Blog

Commercial Mortgage Delinquencies Mixed Across Investor Types

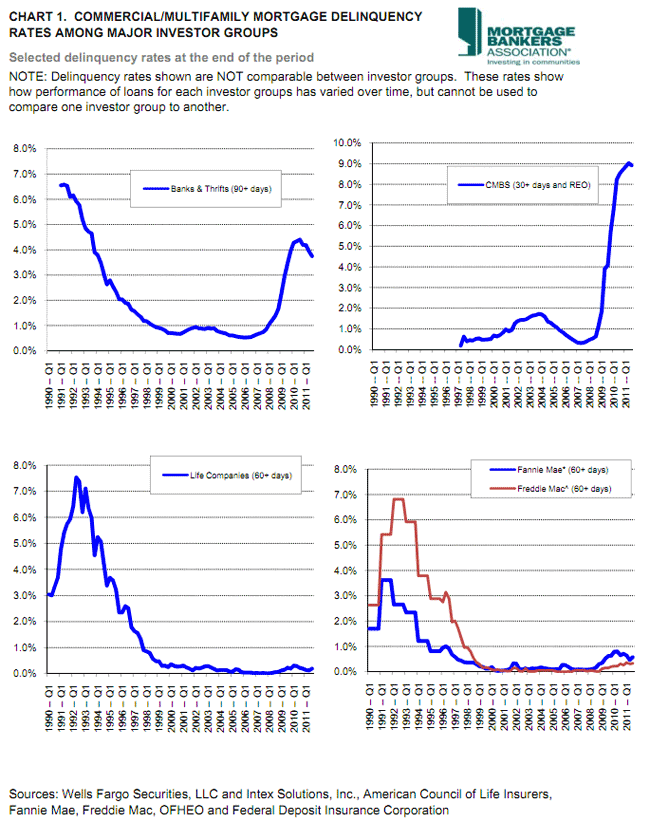

The Mortgage Bankers Association (MBA)rnreports that, in the third quarter of 2011, delinquencies among commercial andrnmultifamily mortgages were mixed, with rates for loans held by some investors decliningrnwhile delinquencies among loans held by others improved. While changes from quarter to quarter werernmodest, loans held by life insurance companies and by Freddie Mac and FanniernMae ticked up slightly while those held by banks or in commercialrnmortgages-backed securities (CMBS) were down.</p

Delinquencies among commercial andrnmulti-family loans held by FDIC-insured banks and thrifts decreased 0.19rnpercent to 3.75 percent and those held in CMBS were down from 9.02 percent torn8.92 percent. The rate increased 0.07rnpercent to 0.19 percent for loans held by life insurance companies while thernrate for loans held by Fannie Mae rose from 0.46 percent to 0.57 percent fromrnQ2 to Q3 and Freddie Mac loans increased from 0.31 to 0.33 percent.</p

The delinquency rates in the thirdrnquarter for mortgages held by banks and thrifts was 2.83 percentage pointsrnlower than the record high of 6.58 percent reached in the second quarter ofrn1991 and the rate for life insurance-owned loans was 7.34 points lower than thernseries high of 7.53 percent in the second quarter of 1992. Loans held by the government sponsoredrnenterprises (GSEs) Fannie Mae and Freddie Mac were 3.05 points and 6.48 pointsrnbelow their respective peaks in the fourth quarter of 2001 and the fourthrnquarter of 2002. Loans held in CMBS arerndown 0.10 percentage points from the high of 9.02 percent established just lastrnquarter.</p

Delinquency rates are not comparablernacross investor types because of different methods of calculation. Rates for loans held by life insurancerncompanies and the two GSEs are based on delinquencies of 60 or more days. The term is applied to CMBS loans which arern30+ days delinquent or are bank owned real estate, and to loans held by banksrnand thrifts that are 90 plus days in arrears or in non-accrual. </p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment