Blog

CoreLogic: July Home Prices See Biggest Monthly Jump Since 2006

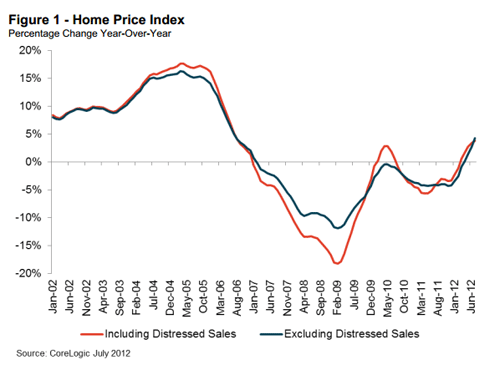

Home prices inrnthe U.S. enjoyed the largest annual increase in July that they had in sixrnyears, increasing 3.8 percent from prices in July 2011. CoreLogic, in releasing its July Home PricernIndex (HPI) which also includes sales of distressed properties, noted that July’srnprices were also up from the previous month, increasing 1.3 percent. This was the fifth consecutive month that thernIndex had increased on both an annual and month-over-month basis.</p

Whenrndistressed sales, transactions involving homes that have been foreclosed intornbank ownership (REO) or are in some stage of foreclosure, are excluded from thernfigures CoreLogic’s HPI rose 4.3 percent from July 2011 and was up 1.7 percentrnmonth-over-month. This was also thernfifth consecutive month-over-month increase.</p

</p

</p

Including distressed transactions, thernpeak-to-current change in the national HPI (from April 2006 to July 2012) was -27.2rnpercent. Excluding distressedrntransactions, the peak-to-current change in the HPI for the same period was -20.2rnpercent. </p

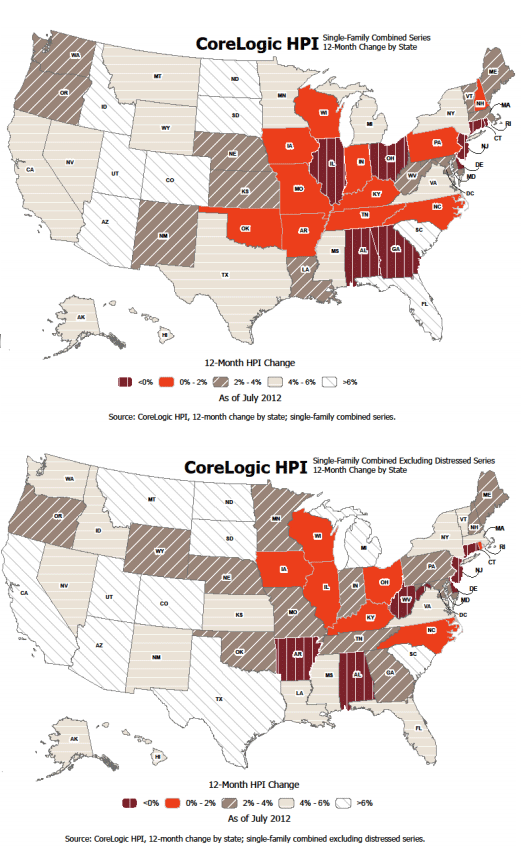

The fivernstates with the highest annual appreciation rate including distressed salesrnwere Arizona (+16.6 percent), Idaho (+10.0 percent), Utah (+9.3 percent), SouthrnDakota (+8.3 percent), and Colorado (+7.3 percent.) With distressed sales excluded the bestrnperformance was still in Arizona (11.3 percent) followed by Utah (+10.5rnpercent), Montana (+9.1 percent), South Dakota (+8.6 percent), and North Dakotarn(+6.9 percent.)</p

Overallrndepreciation was highest in Alabama (-4.6 percent), Delaware (-4.8 percent),rnRhode Island (-2.2 percent), and Connecticut and Illinois, each at -1.7 percent,rnWith distressed sales excluded prices fell 3.5 percent in Delaware, 2.4 percentrnin Alabama, 1.2 percent in New Jersey and were down fractionally in Virginiarnand Connecticut.</p

Of the top 100 Core Based StatisticalrnAreas (CBSAs) measured by population, 23 are showing year-over-year declines inrnJuly, four fewer than in June. </p

CoreLogic predicts that prices will showrnan even faster rate of appreciation in its August report with an expectedrnannual increase of 4.6 percent including distressed sales and 6.0 percent forrnmarket rate sales. The July to Augustrnchanges for the distressed and the non-distressed indices are expected to be +0.6rnpercent and +1.3 percent respectively. rnThe Pending HPI is based on Multiple Listing Service data that measuresrnprice changes in the most recent month.</p

“It’s been six years since the housing marketrnlast experienced the gains that we saw in July, with indications the summerrnwill finish up on a strong note,” said Anand Nallathambi, president and CEO ofrnCoreLogic. “Although we expect somernslowing in price gains over the balance of 2012, we are clearly seeing thernlight at the end of a very long tunnel.”</p

“Thernhousing market continues its positive trajectory with significant price gainsrnin July and our expectation of a further increase in August,” said MarkrnFleming, chief economist for CoreLogic. “While the pace of growth is moderatingrnas we transition to the off-season for home buying, we expect a positive gainrnin price levels for the full year.”</p

</p

</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment