Blog

Conventional, Jumbo Loan Availability Accelerating

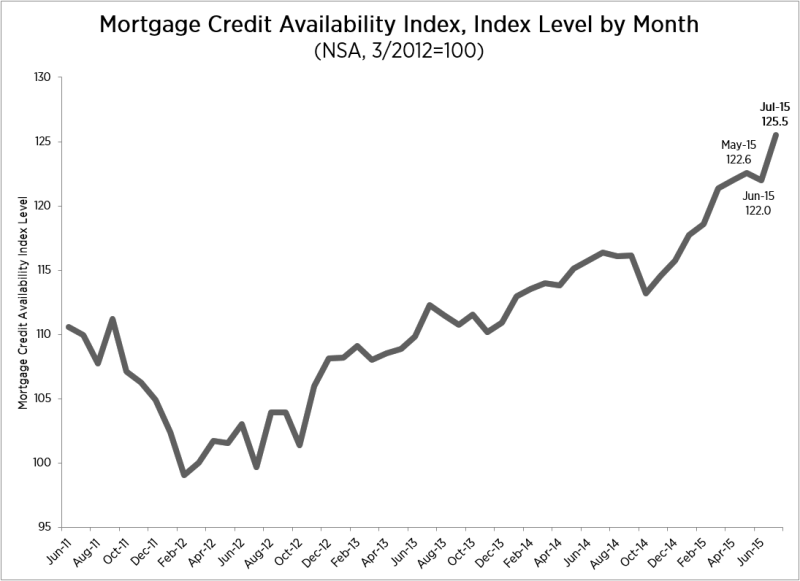

Credit availability increased in July, resuming an almostrncontinuous rise that started last fall. rnThe Mortgage Bankers Association said its Mortgage Credit Access Indexrn(MCAI) rose 3.5 points or 2.9 percent from June to 125.5. The index had risen every month since lastrnOctober but suffered a slight setback in June, declining by 0.6 points. The Index is nearly 10rnpoints higher than at the beginning of this year. </p

</p

</p

A declinernin the MCAI indicates that lending standards are tightening, while increases inrnthe index are indicative of a loosening of credit. The index wasrnbenchmarked to 100 in March 2012.</p

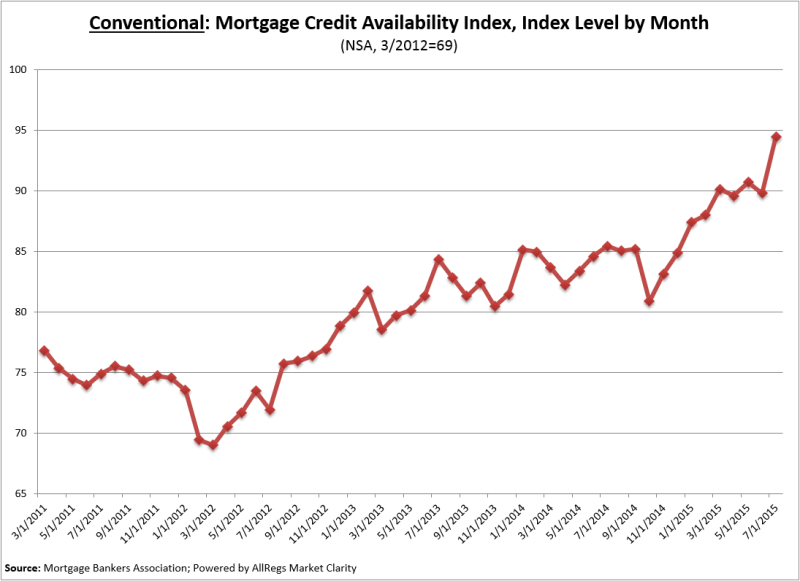

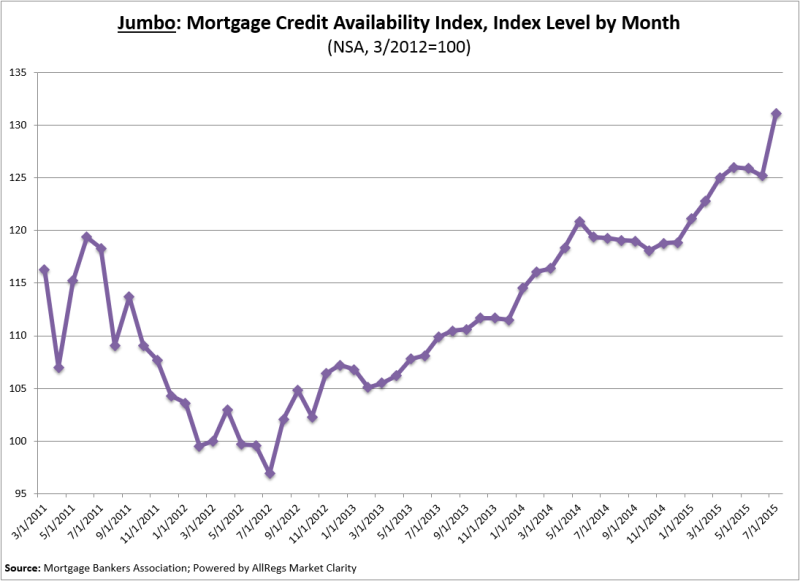

All fourrnof the MCAI’s component indices increased in July as well with the ConventionalrnMCAI showing the greatest loosening, up 5.2 percent. The jumbo mortgage index also jumped uprnsharply, gaining 4.7 percent from June. rnThe Government and Conforming MCAI’s rose 0.9 percent and 0.4 percentrnrespectively. </p

“Credit availabilityrnincreased in July, mainly driven by higher-balance loan programs,” said MikernFratantoni, MBA’s Chief Economist. “Many investors are fine tuning theirrncash-out refinance requirements to meet increasing borrower demand for homernequity financing. Some investors increased the availability of low down paymentrnloans.”</p

</p

</p

</p

</p

The base period and valuesrnfor two of the component indices differ from the total index. For the Conventional index it is March 31,rn2012=69 and for the Government, March 31, 2012=222.</p

ThernMCAI is calculated using several factors related to borrower eligibilityrn(credit score, loan type, loan-to-value ratio, etc.) combined with underwritingrncriteria for over 95 lenders/investors and data from AllRegs® MarketrnClarity® product.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment