Blog

SIFMA Slams Eminent Domain "Scheme" in Letter to FHFA

The Securities Industry and FinancialrnMarkets Association (SIFMA) joined by 25 other trade associations has firedrnanother salvo in the mortgage eminent domain fight that originated inrnCalifornia in June. The 26 organizationsrnsent a letter Friday to the Federal Housing Finance Agency in response to theirrnrequests for comments on its own statement strongly opposing the eminent domainrnproposals.</p

Briefly, the cities of Chicago andrnBerkley California have followed in the footsteps of San Bernardino, Californiarnin purposing to seize performing but underwater loans in their communities outrnof residential mortgage backed securities (RMBS) in order to restructure themrnto reflect the current market value of the collateral. SIFMA, which has issued severalrnearlier statements protesting the proposals, as well as FHFA have objectedrnto the proposals on several grounds:</p<ul class="unIndentedList"<liItrnwould have a chilling effect on credit extension and on investment in housingrnmarkets. While a sliver of borrowersrnmight be helped, the overall market would be harmed as mortgage investors will seekrna significant risk premium to compensate for the risk of future seizure.</li<liThernlimited focus of the proposals would selectively assist only those whosernmortgages that provide the best returns to the promoters.</li<liThernproposal itself may be unconstitutional.</li</ul

Friday’s letter expands considerably on eachrnof these concerns, including as an appendix a legal opinion on thernconstitutionality of such takings. Thernletter also ups the ante rhetorically and introduces a new argument; that therernis a profit motivation underlying what SIFMA calls “this Scheme.” </p

The proposals, the letter says, wouldrnimpose losses on mortgage investors, including the retirement and savings accountsrnof individual investors “in order to extract profits that would be delivered torna small group of opportunistic investors with the added value of guaranteesrngiven by Ginnie Mae. This plan is arnveiled short-term, opportunistic investment strategy that utilizes federalrngovernment insurance and guarantees to achieve its goals.”</p

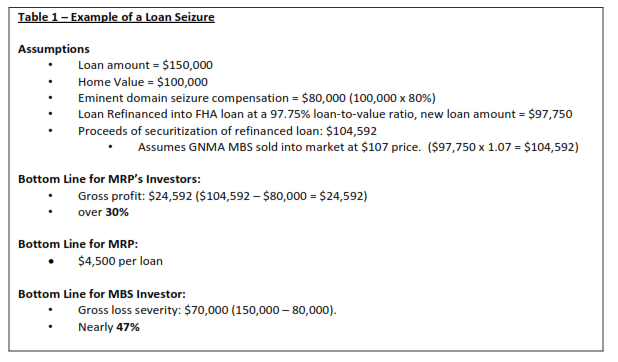

The table below was provided by SIFMA tornillustrate what it called “the scale of this government-enforced private wealthrntransfer.” Calling the example typical,rnthe letter says the proposals would extract profits at the expense of existingrnsecurity holders, transferring it to others and that, on its face therncompensation that is required by the U.S. Constitution and various state lawsrnwould not be provided to “victims” of the seizures. By way of explanation, Mortgage ResolutionrnPartners (MRP) referred to in the table is the entity that would obtain initialrnfinancing for the seizure and administer the resecuritization of the loans.</p

</p

</p

The table, the letter says,rnrepresents only one component of the total losses. In addition to the specific losses due to inadequaterncompensation for a specific loan, trusts and their investors would see anrnoverall deterioration of the asset quality of the pool. Depending on the volume of mortgages seizedrnthere could also be losses incurred related to adjusting or revaluing hedgesrnand funding mechanisms and unanticipated risks from the need to reinvest the unexpectedrnproceeds of eminent domain seizures.</p

“If these proposals go forward, there will be a severe, negative impact onrnmortgage markets, and therefore on mortgage borrowers,” said Randy Snook, SIFMArnexecutive vice president, business policies and practices. “The use ofrneminent domain confronts lenders and investors with an unquantifiable new risk,rnwhich will reduce the amount of credit available to potential homeowners andrncausing irreparable damage to the recovering national housing market. rnThese negative outcomes will vastly outweigh any small benefits thatrnjurisdictions might hope to achieve using these proposals.” </p

In addition to SIFMA the letter was signed by, among two dozen others, AmericanrnBankers Association, American Escrow Association, Association of MortgagernInvestors, California Land Title Association, Community Mortgage BankingrnProject, Mortgage Bankers Association, and United Trustees Association.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment