Blog

MBA Forecasts Housing Demand Over Next 10 Years

We have been reading for several years nowrnabout two trends that appear troubling for the housing industry – a decliningrnrate of homeownership and a stalled out rate of household formation. The latter has recently begun to reversernitself as the huge millennial generation has reached maturity, found jobs, andrnmoved out on their own, but homeownership rates continue to decline, reachingrnthe lowest rate since tracking began.</p

The MortgagernBankers Association (MBA) has just released a paper forecasting housing demand</bover the next ten years. The paper, Demographics and the Numbers Behind the Coming Multi-Million increase inrnHouseholds wasrnwritten by Lynn M. Fisher Vice President, Researchrn& Economics and JamiernWoodwell Vice President of Commercial/Multifamily Research </p

Their study usedrndata from 1975 to 2014 a period encompassing several market and housing cyclesrnand the short version of its conclusionrnwas that “By 2024, demographic and economic changes will bring what could bernone of the largest expansions in the history of the U S housing market – 15 9rnmillion additional households.”</p

Three generationsrnof Americans will constitute the majority of adults over this ten year period,rnthe Baby Boomers, their children, Generation X, and the Millennials. The first and the third of these groups arernhuge. By 2024 aging Baby Boomers willrnincrease the numbers of households headed by those age 60 and older by 12.3rnmillion while millennials will raise the ranks of households age 18 to 44 byrn4.1 million. The much smaller generationrnsandwiched in between will mean there will be 2.1 million fewer households in thern45 to 59 age group than there are today. </p

The authors lookedrnat future demand for housing in three different ways: </p<ul class="unIndentedList"<lihowrnthat demand will be effected by demographic changes that are already underway;</li<lihowrnhousehold formation will change because of long-term societal trends and thernhang-over from the Great Recession;</li<liPotentialrnchanges in the distribution of homeowners and renters.</li</ul

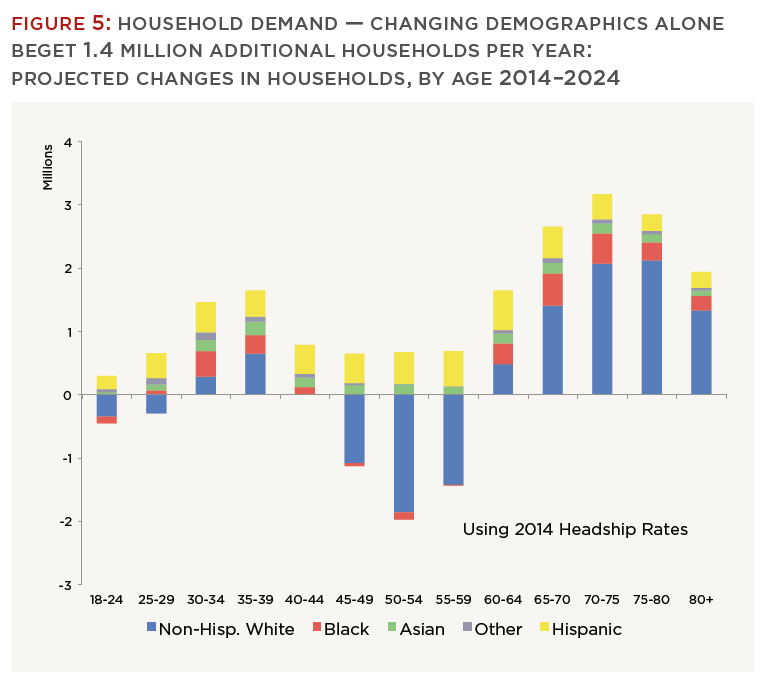

Even if householdrnformation remains at 2014 low rates, demographic changes alone should accountrnfor 13.9 million new households by 2024. rnCurrent household numbers are expected to expand by 5.5 millionrnadditional Hispanic households, 3.4 million non-Hispanic White households, 2.4rnmillion Black households, 1.8 million Asian and 750,000 “other”rnhouseholds. Growth in the olderrnhouseholds will continue to be driven by non-Hispanic Whites as will therndeclines in the middle group. Minoritiesrnwill drive growth among Millennial households and will positively affectrnhousing demand in every age group.</p

</p

</p

The authors say that if people ofrndifferent ages, races, and ethnicity all acted in similar ways demographicrnchanges would be less impactful but changes in age distribution translaterndirectly into changes in housing demand with people becoming more likely to ownrna home as they age. Persons of differentrnraces and ethnicities also interact with the housing market in different waysrnand there is a marked difference in both headship (the number of households per person) and homeownership rates across these groups. </p

Putting these differences together createsrnsome counterintuitive results. Forrnexample the low homeownership rate among Hispanics might lead to the assumptionrnthat as that group grows its population share homeownership rates would droprnfurther. Yet two-thirds of populationrngrowth among Hispanics is in the over 40 age cohort where homeownership isrnabove average. “All else being equal,”rnthe authors say, “the result will be a natural demographics induced increase inrnthe homeownership rate among Hispanics.” </p

In addition to huge generational shifts,rnforecasters must confront the problems that societal changes as well as thernGreat Recession have changed the trajectory of many key life stages. Compared to the early 1990s more young peoplernare earning college and post-graduate degrees but the increases have been muchrngreater among women. People are marryingrnlater and putting off childbearing as well but the birthrate among women overrn30 has increased substantially.</p

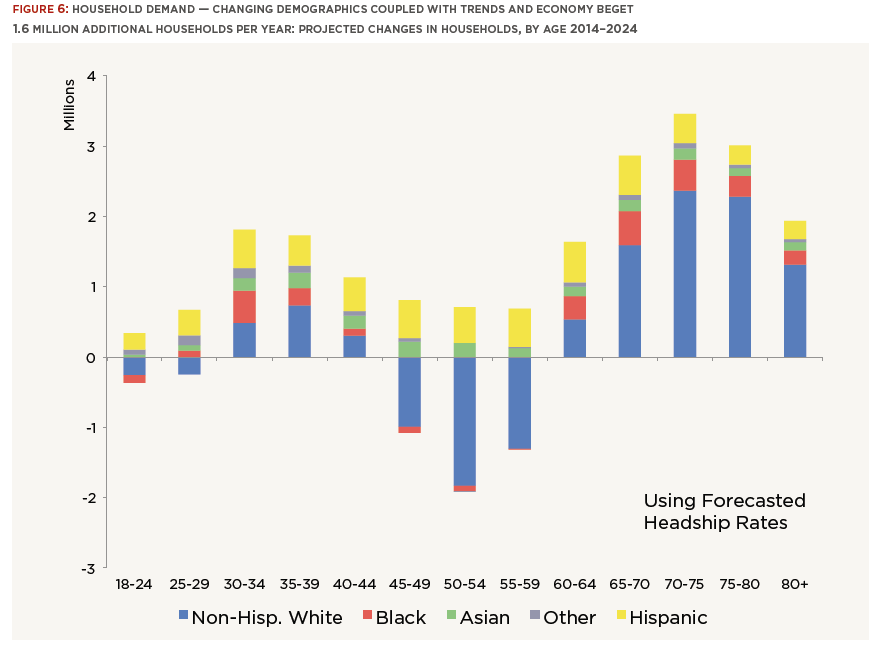

If headship rates adjust and demographicrnchanges continue thee will be 15.9 million additional households over the next decade,rntwo million more than if headship rates remained at 2014 levels. Household growth will be led by 5.7 millionrnmore Hispanic Households, 5.0 million more non-Hispanic White households, 2.4rnmillion more Black households, 1.9 Asian households, and 890,000 more “other”rnhouseholds.</p

</p

</p

MBA looked at the two alternativernscenarios (flat headship rates v increased rates) with respect to the path ofrnhomeownership rates, but regardless of the mix demand for all types of housingrnwill be strong. The authors say that onernaspect that is often ignored is that homeownership rates will also likely bernaffected by shifts in demand between single family homeownership and singlernfamily renting.</p

There is little to suggest, the reportrnsays, that the recent declines in homeownership is permanent or to suggest thatrnthe recession induced rates of decline will carry forward. Homeownership rates always follow the ups andrndowns of the economy, mortgage markets, and federal policies toward it.</p

In the first scenario, using current agernand race specific homeownership rates, the U.S. will see 10.3 millionrnadditional owner households and 5.6 million new renter households over the nextrnten years with 9.9 million more owner households headed by a person over age 60rnthan today. Generation X will accountrnfor 2.0 million fewer households with a head between 45 and 59 and Millennialsrnwill boost homeownership among 18 to 44 year olds by 2.4 million. </p

Under this scenario there will be 4.3rnmillion new non-Hispanic White homeowners and 6 million more minority householdrnowners; 3 million Hispanic, 1.3 million Black, 1.2 million Asian, and arnhalf-million more “Other” households.</p

Demand for rentals will be affected inrnmany of the same ways. By 2024 therernwill be 5.6 million additional renter-occupied households with 3.0 millionrnheaded by someone over age 60. Given thernhigher rentership rates among Millennials however rental households headed byrnsomeone 18 to 44 will increase by 2.7 million households while the middle agerngroup of renters will decline by 100,000.</p

By racial breakdown Hispanics will accountrnfor 2.7 million new renter households, Blacks for 1.1 million, non-HispanicrnWhites and Asians will each add 700,000 and Other households will increase rentrnrolls by 400,000. </p

Under the second scenario which accountsrnfor demographic changes and changes in headship rates MBA projects 15.9 million</baddition households that will include 12.7 million owners compared to 10.3rnmillion in Scenario 1 and 3.1 million renters compared to 5.6 million. In this scenario Millennials play a muchrnsmaller role in renter demand as more are drawn into homeownership.</p

The number of new minority ownerrnhouseholds will be more than one-third higher than the number of newrnnon-Hispanic White Households. Amongrnrenters the non-Hispanic White numbers will decline.</p

The authors conclude that the changesrnoutlined above will flow through to changes in demand for single andrnmulti-family housing. The aging of thernpopulation, in particular Millennials, will generally boost demand forrnsingle-family housing and slow increases in demand for multi-family. Changes in headship rates will boost demandrnfor both types of housing but changes in age-specific homeownership rates willrnaffect demand for multi-family housing very little and will instead mean shiftsrnof some magnitude between single family ownership and single-family renting.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment