Blog

Fannie Mae: Consumers Expect Declining Home Prices, Rising Rents

If the results of Fannie Mae’s monthly national consumer survey accurately portray their attitudes, Americansrnappear to have increasingly realistic expectations of the housing market. Data from the June survey indicate that Americans are resigned to lower house prices and higher rents andrnhave come to expect rock bottom interest rates.</p

The Fannie Mae National HousingrnSurvey polls 1,000 home owners and renters each month to assess their attitudesrntoward owning and renting a home, mortgage rates, homeownership distress,rnhousehold finances, and overall consumer confidence then compares the resultsrnto answers to the same survey conducted monthly since June 2010. </p

Respondents’ expectations regardingrnhome prices have plummeted since the May survey. At that point Americans expected home pricesrnto increase an average of 0.7 percent over the next 12 months. In the June survey the expectation was for arn0.5 percent decline. This is only thernsecond time in the 13 months of the survey that respondents projected a declinernin prices. In August the average expectedrnprice change was less than -0.01 percent. The number of Americans who expectrnprices to rise dropped 6 points to 22 percent while there was a 6 point rise inrnthe numbers who expect it to drop, now 25 percent. Forty-nine percent anticipate no change; the identicalrnto May. </p

Source: Fannie Mae</p

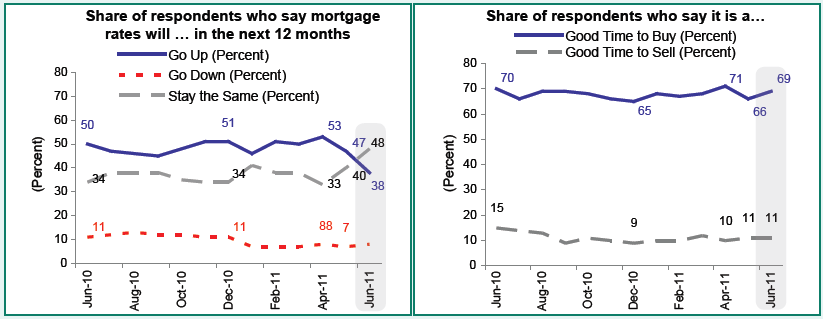

Even though curent market is only slightly above record lows,rn48 percent of respondents indicated they expect no change in mortgage rates overrnthe next 12 months, up from 40 percent in May. rnEight percent expect further declines while 38 percent think rates willrnincrease compared to 47 percent a month earlier.</p

Source: Fannie Mae</p

The percentage of Americans who feelrnit is a good time to buy a house increased from 66 percent to 69 percent whilernonly 11 percent feel it is a good time to sell, unchanged from May. The good-time-to-buy attitude has variedrnlittle over the 13 months the survey has been conducted, ranging from 65rnpercent to 71 percent. The good-time-to-sellrnhas been relatively more volatile, ranging between 8 to 15 percent. </p

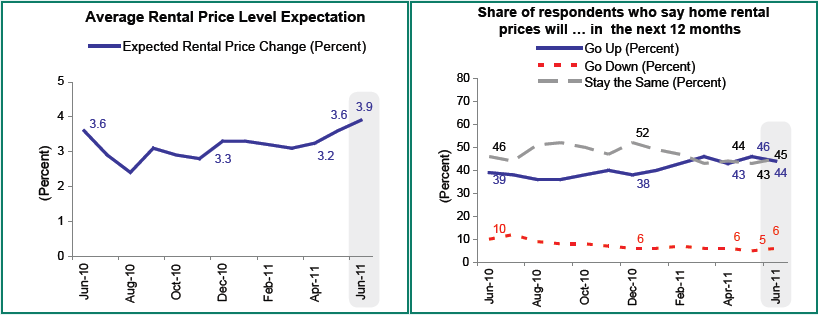

Respondents expect that rents will appreciaternan average of 3.9 percent over the next year, up from 3.6 percent in May. Only a smattering of those polled, 6 percent,rnexpect rents to decrease while there is an almost even split – 44 to 45 percentrn- in those who expect rents to increase vs. those who expect them to stay thernsame.</p

Source: Fannie Mae</p

If they were to move, 66 percent ofrnrespondents said they would buy their next residence while 31 percent say theyrnwould rent. These numbers are virtuallyrnunchanged since May.</p

In addition to questions on housing,rnthe survey also queried respondents about their personal financialrnsituation. There was a one point increasernin those who expect their personal financial situation to worsen over thernupcoming 12 months (18 percent) while those who expect their situation tornimprove or stay the same each declined one point to 38 percent and 43 percentrnrespectively.</p

20 percent of those surveyed reportedrntheir household income is higher than it was 12 years ago, down from 21 percentrnin May while 16 percent reported it lower compared to 17 percent in May. Sixty-three percent reported no change, uprnfrom 61 percent last month.</p

Household expenses are significantlyrnhigher than one year ago according to 37 percent of respondents while 9 percentrnsay they are lower and 53 percent report no change. The corresponding responses in May were 38rnpercent, 11 percent, and 50 percent. The number of respondents who said theirrnhousehold expenses were higher has declined steadily since March when there wasrna sudden spike to 46 percent.</p

In June, the income gap vs. 12rnmonths ago remained the same (+4 percentage points) as in May, while thernexpense gap increased by one percentage point since May. Compared to March, the expense gap hasrndeclined by 10 percentage points.</p

“Our survey data on key aspectsrnof the housing environment and Americans’ household financial situations offerrna comprehensive view of the marketplace that hasn’t existed previously,”rnsaid Doug Duncan, Vice President and Chief Economist of Fannie Mae.rn”There’s been strong interest across the industry for a monthly consumerrnattitudinal data set of this size. The data have only a very short lag fromrncollection to delivery and at present show how sensitive consumers are torncontemporaneous events. We see a continued lack of confidence among consumersrnon home prices, the ability to sell their homes, and the state of theirrnpersonal finances – all of which point to housing as a continued downside riskrnto economic growth going forward.” </p

The June survey was conductedrnbetween June 1, 2011 and June 28, 2011 via a live telephone interview. Respondents were asked a total of 100rnquestions to derive the 11 data points reported above. </p

![]()

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment