Blog

Rental Vacancies at Lowest Point in a Decade; Homeownership Increases

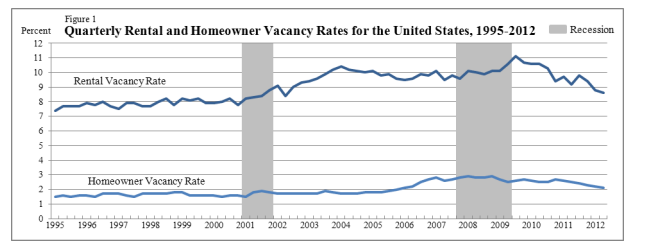

Vacancy rates in both rental and homeowner properties declinedrnin the second quarter of 2011 the U.S. Census Bureau said on Friday. Vacancy rates for rental houses declined 2rnbasis points from 8.8 percent in the first quarter of 2012 to 8.6 percent inrnthe second quarter. One year earlier the rate was 9.2 percent. Homeowner vacancies declined slightly, fromrn2.2 percent in the first quarter to 2.1 percent. This rate was 2.5 percent one year earlier.</p

The rate of homeownership increased slightly – from 65.4rnpercent to 65.5 percent from the first to the second quarter but was 4 basisrnpoints lower than a year earlier. While thernhomeownership rate has blipped up slightly in a few quarters the general trendrnhas been down since the most recent peak of 69.0 percent in the third quarterrnof 2006.</p

Vacancies in rental units have decreased substantially sincernthe worse of the recession. The raternrose above 10 percent in the first quarter of 2007, peaked at 11.1 percent inrnthe third quarter of 2009 and has fallen steadily since then. Homeowner vacancies were at a high point ofrn2.8-2.9 percent through all of 2008 but have eased down in most subsequent quarters.rn </p

</p

</p

Rental vacancies were highest in the South at 11.0 percent,rndown from 11.4 percent one year earlier. rnThe Midwest rate was 9.1 percent compared to 10.3 percent in the secondrnquarter of 2011 while the Northeast and the West were at 6.7 percent and 6.2rnpercent, both dropping from 6.8 percent in the previous period. Homeowner vacancies were down on an annualrnbasis in all regions, most notably the Northeast and the South which each declinedrn6 basis points. With the exception ofrnthe Northeast at 1.7 percent, regions had vacancy rates of either 2.1 or 2.2 percent.</p

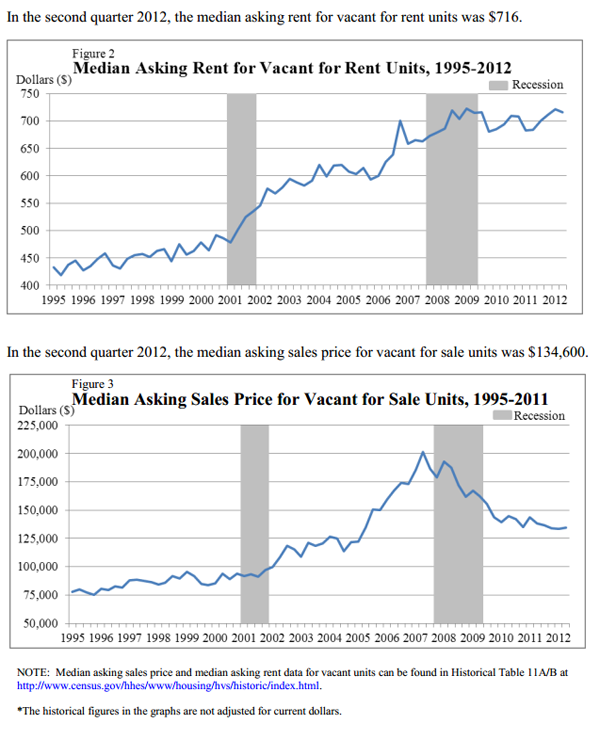

Despite the tightening market, the median asking price forrnrenting a housing unit dipped slightly in the second quarter but had climbed steadilyrnthrough 2011. The median asking is now inrnthe $710 per month range. The askingrnprice for vacant for sale units ticked up very slightly in the most recentrnperiod after sliding down gradually through the past year. It is now in the $130,000 range.</p

</p

</p

The Census Bureau estimates there are 132.7 million housingrnunits in the U.S. of which 114.2 are occupied, about two thirds by ownerrnoccupants. The number of housing unitsrnincreased by 486,000 between the second quarters of 2011 and 2012 while occupiedrnunits increased by 809,000. Of the 18.5rnmillion vacant properties 14 million are classified as year-round and of thosern3.8 million are for rent, 1.6 million are for sale, and 7.6 million are beingrnheld off the market for various reasons.</p

While homeownership rates increased slightly on a nationalrnbasis they declined in two of the four regions. rnThe South was down from 67.5 percent to 67.4 percent while the Westrndeclined two basis points to 59.7 percent. The Northeast saw an annual increasernfrom 62.5 percent to 63.7 percent while homeownership in the Midwest increasedrnby one basis point to 63.7 percent. </p

Homeownership increased among three of the five age cohorts. The 65 year and older group increased to 81.6rnpercent from 80.9 percent and the 35 to 44 and 45 to 54 groups were up to 62.2rnpercent and 71.4 percent respectively. rnHomeownership among the youngest group, those under 35, fell to 36.5rnpercent from 36.8 percent and among the 55 to 64 age group it was down to 77.1rnpercent from 77.8 percent.</p

While still way below rates in the white community, minorityrnhomeownership rose appreciably from the first quarter of 2011 while remainingrnunchanged among those who identified as non-Hispanic White at 73.5 percent. The rate for those who identified as Black hadrnan increase in homeownership from 43.1 percent to 43.8 percent and among Hispanicsrnit rose from 46.3 to 46.5. The rate wasrndown one basis point among those who identified themselves as of another racernto 55.0 percent from 55.1 percent.</p

Homeownership rates remain highly disparate by income. With an overall homeownership rate of 65.5rnpercent in the second quarter the rate for households with family income at orrnabove the median family income had a rate of 80.5 percent while the rate forrnhouseholds with income below the median was at 50.6 percent. Both rates increased two basis points fromrnQuarter One to Quarter Two.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment