compared to 81 percent the year before and 30-yearrnloans made up 47 percent of all originations, down 1 percentage point from thernyear before.</p

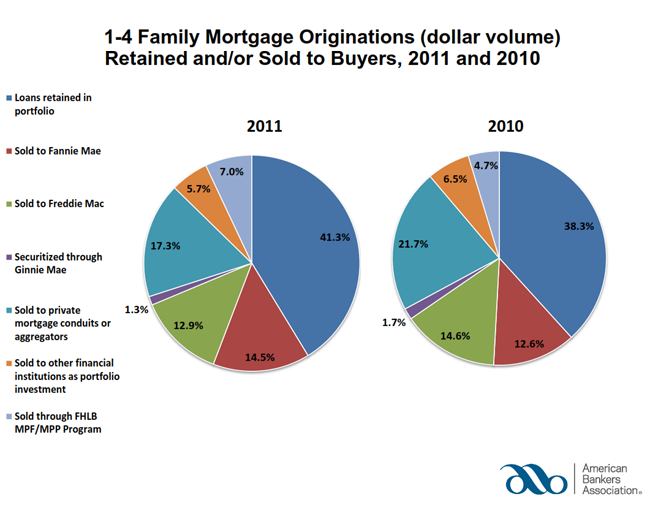

Banks retained 41 percent of thernone-to-four family mortgages they originated during the year, an increase of 3rnpercentage points, and sold 27 percent directly to one of the governmentrnsponsored enterprises (GSEs), unchanged from 2010 but triple the volume inrn2006. Salesrnto aggregators fell from 21.7 percent in 2010 to 17.3 percent in 2011, whilernsales to the Federal Home Loan Bank programs increased from 4.7 percent to 7.0rnpercent. </p

</p

</p

Conformingrnloans made up 72.0 percent of production, down from 72.0 while non-conformingrnloans increased from 11.6 to 14.0 percent. rnFHA loans were down from 6.5 percent to 5.0 percent and Jumbornoriginations increased slightly to 9.0 percent from 8.7 percent. Mortgage features such as piggy-backs, lowrndocumentation loans and pre-payment penalties have virtually disappeared inrnrecent years. The only loan feature surveyedrnthat had a greater than 5 percent reported occurrence was balloon payments.</p

</p

</p

Mortgagesrnto first-time homebuyers represented 9 percent of originations, virtuallyrnunchanged over the last two years. Thernpercentage of loans written with loan-to-value ratios of 60-80 percent rosernslightly from 48 percent in 2010 to 51 percent with the difference made up byrnvery slight decreases in several higher LTV categories.</p

Two-thirdrnof the banks surveyed used some type of automatic loan underwriting system withrnDesktop underwriter being the most popular type. A majority, 55 percent, reported that they dornnot scan or image loan documents for transmittal but 61 percent said imagingrnwas a priority for 2012.</p

Respondentsrnsaid that their major concerns regarding the mortgage market in 2012 were:</p<ul

“Continued concern about forthcoming mortgage rules and thernunknown future of Fannie Mae and Freddie Mac have increased lending uncertaintyrnin an already sluggish market,” said ABA’s Executive Vice President Bob Davis.rn”Clarity through well-constructed rules that ensure credit availability forrnqualified borrowers is essential for the housing recovery.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment