Blog

Credit Loss Reserves and Foreclosed Inventory Expenses Eat at Fannie Mae’s Earnings

Fannie Mae has reported First Quarter 2010 Earnings Results.

The government-sponsored enterprise, which has been operating under governmentrnconservatorship since September 7, 2008, lost $11.5 billion in the firstrn quarterrncompared with a net loss of $15.2 billion in the fourth quarter of2009. Fannie Mae paid $1.5 billion to the Treasury Departmentrnduring the quarter in the form of dividends on senior preferred stockheld byrnthe U.S. government.

The lossrnattributable to common stockholders was $13.1 billion or ($2.29) perdilutedrnshare. The shareholder loss in thernfourth quarter of last year was $16.3 billion or ($2.87) per dilutedshare.

Net revenues in the currentrnstatement were $3 billion compared to $5.8 billion in Quarter Four and$5.2rnbillion during the same period one year ago. rnNet interest income was $2.8 billion compared to $3.7 billion lastrnquarter and $3.3 billion a year ago; and guarantee income was $54million comparedrnto $1.9 billion and $1.8 billion respectively.

Fannie Mae said that its first-quarter results were drivenrnprimarily by credit-related expenses, which are total provisions for credit losses and foreclosed property expenses. Credit relatedlosses for the quarter were $11.88rnbillion compared to $11.92 billion in the fourth quarter of 2009. The losses,however, were substantially lowerrnthan the $20.87 billion reported one year ago. These expenses remain at elevatedlevels becausernof the on-going recession and weakness in the housing market; weaknesstherncompany says it expects will continue through 2010.

The company made the following statement in its FirstrnQuarter Formrn 10-Q filed with the Securities and Exchange Commission:

“There isrnsignificant uncertainty in the current market environment and anychanges inrnthe trends in macroeconomic factors that we currently anticipate, suchas homernprices and unemployment may cause our future credit-related expenses andrn creditrnlosses to vary significantly from our current expectations. AlthoughTreasury's funds under the seniorrnpreferred stock purchase agreement permit us to remain solvent and avoidrnreceivership, the resulting dividend payments are substantial. Givenrnourrn expectations regarding future losses and draws from Treasury, we do notrnexpect to earn profits in excess of our annual dividend obligation toTreasuryrnfor the indefinite future. As a resultrnof these factors there is significant uncertainty as to our long termfinancialrnsustainability.”

The loss resulted in a net worth deficit ofrn$8.4 billion as of the end of March, taking into account a $3.3 billionrnreduction in the deficit related to the adoption of new accounting standardsrnand unrealized gains on available-for sale securities during the first quarter.

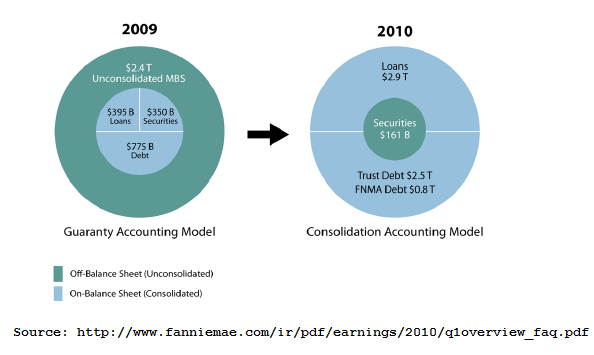

Fannie Mae's balance sheet reflects several changes because of new accounting rules including:

- A significant increase in loans and debt and a decrease in trading and available-for-sale securities.

- Separate presentation of the elements of the consolidated MBS trusts (such as mortgage loans, debt, accrued interest receivable and payable) on the face of their condensed consolidated balance sheets.

- Significant increase in allowance for loan losses and significant decrease in reserve for guaranty losses.

- Elimination of substantially all previously recorded guaranty assets and guaranty obligations.

During the quarter Fannie Mae purchased or guaranteed anrnestimated $191.4 billion loans based on the unpaid principal balance. This included $40 billion in loans purchasedrnin March from Mortgage Backed Securities (MBS) Trusts. Not including thern delinquent MBS purchases, Fannie Mae's purchasesrnfinanced approximately 516,000 single-family homes and 61,000multi-familyrnunits. The corporation had a 40.8rnpercent share of the single-family market.

The company acquired 61,929 single-family properties throughrnforeclosure during the first quarter compared to 47,189 in the fourthrnquarter. The total inventory of ownedrnsingle-family real estate at the end of March was 109,989 compared with86,155rnat the end of December.

The GSEs single-family serious delinquency rate increased to 5.47 percent as of March 31, 2010 from 5.38 percent as of December 31, 2009, but grew at a slower pace than in each quarter of 2009 as they continued to work with servicers to reduce delays in completing workouts and more modifications and foreclosure alternatives. Total nonperforming loans in Fannies' guaranty book of business were $223.9 billion as of March 31, 2010, compared with $216.5 billion as of December 31, 2009.

Fannie Mae said it had maintained pricing and eligibility standardsrnthat promote sustainable home ownership and stability and the risk profile ofrnthe loans it acquired remained strong. rnSingle-family loan acquisitions had a weighted average original loan tornvalue ratio of 69 percent and a weighted average FICO score of 758.

HERE are tables and graphs presented by Fannie Mae in their Credit Supplement.

Due to the loss,Fannie will join Freddie Mac inasking the Treasury Department for additionalrnfunding . Fannie Mae has already asked the Acting Director ofthernFederal Housing Finance Agency (FHFA) which acts as Fannie'sconservator, tornrequest a cash infusion from Treasury of $8.4 billion by the endof the secondrnquarter, June 30, 2010.

Fannie Mae President and CEO Mike Williams said of thernfinancial results, “In the first quarter we continued to serve as arnleading source of liquidity to the mortgage market, and we made solid progressrnin our ongoing efforts to keep people in their homes. Working with our lender partners, we completedrn94,000 loan modifications in the quarter, more than half of which werernconversions of trial modifications under the Obama Administration's HomernAffordable Modification Program.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment