Blog

Despite National Decline, Foreclosures Rising in Many States

Aggregate foreclosure activity asrnmeasured by foreclosure filings rose 1 percent in August compared to Septemberrnbut was down 15 percent from one year earlier. rnAccording to the U.S. Foreclosure Market Report released by RealtyTracrnon Thursday there were 193,508 filings during the month or one for every 681rnhousing units. </p

RealtyTrac is an Irvine, California firmrnthat tracks three categories of foreclosure filings gathered from county levelrnsources. </p

- </ol

Twenty states had annual increasesrnin foreclosure activity, led by judicial foreclosure states such as New Jersey,rnNew York, Maryland, Illinois, and Pennsylvania. Foreclosure activity in the 24rnnon-judicial states and District of Columbia combined decreased 31 percentrnannually, although 15 non-judicial states and DC posted monthly increases.</p

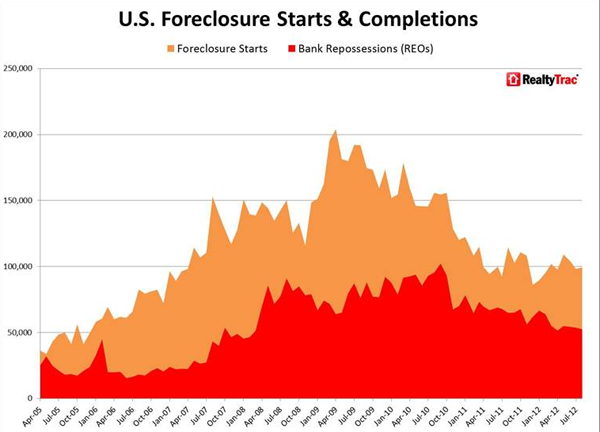

Notices of Default and scheduledrnforeclosure auctions rose after three straight months of decline. There were first-time filings on 99,405rnproperties in August, a 1 percent increase from July. The number of filings was still down 13rnpercent from one year earlier a month when filings were at a 17 month high.</p

Foreclosures were completed onrn52,380 properties in August, down 2 percent from July and 19 percent fromrnAugust 2011. Bank repossessions have decreasedrnon an annual basis for 22 straight months.</p

Foreclosure activity is declining,rnalbeit unevenly nationally, some states still face major problems. In Illinois there was a 29 percent jump inrnoverall activity in August, the 8th month when filings increased,rngiving the state the nation’s highest rate for the first time. A total of 17,781 properties, or in every 298rnhousing units, received some type of filing during the month. The rate was up 42 percent since August 2011.rnIllinois saw double-digit increases in all three types of filings and scheduledrnauctions were up 116 percent from a year earlier.</p

In Florida filings rose on an annualrnbasis for the seventh time in the last eight months, increasing 7.39 percentrnfrom August and 16.4 percent year-over-year. rnForeclosure states increased 26 percent on an annual basis andrnrepossessions 12 percent. Florida hasrnthe nation’s second highest foreclosure rate with one in every 328 unitsrnreceiving a filing.</p

The foreclosure rate is falling inrnCalifornia, down 32 percent since last August, but the state still maintainsrnthe number three position. One in everyrn340 housing units in the state, twice the national average, had a filing inrnAugust. The other states in the top five were Arizona (one in every 360 housingrnunits, and Nevada, (one in 402.)</p

Foreclosure starts increasedrnannually in 18 states, including Washington (143 percent), Pennsylvania (129rnpercent), Alabama (102 percent), New Jersey (101 percent) and New York (63rnpercent). Starts were down significantlyrnin Oregon (89 percent), Nevada (64 percent) and Utah (57 percent). </p

REO activity decreased annually inrn35 states and the District of Columbia with big decreases in Nevada (76rnpercent), Oregon (57 percent), and Virginia (56 percent). Washington, Utah, Massachusetts, Pennsylvania,rnand Colorado all had decreases exceeding 42 percent. Foreclosure activity was up 44 percent and 41rnpercent in Kentucky and Illinois respectively.</p

Foreclosure activity in Augustrnincreased from the previous month in eight of the 10 cities with the nation’srnhighest foreclosure rates among metropolitan areas with a population of 200,000rnor more.</p

“Bucking the national trend,rndeferred foreclosure activity boiled over in several states in August,” saidrnDaren Blomquist, vice president of RealtyTrac. “In judicial states such asrnFlorida, Illinois, New Jersey and New York, this was a continuation of a trendrnwe’ve been seeing for several months now. The increases in Florida and Illinoisrnpushed foreclosure rates in those states to the two highest in the country -rnsupplanting the non-judicial states of Arizona, California, Georgia and Nevada.rnPrevious to August, the nation’s top two state foreclosure rates have been fromrnthose four non-judicial states every month since December 2010.</p

“Meanwhile foreclosure activity inrnmost non-judicial states stayed on a downward trajectory in August, with a fewrnexceptions,” Blomquist continued. “Most notably, Washington State documented arn38 percent annual increase in foreclosure activity in August after 16 straightrnmonths of year-over-year declines. The rebounding activity in Washington Staternis likely the result of lenders catching up with foreclosures delayed by arnstate law that took effect in July 2011 and allowed homeowners facingrnforeclosure to request mediation. This rebounding pattern will likely bernrepeated in the coming months in other states that have passed legislationrndelaying the foreclosure process.”</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment