Blog

FEEDBACK NEEDED: New Loan Disclosures

Transparency is critical and today much of the paperwork associated with a mortgage is far too confusing. </p

Recent government regulations have made credit products, especially mortgages, even more opaque with mandated disclosures in obscure legal language produced in small type. As a result, an extra burden has been imposed on lenders while providing no additional benefit to consumers. </p

Elizabeth Warren, the ex-Special Advisor to the Secretary of the Treasury for the Consumer Financial Protection Bureau, told a House subcommittee on March 17th that, “A simple, straightforward and consistent presentation of a credit agreement is the best way to level the playing field between consumers and lenders – and among different types of lenders – and foster honest competition.” </p

So on May 18th, the Consumer Financial Protection Bureau (CFPB) put pen to paper and released their first attempt at simplifying home loan disclosures by combining the Good Faith Estimate and Truth in Lending statement. After receiving more than 13,000 comments the CFPB then released two more prototypes on June 29th. And now, without Elizabeth Warren at the helm, they’ve released a third set of forms…</p

From the CFPB…</p

Today, we’re asking for your input once again. Just like last time, here are a few questions we’d like you to keep in mind as you review:</p<ol

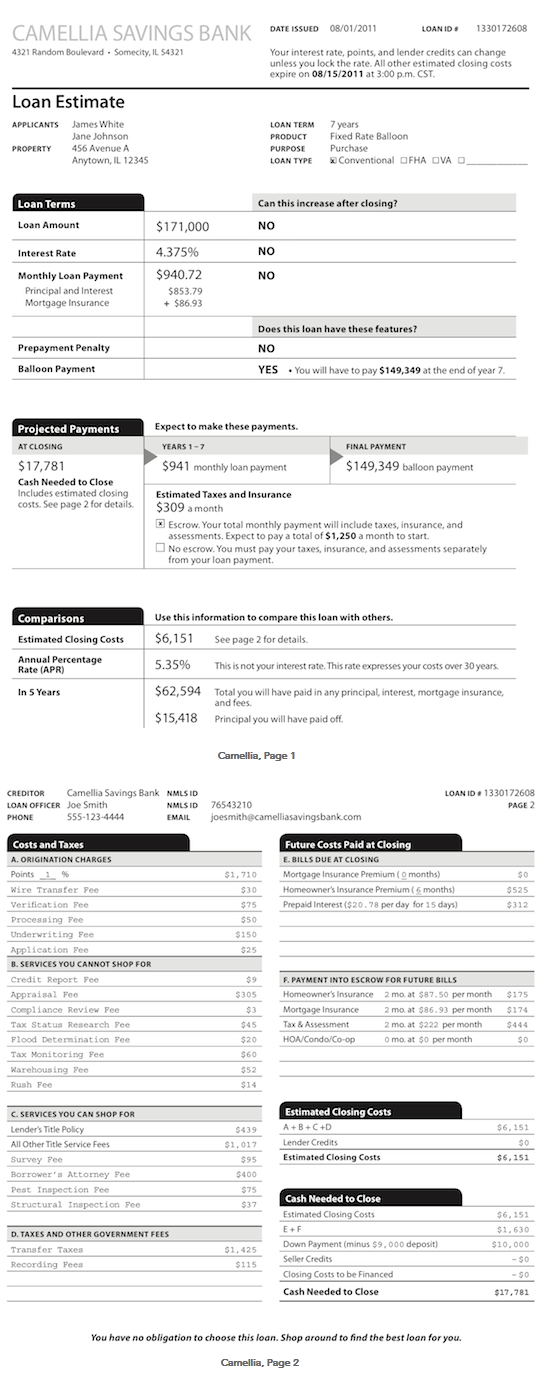

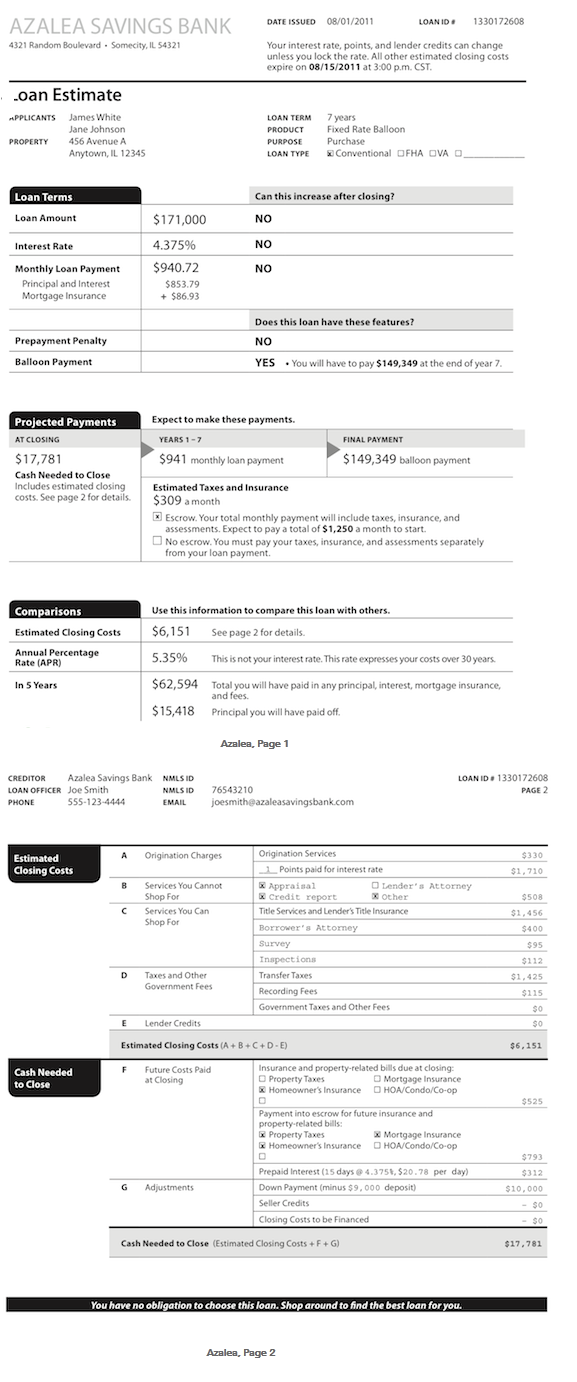

Here are two disclosure forms for the same loan product.

Which format would you prefer for your customer to use to compare your loan with another?</p

OPTION 1</p

</p

</p

OPTION 2</p

</p

</p

Please note: The prototype forms you are reviewing are designed to combine both the Good Faith Estimate and the initial Truth in Lending disclosure, consistent with the requirements of the Dodd-Frank Act. These prototypes are still early in the design phase. The numbers that appear on the forms are designed to comply generally with the existing regulations under TILA and RESPA, but we have made adjustments as necessary to enable us to test certain elements with consumers. For example, in Round 3 (Azalea and Camellia), the fee detail does not include language about tolerances. This allows us to focus on the design on this round. We will work on consumer understanding of tolerances in later rounds.</p

We are currently testing the application-triggered disclosures. This fall, we expect to test closing stage disclosures, which include the settlement statement.</p

We will consider the information submitted through our website as we analyze the information we receive in the in-depth interviews to further revise the prototypes. This round is open for feedback until Monday, August 8th at 7pm Eastern time. You can participate any time between now and then, but the sooner you tell us the earlier we’ll be able to start thinking about how to improve on these forms for the next round. Send us your feedback today!</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment