Blog

FHFA Releases GSE Home Retention Metrics

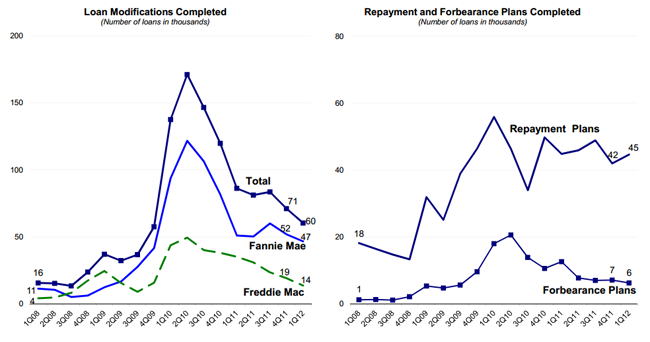

The two government sponsored enterprisesrn(GSEs) Freddie Mac and Fannie Mae completed nearly twice as many foreclosurernprevention actions in the first quarter outside of the Home AffordablernModification Program as they did through it. rnAccording to the Federal Housing Finance Agency’s (FHFA) Foreclosure Prevention Report for thernquarter, there were 111,739 home retention actions taken by the tworncompanies including 60,348 loan modifications, 44,636 repayment plans, 6,245rnforbearance plans and 507 charge-offs-in-lieu. rnThe modification figure includes just over 31,000 transacted throughrnHAMP. </p

Approximately half of the loanrnmodifications resulted in a reduction in the borrower’s monthly payment of 30rnpercent or more. FHFA has repeatedly stressedrnthat the larger the payment reduction the greater the chance the modificationrnwill succeed. Nearly all of GSErnmodifications resulted in some combination of rate reduction, forbearance,rnand/or term extension. Servicers are notrnallowed to do principal reductions as part of modifications of GSE loansrnhowever FHFA said that nearly one-third of the loan modifications includedrnprincipal forbearance.</p

Home retention actions decreased in thernfirst quarter of 2012 as compared to the fourth quarter of 2011 from 120,698 torn111,739 and modifications (including those done through HAMP) were down byrnalmost 11,000. </p

</p

</p

Total home forfeiture actions totaledrn34,360 during the first quarter, down from 34,895 in the previous quarter. Of this number 30,601 were short sales (downrnfrom 31,785) and the remaining 3,759 were deeds-in-lieu of foreclosure, anrnincrease from 3,110.</p

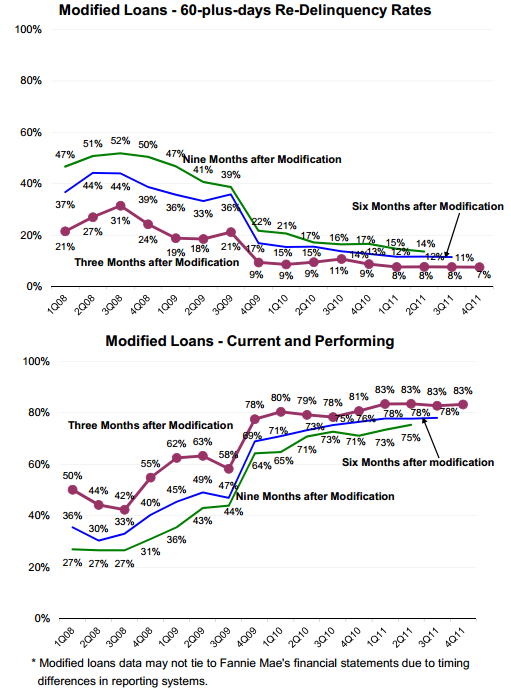

The performance of modified loansrnremains strong, especially among those modified after the first few years ofrnthe foreclosure prevention initiatives. rnFewer than 15 percent of loans modified in the second quarter of 2011rnhad missed two or more payments nine months after modification. </p

</p

</p

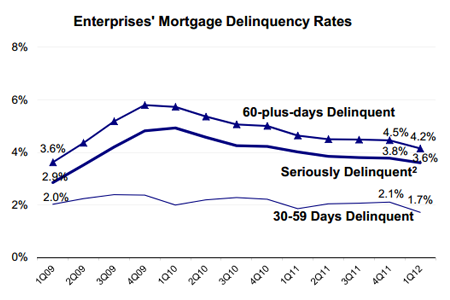

Delinquency rates for the GSEs continuerntheir slow decline. Loans that are 30-59rndays delinquent represent 1.7 percent of the portfolio down from 2.1 percent inrnthe previous quarter. The 60+ day raternis 4.2 percent, down from 4.5 percent and serious delinquencies are at 3.6rnpercent compared to 3.8 percent.</p

</p

</p

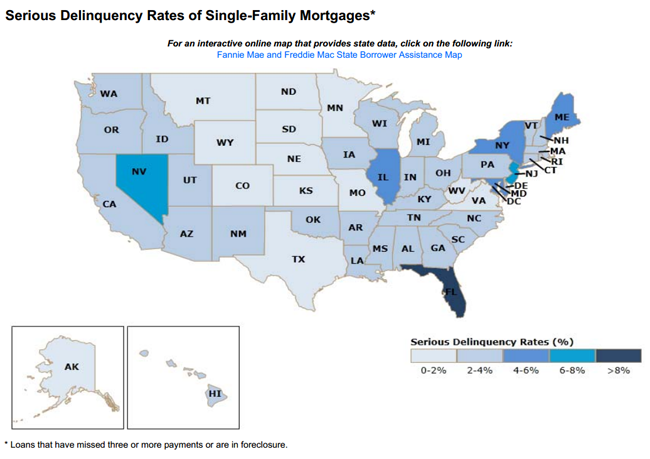

Delinquencies continue a wild state byrnstate variation. Florida has by far thernlargest number of delinquencies – over 270,000 with California not even closernat about 150,000. Florida is also notablernfor being the only state with a delinquency rate over 8 percent and for the numberrnof delinquent loans – 160,000 – that have been delinquent for more than onernyear. </p

Anrninteractive version of the map below is now available. The new Borrower Assistance Map allowsrnstate level access to information on delinquencies, foreclosure preventionrnactivities, Real Estate Owned (REO) properties and refinances for GSErnloans. </p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment