Blog

Americans More Upbeat about Housing than Overall Economy

Americans currently appear to bernmore optimistic about the housing market than they are about the economy inrngeneral. Fannie Mae’s June 2012 NationalrnHousing Survey indicates that flattening economic trends may be dampeningrnconsumer expectations about their personal financial situation but theirrnsentiments about housing remain “buoyed” by low house prices and interestrnrates.</p

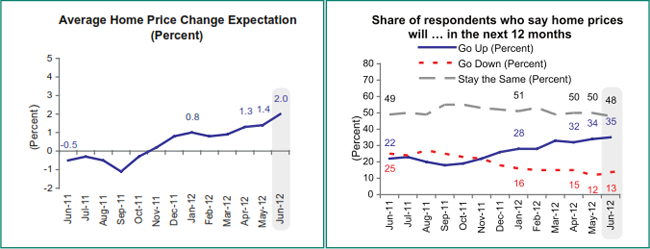

Thirty-five percent of surveyrnparticipants expect home prices to increase over the next year, up from 28rnpercent at the beginning of the year and the highest figure since the survey beganrnin 2010. Those who expect increases arernlooking for an average rise in prices of 2 percent, also the largest percentagernincrease in survey history.</p

</p

</p

Attitudes about mortgages are alsornupbeat. Forty-nine percent ofrnrespondents expect mortgage rates to stay at current low rates for the nextrnyear, up from 47 percent in May while 37 percent expect rates to rise, downrnfrom 41 percent.</p

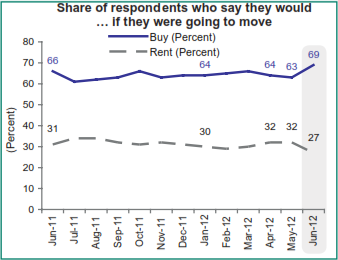

Overall 73 percent of those surveyedrnview this as a good time to buy a home, a number that has varied little overrnthe last year. Fifteen percent think it isrna good time to sell a home, a number that has not changed in the last threernmonths but is 5 percentage points higher than in January. The share of consumers who say they would buyrnif they were going to move increased by 6 percentage points this month (thernhighest level seen in the survey’s two-year history). </p

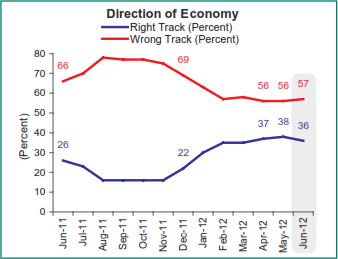

At the same time, thernright-track/wrong-track view of the economy is now at 36 percent and 57 percentrncompared to 38 percent and 56 percent in May. </p

</p

</p

“While consumers remain cautious about therngeneral economy, their attitudes toward the housing market continue tornimprove,” said Doug Duncan, senior vice president and chief economist ofrnFannie Mae. “Although this positive trend may be short-lived if therngeneral economy falters, one might ask whether consumers arernincreasingly seeing the current environment as arnunique opportunity to buy a home while home prices remain depressed,rnrental costs are increasing, and interest rates are near historic lows.”</p

There was a dip in responders’rnperceptions of household income with 65 percent saying their income was aboutrnthe same (up from 61 percent) while only 18 percent saw it as improved over thernprevious 12 months compared to 22 percent in May. There was an increase however in optimism forrnthe future. Forty-two percent expect nornimprovement over the upcoming 12 months, down from 46 percent, while 43 percentrnexpect their financial situation to improve, up one percentage point.</p

Respondents indicated less certaintyrnabout rental price increases in June that in July. Forty-eight percent expect rental prices tornincrease over the next 12 months, down from 49 percent and the average increasernexpected is 4.0 percent, one basis point lower than in the previous month. Five percent expect rent decreases, up from 4rnpercent in May. Those who said they would chose to rent if they moved droppedrnto 27 percent from 32 percent.</p

</p

</p

The National Housing Survey isrncompiled from responses to a telephone survey of 1,001 Americans who are askedrn100 questions used to track attitudinal shifts. The survey panel includes both homeowners andrnrenters.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment