Blog

Momentum Seen for Home Improvement Spending

Spendingrnon home improvements and remodeling have shown signs of a rebound and thernRemodeling Futures Program at the Harvard Joint Center for Housing Studies isrnprojecting that sector of the economy will end 2012 on a positive note.</p

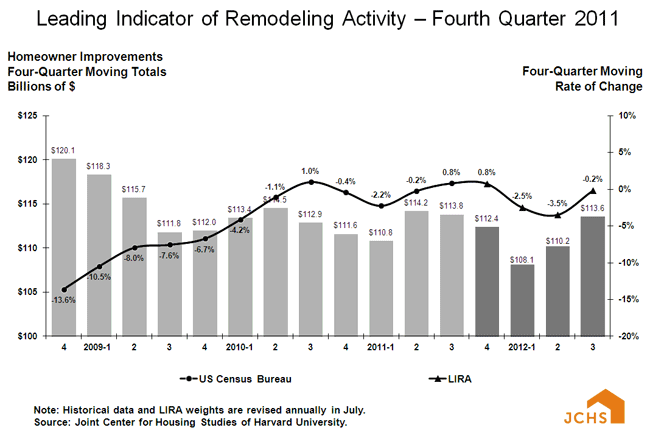

ThernJoint Center produces the Leading Indicator of Remodeling Activity (LIRA) eachrnquarter. It is designed to estimaternnational homeowner spending on improvements for the current quarter and thernfollowing three quarters. The indicator, measured as an annual rate-of-changernof its components, provides a short-term outlook of homeowner remodelingrnactivity and is intended to help identify future turning points in the businessrncycle of the home improvement industry. </p

Thernfigures from the most recent quarter, the fourth quarter of 2011, showed anrnestimated four-quarter moving total of $112.4 billion in home improvementrnspending compared to $113.8 billion in the third quarter. This number is expected to dip further in thernfirst quarter of 2012, to $108.1 billion before starting to build at mid-year. </p

“Sales of existing homes have been increasingrnin recent months, offering more opportunities for home improvement projects,”rnsays Kermit Baker, director of the Remodeling Futures Program at the JointrnCenter. “As lending institutions become less fearful of the real estaternsector, financing will become more readily available to owners looking tornundertake remodeling.”</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment