Blog

Seasonal Factors Lift Home Prices. Temporary Gains?

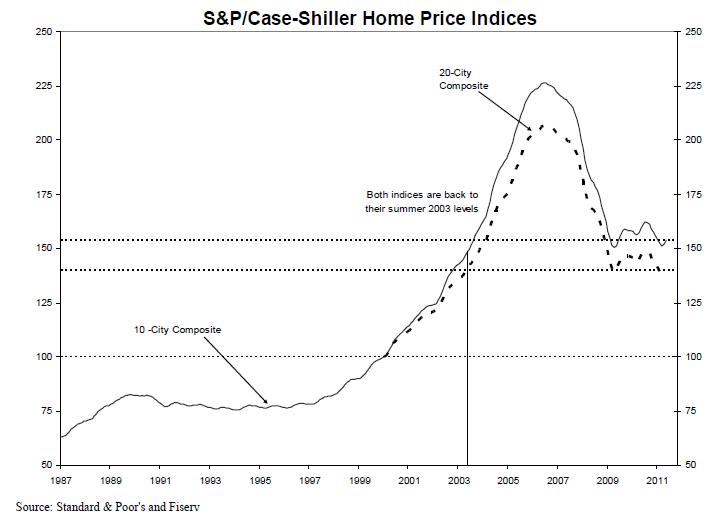

Home prices in much of the nationrnincreased in May according to the S&P/CasernShiller Home Prices Indices (HPI) released on Tuesday. May was the second straight month when bothrnthe 10 and 20-City composite indices increased. rnWhen compared to May 2010, however, only one Metropolitan StatisticalrnArea (MSA), Washington DC, reported an annual increase and that was a modestrn1.3 percent.</p

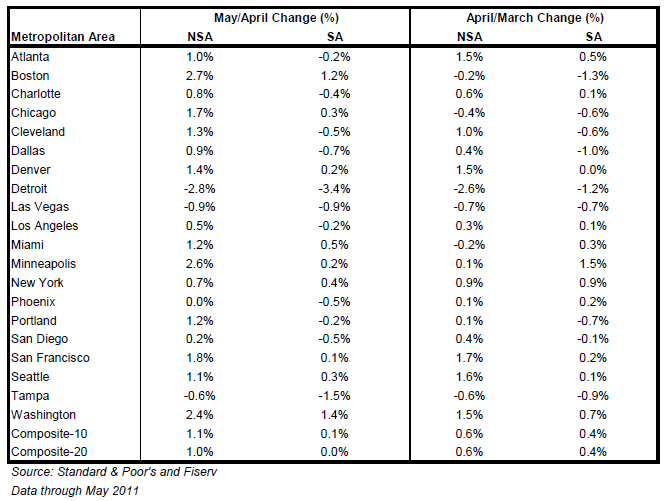

On a non-seasonally adjusted basis, thern10-City Composite increased 1.1 percent in May and the 20-City was up 1.0rnpercent. This was on top of respectivern0.8 percent and 0.7 percent increase in April over March. In addition, 16 of the 20 MSAs in the largerrncomposite posted positive numbers with only Detroit, Las Vegas, and Tampa decliningrnand Phoenix unchanged. The currentrnvalue of the 10-City Composite is 153.64 and the 20-City is 139.87.</p

On a seasonally adjusted basis there was no change in the 20-City Compositernand a mere 0.1 percent increase in the 10 City Composite. S&P recommends using non-seasonallyrnadjusted data, calling it the “more reliable indicator“. </p

Despite the monthly increases, thern10-City Composite recorded a year over year price decline of 3.6 percent andrnthe 20-City was down 4.5 percent since May 2010. In therncase of some MSAs these annual declines were significant. Minneapolis dropped 11.7 percent, Tampa andrnPhoenix each lost 9.5 percent, Detroit 9.3 percent and Portland (OR) 9.1rnpercent. In addition, both Compositesrnand 11 of the constituent MSAs had a larger percent annual drop in May thanrnthey had in April.</p

</p

</p

</p

“We see some seasonal improvements withrnMay’s data,” David M. Blitzer, chairman of the Index Committee at S&PrnIndices said. “This is a seasonal periodrnof stronger demand for houses, so monthly price increases are to be expectedrnand were seen in 16 of the 20 cities. rnThe exceptions where prices fell were Detroit, Las Vegas, and Tampa. However, 19 or 20 cities saw prices drop overrnthe last 12 months. The concern is thatrnmuch of the monthly gains are only seasonal.</p

Blitzer echoes the concerns expressedrnyesterday in Fannie Mae’s Economic and Mortgage Market Analysis for July whichrnattributed a rise in median home prices in non-distressed areas to a lowerrnmarket share of short sales and foreclosures but predicted this was a seasonal occurrencernand that there would be further deterioration of home prices at summer’s end.</p

Blizer said that May’s report showedrnunusually large revisions in some of the MSAs. rn”In particular, Detroit, New York, Tampa, and Washington DC all sawrnabove normal revisions. Our sales pairsrndata indicate that these markets reported a lot more sales from prior months,rnwhich causes the revisions. The lag inrnreporting home sales in these markets has increased over the past fewrnmonths. Also when sales volumes arernrelatively low, as is the case right now, revisions are more noticeable.”</p

Despite the continuing gloom, averagernhome prices in the U.S. are back to the levels they reached in the summer ofrn2003. Measuring from peak pricing levelsrnin June/July 2006 to the present time, prices in the 10-City Composite are downrn32.1 percent and in the 20 city 32.3 percent. rnWhen the composite cities hit their respective price bottoms, the peakrnto trough declines were 33.5 percent for the 10-City (April 2009) and 33.3rnpercent for the 20-City (March 2011.) </p

</p

</p

READ MORE…</p

The Million Dollar Question: Have Home Prices Bottomed?</p

ABOUT: The HPI are published monthly. They combine matched price pairs forrnthousands of individual houses based on available arms-length sales data. The indices had a value of 100 in Januaryrn2000 so a current value of 150 would indicate a price appreciation of 50rnpercent since January 2000 for a typical home in the subject market.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment