Blog

NAR Sees Gradual Housing Recovery Based on Several Assumptions

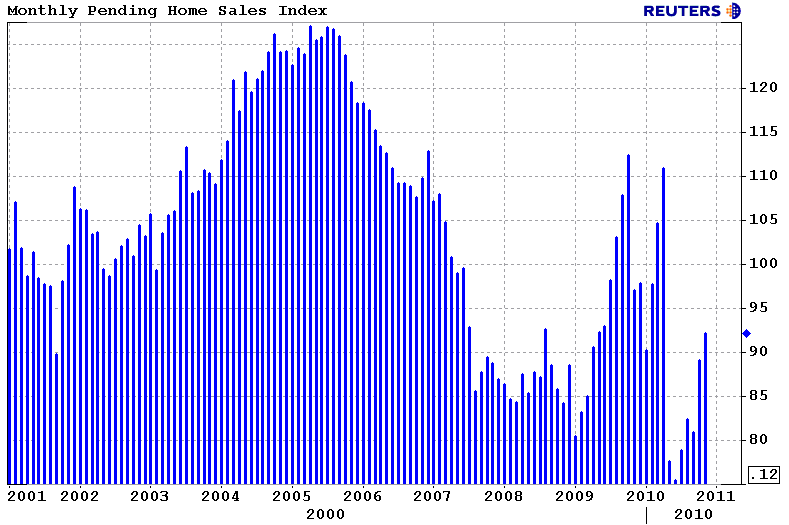

The National Association of Realtors released the Pending Home Sales Index for November today.

NAR’s Pending Home Sales Index measures the number of home purchase contracts that were signed in the monthly reporting period. Once “pending” sales contracts are closed, they are considered an Existing Home Sale. Because the Pending Home Sales index tells us how many contracts were signed, it is considered a forward indicator of Existing Home Sales. A signed contract is not counted as an Existing Home Sale until the transaction actually closes.</p

Excerpts from the Release…</p

Pending home sales rose again in November, with the broad trend over the past five months indicating a gradual recovery into 2011, according to the National Association of Realtors®.

The Pending Home Sales Index, a forward-looking indicator, rose 3.5 percent to 92.2 based on contracts signed in November from a downwardly revised 89.1 in October. The index is 5.0 percent below a reading of 97.0 in November 2009. </p

</p

</p

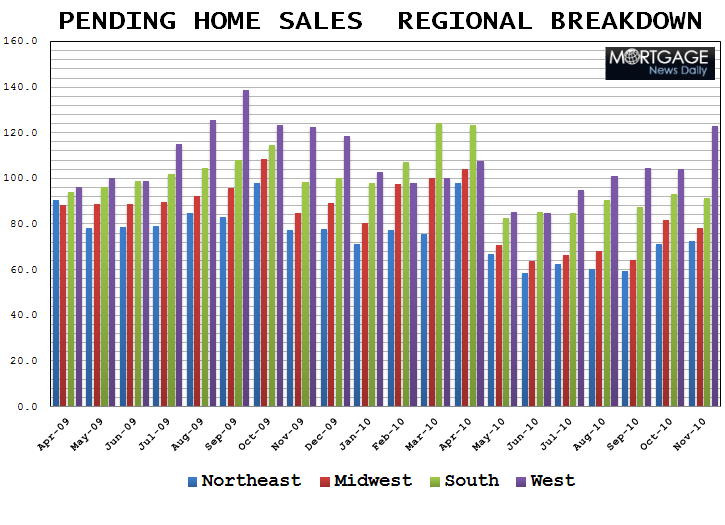

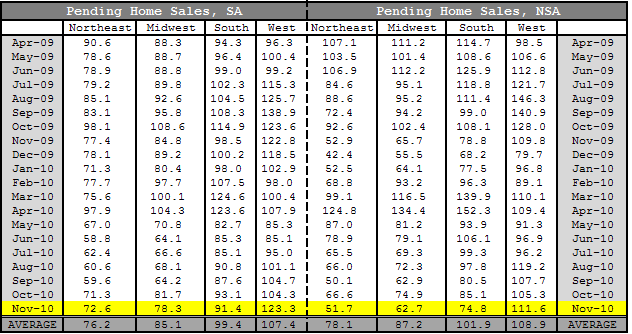

The PHSI in the Northeast increased 1.8 percent to 72.6 in November but is 6.2 percent below November 2009. In the Midwest the index declined 4.2 percent in November to 78.3 and is 7.7 percent below a year ago. Pending home sales in the South slipped 1.8 percent to an index of 91.4 and are 7.2 percent below November 2009. In the West the index jumped 18.2 percent to 123.3 and is 0.4 percent above a year ago.</p

</p

</p

When looking at the regional breakdown it is obvious that seasonal factors helped the overall index improve in November. Check out the seasonally adjusted data vs. the non-seasonally adjusted data below. Only the West recorded an uptick in Pending Home Sales when not adjusting for seasonal factors.</p

</p

</p

A few comments from Lawrence Yun, NAR’s chief economist…</p

“All the indicator trends are pointing to a gradual housing recovery,” </p

“Home price prospects will vary depending largely upon local job market conditions. The national median home price, however, is expected to remain stable even with a continuing flow of distressed properties coming onto the market, as long as there is a steady demand of financially healthy home buyers.”</p

“As we gradually work off the excess housing inventory, supply levels will eventually come more in-line with historic averages, and could allow home prices to rise modestly in the range of 2 to 3 percent in 2012,” </p

“If we add 2 million jobs as expected in 2011, and mortgage rates rise only moderately, we should see existing-home sales rise to a higher, sustainable volume,” </p

“Credit remains tight, but if lenders return to more normal, safe underwriting standards for creditworthy buyers, there would be a bigger boost to the housing market and spillover benefits for the broader economy.”</p

“In addition to exceptional affordability conditions, steady improvements in the economy are helpingrn bring buyers into the market,” he said. “But further gains are needed to reach normal levels of sales activity.”</p

For perspective, Yun said that the U.S. has added 27 million people over the past 10 years. “However, the number of jobs is roughly the same as it was in 2000 when existing-home sales totaled 5.2 million, which appears to be a sustainable figure given the current level of employment,” he explained.</p

Plain and Simple: Correct me if I am putting words in Lawrence Yun’s mouth here but it sounds like he is saying…IF WE CREATE 2 MILLION JOBS…IF MORTGAGE RATES ONLY RISE MODERATELY…IF LENDERS RETURN TO MORE NORMAL (SAFE) UNDERWRITING GUIDELINES…IF HOME PRICES DON’T DOUBLE-DIP…IF IF IF…..housing will only GRADUALLY RECOVER.</p

Sounds like a lot of IF’s need to play out just to see a GRADUAL housing recovery. Oh well. We gotta start somewhere.</p

Call me when GSE reform is done. Call me when we figure out how in the hell we’re gonna deal with excessive excess inventory. Call me when common sense makes it way back into underwriting guidelines and lenders stop overlaying already overdone overlays. Call me when the CFPB is finally set up or when the GFE and TIL are successfully combined. </p

Ugh. Call me when regulators question how REALTORS GET PAID.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment