Blog

Fed MBS Program Update: 94% of Funding Used

The Federal Reserve today reported on their weekly purchases of agency mortgage-backed securities (MBS).

In the week ending February 3, 2010, the Federal Reserve purchased a total of $17.63 billion agency MBS. In those five days the Federal Reserve sold $5.63 billion (supported the roll market) for a net total of $12 billion MBS purchases.

The goal of the Federal Reserve's agency MBS program is to provide support to mortgage and housing markets and to foster improved conditions in financial markets more generally. Only fixed-rate agency MBS securities guaranteed by Fannie Mae, Freddie Mac and Ginnie Mae are eligible assets for the program. The program includes, but is not limited to, 30-year, 20-year and 15-year securities of these issuers.

Since the inception of the program in January 2009, the Fed has spent $1.17 trillion in the agency MBS market, or 93.83 percent of the allocated $1.25 trillion, which is scheduled to run out in March 2010. This leaves $77.08 billion left to purchase MBS coupons in the TBA market.

Of the net $12.00 billion purchases made in the week ending February 4, 2010:

- $450 million was used to buy 30 year 4.0 MBS coupons. 3.75 percent of total weekly purchases

- $7.45 billion was used to buy 30 year 4.5 MBS coupons. 62.08 percent of total weekly purchases

- $2.68 billion was used to buy 30 year 5.0 MBS coupons. 22.29 percent of total weekly purchases

- $675 million was used to buy 30 year 6.0 MBS coupons. 5.63 percent of total weekly purchases

- $300 million was used to buy 15 year 4.0 MBS coupons. 2.50 percent of total weekly purchases

- $300 million was used to buy 15 year 4.5 MBS coupons. 3.75 percent of total weekly purchases

30.6 percent of the mortgage-backs purchased were Fannie Mae MBS, 47.1 percent were Freddie Mac coupons, and 22.3 percent were Ginnie Mae. 94 percent of purchases were 30 year MBS coupons.

The Fed's daily purchase average was $2.40 billion per day, which is unchanged from last week's daily average of $2.40 billion per day. If the Fed were to evenly disperse the remaining $77.08 billion over the next 8 weeks, they would average $1.92 billion purchases per day or $9.64 billion per week.

Given the slowdown in the mortgage market, this should be enough to offset new loan production supply from originators.

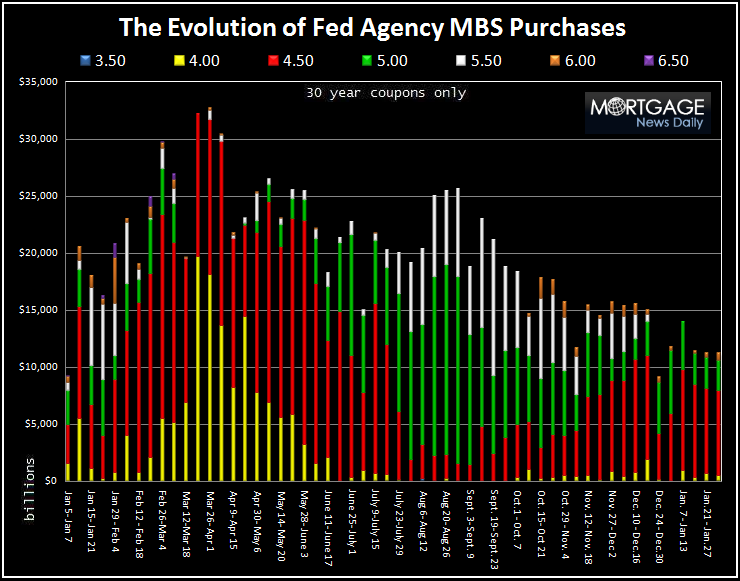

Below is a chart illustrating the evolution of the Federal Reserve's Agency MBS Purchase Program. Notice over the past few months the Fed has reduced their purchases and used remaining funds to offset new loan production supply, 4.50 (RED) and 5.00 (GREEN) MBS coupons specifically, which has helped keep mortgage rates low relative to benchmark Treasury yields. Overall, weekly purchases continue to decline, yet mortgage valuations remain stable.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment