Blog

Administration Releases October Housing Scorecard

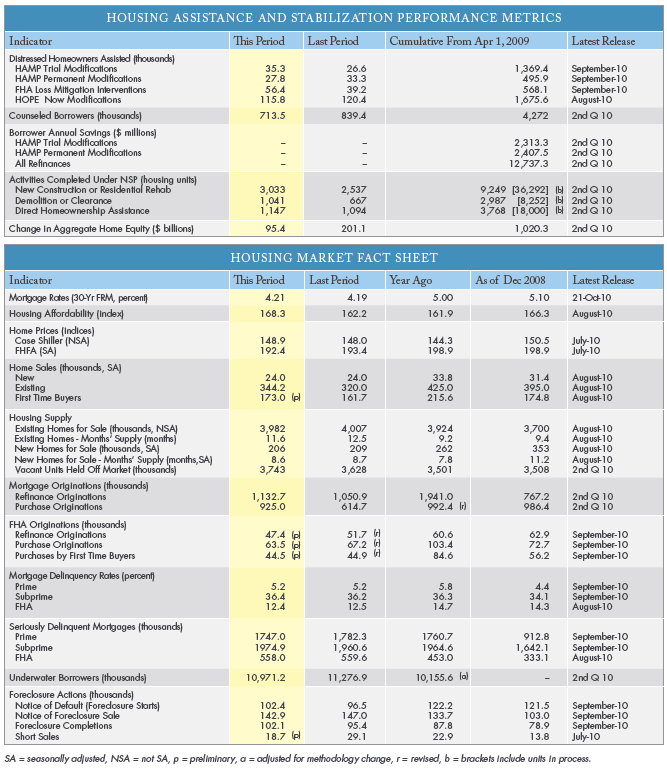

The take-away from the Octoberrnedition of the monthly housing scorecard issued by the Obama Administration onrnMonday is that, nine months after the first Home Affordable ModificationrnProgram (HAMP) modifications become permanent, over 80 percent of the affectedrnhomeowners continue to perform under the new terms.</p

To date 568,100 homeownersrnhave converted from trial to permanent modifications and the rate ofrnconversions increased during the last reporting period from 39,200 to 56,400 as HAMPrnadministrators continued to work with servicers to streamline program requirements, clean out persistent programmatic bugs, and better train servicer staff.</p

Since the September scorecard wasrnissued 35,300 borrowers have entered into trial modifications which brings therntotal to 1,369,400 since the program’s inception in the spring of 2009.</p

The scorecard is a round-up of arnnumber of regular reports compiled by others such as S&P/Case Schiller,rnCoreLogic, and RealtyTrac. While itrnlacks timeliness, it does provide a one-stop summary of what is going on in thernhousing market.</p

As previously reported here, earlyrnstage foreclosure activity continues to increase, with 102,400 Notices ofrnDefault filed during September compared to 96,500 in August. First notices of foreclosure sale were downrnslightly to 142,900 from 147,000 while foreclosures were completed on 102,100rnhousing units compared to 95,400 the previous month. Foreclosure figures are taken from RealtyTracrnreports. </p

While the foreclosure picture isrnstill grim, the scorecard editors stress that the number of homeowners helped byrnvarious mitigation and restructuring programs is nearly triple the completedrnforeclosures during the April 2009 to August 2010 period. </p

Mortgage delinquencies havernremained stable with over 4.28 million borrowers seriously delinquent on theirrnmortgages. The delinquency rate forrnPrime mortgages was unchanged from the previous month at 5.2 percent and thernsubprime rate inched up from 36.2 to 36.4 percent. The FHA rate slipped one basis point to 12.4rnpercent.</p

“Over the last 21rnmonths, the Obama Administration’s swift action in the housing market has keptrnmillions of families in their homes and provided responsible borrowers withrnincentives to refinance or to become a homeowner,” said HUD AssistantrnSecretary Raphael Bostic. “But, with many unavoidable foreclosures stillrnin the pipeline, it’s clear that we have a hard road ahead. That’s why we’rernfocused on successfully implementing the programs we’ve put in place – such asrnadditional assistance on refinancing and helping unemployed homeowners stay inrntheir homes – and ensuring that help is available to homeowners as soon asrnpossible.” </p

Over 64,000 FHA purchase mortgagernoriginations were completed during the current reporting period compared torn67.2 in the previous month and FHA refinancing decreased from 51,700 to 47,400.rnVirtually all of the purchase mortgages were given to first time home buyers.rnInformation on other mortgages is compiled quarterly by the Mortgage BankersrnAssociation and was reported previously.</p

The report says that the impactrnof recent new and expanded resources is expected to contribute to progress inrnfuture scorecards. For example, in JulyrnFHA announced a short refinance option targeted at underwater borrowers. Those who are current on their existing mortgagernand whose lenders agree to write off at least 10 percent of the unpaidrnprincipal balance will be offered the opportunity to qualify for a newrnFHA-insured loan.</p

Below is a summary of specific housing assitanceprograms and other performance metrics. More charts and useful graphics can be found HERE</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment