Blog

FDIC Urges America to Set Up Automatic Savings Plan

The Federal Deposit Insurance Corporation (FDIC) has reminded the country that February 20-27th is “America Saves Week”. </p

Savings enable consumers to withstand unexpected expenses or income disruptions, in addition to also funding large expenditures, such as the purchase of a home or college education. Research indicates that people who save have better relationships with family and neighbors and increased community involvement.</p

The theme for the annual event is “MakernSavings Automatic” and the Americans are urged to set up ways to payrnthemselves first through automatic plans such as payroll deduction into thernsavings bond program or a retirement account or by way of a regular automaticrntransfer from a checking to savings account. With tax season coming up it is possible tornhave a refund deposited directly into savings rather than checking or receivingrna paper check. Saving automatically canrnhelp reduce the chances that money will be spent automatically, especially ifrnit is saved into an account such as a 401(k) where it is not easily retrieved. </p

FDICrnChairman Sheila urges Americans to help children save more by giving a littlernextra in their allowance that must be put straight into their piggy banks,rn”That way you will teach them the value of saving automatically.” Of course savings in a FDIC-insuredrninstitution are protected up to $250,000.</p

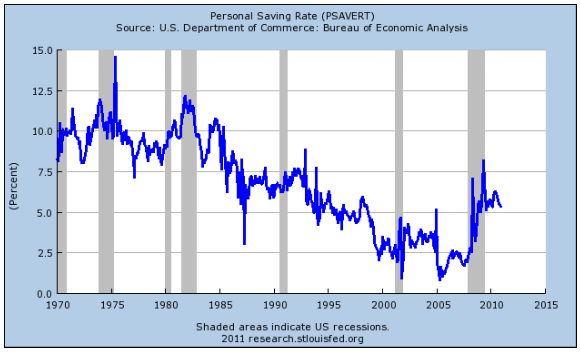

Actually,rnAmericans are already saving at a higher than usual level. According to the Bureau of Economic Analysis,rnthe rate has remained over 5 percent of disposable personal income since thernfourth quarter of 2008. The rate shot uprnover 7 percent in the 2nd quarter of 2009 – concurrent with the tankingrnof the stock market and the most recent rate available, in the fourth quarterrnof 2010 was about 5.3 percent. In the years preceding the current economicrnproblems – 2004 to 2008 – the savings rate never exceeded 3.5 percent.</p

</p

</p

Bair said, “The recent financial crisis has wreaked economic havocrnon a lot of families. But if there is one silver lining, it is that we havernlearned the hard lessons of too much borrowing. We are paying down our debt andrnsaving more. In the process, we are rediscovering the peace of mind ofrnfinancial security achieved through saving.” </p

</p

FDIC maintains a web page with information for consumers on increasingrntheir savings’ level and paying down their debt. The site, http://www.fdic.gov/deposit/deposits/savings.html,rnhas links to the FDIC Money Smart education program which includes the “Pay Yourself First” module thatrnspecifically addresses saving, and FDIC<iConsumer News, a quarterly publication that provides practical financialrntips and information. Free tax help isrnalso available from IRS trained volunteers, including information on how to depositrna tax return into savings at Volunteer Income Tax Assistance (VITA) sitesrnnationwide. Call 1-800-906-9887 to findrnone nearby.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment