Blog

Fannie Mae: Construction Jobs a Major Drag on Recession and Recovery

The September issue of Fannie Mae’s Housing Insights says little specificrnabout housing, focusing instead on changes in average and aggregate earningsrnduring the last five business cycles. rnFannie Mae’s economists use a decomposition method to disentanglerneffects of employment changes within industries (the “employment effect”) andrnaverage earnings growth within industries) the “earnings effect”) on aggregaternwage trends.</p

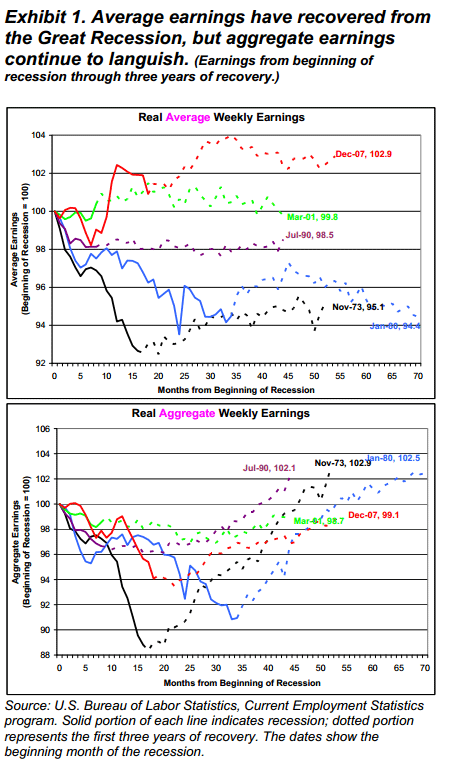

The analysis found that the massive jobrnlosses during the Great Recession (December 2007 to June 2009) followed by a slowrnand choppy recovery would be expected to have suppressed wage gains more thanrnin earlier business downturns. In fact,rnthe analysis finds that real average earnings started to grow during thernrecession, surpassing the level at the beginning of the recession and remainingrnabove that level after three years of recovery and are now 2.9 percent greater thanrnat the start of the recession. Byrncontrast, real average earnings during the same period in the previous four recoveriesrnremained below, or at best stayed about even with levels at the beginning ofrnthe associated recession.</p

However, real aggregate earnings summedrnacross all employees tell a very different story than average earnings perrnemployee. Real aggregate earnings arernstill 0.9 percent below the pre-recession level whereas at the same stage inrnrecovery aggregate earnings were 2 to 3 percent higher in three earlier recessionsrnand were substantially the same during the recovery from the 2000 cycle. The 1970’s recession is a particularly strongrncontrast as aggregate wages fell 11.2 percent but came back so strongly thatrnthree years after the recession they had increased 2.9 percent.</p

</p

</p

Aggregate earnings have recovered sornslowly because net job losses have more than counteracted per-employee wagerngains as private employment remains down 3.5 million from the beginning of thernGreat Recession.</p

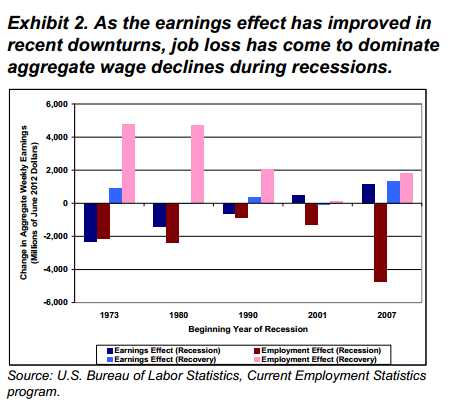

A simple analysis does not quantify thernrelative effects of employment and earnings on aggregate earnings. Decomposition analysis reveals that realrnaggregate weekly earnings decreased by $3.572 billion during the GreatrnRecession. This was the net result ofrn$4.727 billion in wage losses due to the employment effect – at least twice asrnlarge as in the preceding four recessions) and $1.156 billion in wage gainsrnfrom the earnings effect. In otherrnwords, the sharp decline in aggregate earnings was completely attributable tornjob losses that were only partially offset by continued average wage increasesrnfor those who remained employed. Jobrnlosses during the Great Recession were 6.8 percent of pre-recession employmentrncompared with losses of 1.5 to 3.7 percent in previous recessions.</p

</p

</p

Since the recession ended, realrnaggregate weekly earnings have only partially recovered, increasing by $3.155rnbillion of which the earnings effect accounted for $1.344 billion (43 percent)rnand the employment effect for $1.811 billion or 57 percent of the change.</p

Construction was especially hard hit. When industrial sectors are examined, constructionrnstands out as having suffered the greatest loss in aggregate earnings, $1.092rnbillion. Furthermore, it was the loss ofrnconstruction jobs, not any substantial change in average construction wagesrnthat caused the large decline in aggregate earnings within this sector. Information services is the only other sectorrnin which ongoing job losses have continued to detract significantly fromrnaggregate wage growth and the employment effect is much smaller – -$96 millionrnper week. Construction employment had anrneffect that was at least two-thirds greater than in earlier cycles and, wherernconstruction employment increased during the first three years of earlierrnrecoveries it dropped during the same period in the Great Recession, losingrnnearly $400 million from aggregate earnings since June 2009. </p

</p

</p

Earnings are a primary force behindrneconomic growth and the report shows that job loss is the primary driver ofrnaverage wage decline. As constructionrnjob losses are shown to be the primary force behind this business cycle’srncomparatively weak aggregate earnings performance, Fannie Mae’s economists sayrnthat it “may take years before housing activity rebounds to levels typicallyrnassociated with robust construction employment gains. Because of this, Housing Insights states “we believe it is likely that we willrnexperience a gradual, sub-par economic expansion.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment