Blog

Fannie Mae Outlook: Economy Hits Air Pocket

The economyrnhas hit an “air pocket” according to FanniernMae’s latest economic projections. If your plane hasrnever hit one you’re familiar with the feeling; weightlessness, stomach not quite where yournleft it. You know or at least hope thernplane will stop dropping, you are just not sure when…</p

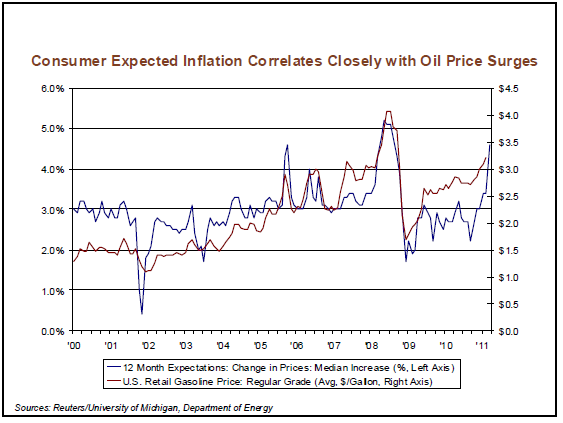

Fannie Mae’s April Economics and Mortgage Market Analysis attributes the currentrnstate of temporary weightlessness to a pair of major shocks – the politicalrnturmoil which continues in the Middle East and North Africa and the earthquakernand resulting nuclear catastrophe in Japan coupled with what it calls multiplerncross-currents in both the U.S and Europe. These includernbudget problems on all levels of government and related cut-backs in spending,rnconcern over federal monetary policy and “rising headline inflation” driven by increasing food and energy prices.</p

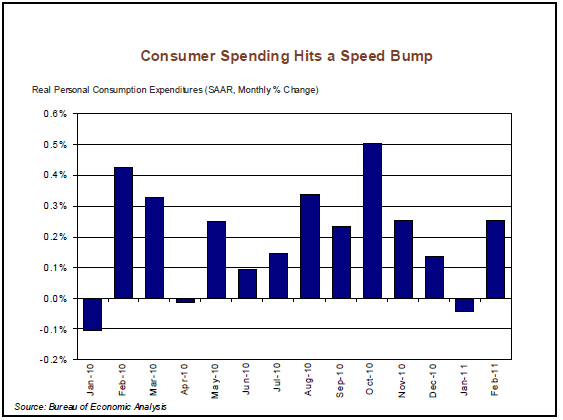

Meanwhile, there appears to be a slowdown in economic activity in thernfirst quarter of the year with consumer spending growth poised to come in wellrnshort of the high-water mark set in the fourth quarter of 2010. Business investment and nonresidentialrninvestment in structures also slowed and housing is showing renewedrnsoftness. Just as the picture begins tornseem bleak, Fannie Mae’s economists post some good news – more new jobsrncreated in March, an unemployment rate that dropped to its lowest level in twornyears, and the best quarter for the Dow Jones Industrial Average in 12 years. Despite the overall gloom in the report, Fannie Mae says the contraction in growth is expected to be temporary with a modest acceleration projectedrnfor the second half of the year. The group predicts economic growth to averagern3.1 percent for 2011, a downgrade from 3.5 percent projected in the March forecast. The key to this outlook is continued improvement in the labor market and moderating oil prices in the second half of the year. Fannie does however exhibit nervous sentiments on the potential for further downgrades, saying “significant challenges lie ahead, which could potentially lower growth this year by much more than we project.”</p

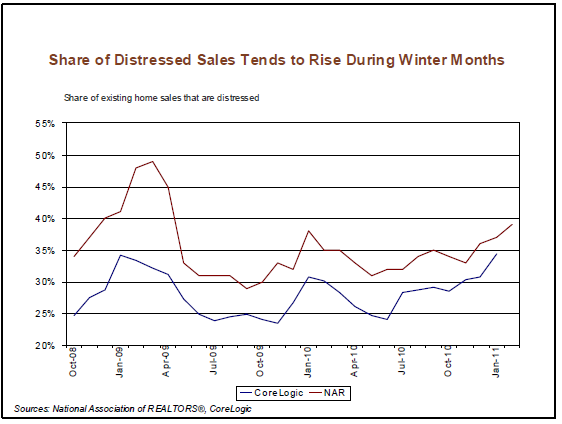

The report calls housing the “Achilles Heel of thernExpansion.” Activity weakenedrnacross the board in February. Existingrnhome sales fell 10 percent, perhaps partially due to earlier weather conditionsrnand distressed sales continue to account for more than a third of total housingrnsales. The distressed sales are a particularrnhurdle for the new home market which set a new record low in February and isrnnow 9 percent below the old record set last August. The lack of salesrnactivity has resulted in sharp drops in housing starts which are now only aboutrnfour percent above the record lows in January 2009 and the second consecutivernmonthly drop in the issuance of single-family permits suggest continuedrnsluggish homebuilding activity near term.</p

</p

</p

Distressed sales and a winding down of programs to support the housingrnmarket have affected home prices which have shown persistent declines. The FHFA purchase-only price index fell inrnJanuary for the seventh time in eight months while the CoreLogic andrnCase-Shiller indices show year-over-year home price appreciation during the firstrnhalf of 2010 and then renewed declines following expiration of the homebuyerrntax credits. Market expectations forrnhome prices have deteriorated over the past several months according tornmultiple surveys of consumers.</p

Some of the shifts in housing projections since the March report arerndisquieting. Median prices of existing homes which were projected to float inrnthe $211,000 to $223,000 range through the end of 2012 have been downgraded torna range of $160,300 to $167,500 in the first three quarters of 2011, fallingrnagain at the end of this year and beginning of next before recovering to aroundrn$167,000 by Q4 2012. Housing starts havernbeen downgraded to 478,000 for the year compared to 508,000 in the March reportrnand total housing sales projections were modified slightly from 5.56 million 5.53rnmillion. Mortgage originations are still projected to total $1.038 billion withrn40 percent coming from refinances and the estimate for the 30-year interestrnrate remains at 5.4 percent at year-end. </p

Some other details from the forecast….</p

In January real (inflation adjusted) consumer spending declined for thernfirst time in nine months, Januaryrngrowth was approximately -.03 percent compared to over 1 percent inrnDecember. It rebounded to Decemberrnlevels in February but the near-term outlook appears, the report says, subduedrn”as confidence has recently turned sour.” </p

</p

</p

The rapid rise in gasoline prices – up by 80rnpercent on an annualized basis in the three months ending in February (andrnsubstantially higher since) has taken a toll on consumer confidence. The March Conference Board consumerrnconfidence index fell to 63.4 percent from the recovery high point of 72.0 it reachedrnin February and the consumer sentiment index from Reuters/University ofrnMichigan fell ten points during the month. rnFannie Mae economists expect that the growth in consumer spending duringrnthe first quarter will be below 2 percent compared to over 4 percent in Q4rn2010.</p

</p

</p

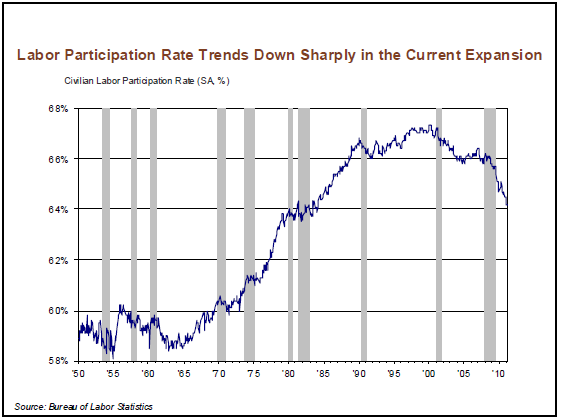

Unemployment was down to 8.8 percent in March, the fourth consecutivernmonthly drop and the rate for the quarter decreased 0.7 percent to 8.9 percent,rnthe steepest quarterly drop since 1984. The vast improvement in the unemployment rate in December and January was due to a huge drop in the labor force (nearly 800,000 during the tworn month period). The forecast projects an unemploymentrnrate of 8.4 percent by year-end. Initial unemployment claims have also declinedrnwith the four-week moving average remaining below 400,000 for six straight weeks. In a survey by Business Roundtable 52 percentrnof CEOs said they intend to add to payrolls, up from 45 percent in the fourthrnquarter. </p

The labor participation rate, which had been falling almost continuously since April of last year, has shown signs of stabilization though. The rate remained unchanged in March for the second consecutive month at an historically low level of 64.2 percent, half a percentage point below that of six months ago. A declining participation rate is historically quite unusual during economic expansions with the notable exception of the jobless recovery following the 2001 recession.However, the dip in the rate in February and March indicated a genuine improvement as gains in household employment substantially outweighed the increase in the labor force.</p

</p

</p

The average workweek for all employees on private payrolls was unchanged at 34.3 hours in March. In addition, the average hourly earnings of all employees also were unchanged for the fourth time during the last five months. During the past year, wages have risen just 1.7 percent, which will provide little help for consumers to combat higher gasoline prices. However, soft wage trends appear to give the Fed some comfort, in that underlying inflation will likely be benign in the face of rising energy and commodity prices.</p

READ MORE…</p

Inflation Update: Cost of Living Rising as Wage Growth Lags</p

Inflation Expectations Distorted by Bullish Perspectives of Reality</p

Two-Headed Labor Market Presents Problem for Bond Investors

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment