Blog

NAR: Lending Standards Holding Down Home Sales, Job Growth

LawrencernYun, Chief Economist for the National Association of Realtors® (NAR) said Mondayrnthat there would be enormous benefits to the nation’s economy if mortgagernlending standards would return to normal. rn”Sensiblernlending standards would permit 500,000 to 700,000 additional home sales in therncoming year,” he said. “The economic activity created through thesernadditional home sales would add 250,000 to 350,000 jobs in related trades andrnservices almost immediately, and without a cost impact.”</p

Yun’s remarks accompanied release of NAR’srnmonthly nationwide survey of Realtors, this month combined with an analysisrnfrom Yun’s office of historic credit scores and loan performance. </p

The survey of Realtors Yun said, showsrnwidespread concern over continuing tight conditions, delays in mortgagernapprovals, and excessive requirements for documentation. Some respondents said it appeared that lendersrnwere focusing only on loans to individuals with the highest credit scores.</p

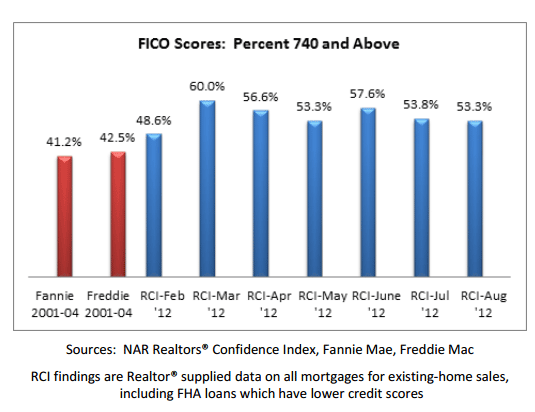

Survey respondentsrnsaid 53 percent of loans in August went to borrowers with credit scores abovern740 while in the 2001 to 2004 time period only 41 percent of loans backed byrnFannie Mae and 43 percent of those backed by Freddie Mac were above 740. In 2011, about 75 percent of total loansrnpurchased by Fannie Mae and Freddie Mac, which are now a smaller market share,rnhad credit scores of 740 or above. </p

There is arnsimilar pattern for FHA loans. The Office of the Comptroller of thernCurrency has defined a prime loan as having a FICO score of 660 andrnabove. However, the average FICO score for denied applications on FHArnloans was 669 in May of this year, well above the 656 average for loansrnactually originated in 2001. </p

</p

</p

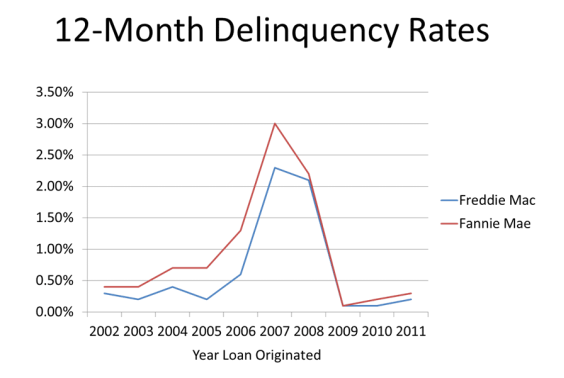

A normalrn12-month default rate is about 0.4 percent, the rate that prevailed in 2002 andrn2003. The rate then spiked to 3.0rnpercent for Fannie Mae and 2.5 percent for Freddie Mac in 2007, reflecting thernrisky mortgages written in the 2005-2007 period. Sincern2009, the 12-month default rates have been abnormally low, averaging 0.2rnpercent for Fannie and 0.1 percent for Freddie despite the high unemploymentrnthat has existed in the timeframe.</p

</p

</p

Under normalrnconditions, existing-home sales should be in the range of 5.0 to 5.5rnmillion. “Sales this year are projected to rise 8 to 10 percent. rnAlthough welcoming, this still represents a sub-par performance of about 4.6rnmillion sales,” Yun said. “These findings show we need to return to thernsound underwriting standards that existed before the aberrations of the housingrnboom and bust cycle, and thoroughly re-examine current and impending regulatoryrnrules that may cause excessively tight standards.”</p

Yun said allrnit takes is a willingness to recognize that market conditions have turned inrnthe wake of an over-correction in home prices, with all of the price measuresrnnow showing sustained gains. “There is an unnecessarily high level ofrnrisk aversion among mortgage lenders and regulators, although many are sittingrnon large volumes of cash which could go a long way toward speeding our economicrnrecovery. A loosening of the overly restrictive lending standards is veryrnmuch in order,” he said.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment