Blog

CoreLogic Home Prices Down for Second Month

For the second consecutive month thernHome Price Index (HPI) published by CoreLogic posted a decline. The September HPI decreased 1.1 percent comparedrnto August figures. National home prices,rnincluding distressed sales, also declined year-over-year and are now 4.1rnpercent lower than in September 2010. rnThis was also the second straight month the numbers were down on anrnannual basis; revised August 2011rnfigures were down 4.4 percent from the same period one year earlier. When distressed sales including short salesrnand real estate owned (REO) are removed from the equation the year-over-yearrnfigures reflect a 1.1 percent decline in September and a 2.2 percent loss inrnAugust.</p

The losses were felt nationwide. Eighty-two of the top 100 Core BasedrnStatistical Areas (CBSAs) as measured by population showed year-over-yearrnlosses in both August and September.</p

“Even with low interest rates,rndemand for houses remains muted. Home sales are down in September and therninventory of homes for sale remains elevated. Home prices are adjusting torncorrect for the supply-demand imbalance and we expect declines to continue throughrnthe winter. Distressed sales remain a significant share of homes that do sellrnand are driving home prices overall,” said Mark Fleming, chief economistrnfor CoreLogic.</p

Since the peak in the National HPIrnwhich was recorded in April 2006, the HPI including distressed transactions hasrndeclined 31.2 percent. When distressedrntransactions are excluded, the HPI for the same period was 21.9 percent.</p

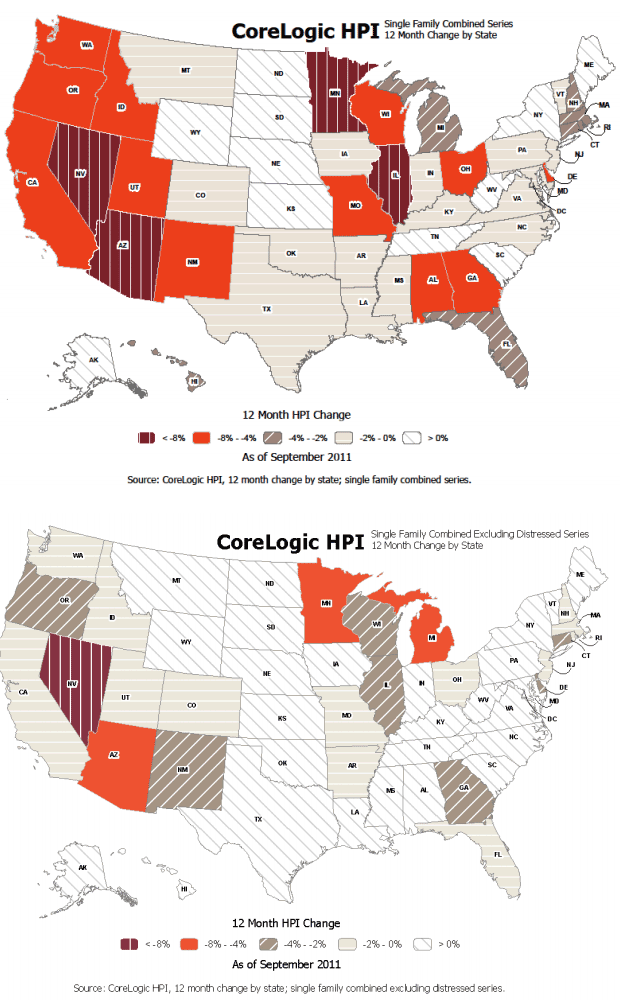

The states with the highestrnappreciation in the HPI including distressed sales were West Virginia, Wyoming,rnSouth Dakota, Main, and North Dakota and excluding HPI, West Virginia, Main,rnWyoming, Montana, and Kansas. The statesrnthat saw the greatest decrease in the HPI including distressed sales werernNevada, Illinois, Arizona, Minnesota, and Georgia. Excluding distressed sales the biggestrndepreciation was in Nevada, Arizona, Minnesota, Michigan, and Delaware.</p

The CoreLogic HPI provides arnmulti-tier market evaluation based on price, time between sales, property type,rnloan type (conforming vs. nonconforming), and distressed sales. The CoreLogicrnHPI is a repeat-sales index that tracks increases and decreases in sales pricesrnfor the same homes over time incorporating more than 30 years’ worth of repeatrnsales transactions representing more than 65 million observations. </p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment