Blog

HAMP Servicers and Their Metrics Continue to Improve

The Departments of Treasury and Housingrnand Urban Development released the August version of its monthly HousingrnScorecard this afternoon. The Scorecard is a summary of housing data fromrnvarious sources such as the S&P/Case-Shiller house price indices, thernNational Association of Realtors® existing home sales report, Census data, andrnRealtyTrac foreclosure information. Mostrnof the information has already been covered by MND. </p

The Scorecard includes by reference thernmonthly report on the Home Affordable Modification Program (HAMP). The current report covers information throughrnJuly and includes the program’s second quarter Servicer Assessment Results.</p

Since the June HAMP report the programrnhas initiated 14,117 trial modifications and converted 16,767 trials tornpermanent status. Over the life of thernprogram which began in early 2009, 1.90 million trials have been started andrn1.06 million of them have been converted to permanent status. </p

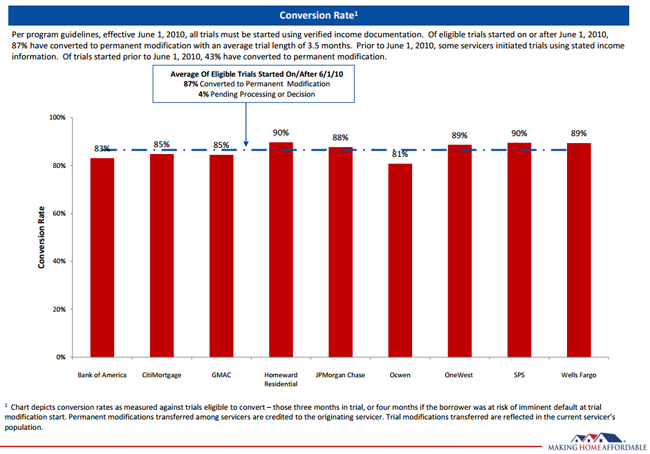

Some of the metrics in the report indicaternhow much the HAMP program has changed over its lifetime. In the early months of the program trialrnmodifications dragged on for months as documentation was mishandled and otherrnproblems jammed the system. After the administrationrnmade substantial changes to the program in June, 2010, many of the problemsrnbegan to clear. For example, the monthrnbefore the changes were put in place there were 190,412 loans that had been inrna trial modification for more than six months; today there are 10,286. Only about 4 percent of the loans thatrnentered trials after the changes are still pending conversion.</p

</p

</p

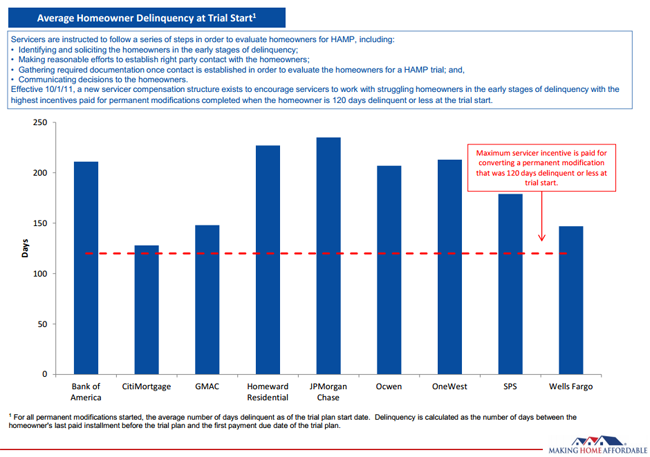

Servicers are not performing as well onrna mandate to convert loans to permanent status that were 120 or fewer daysrndelinquent when the trial started, a benchmark at which a maximum incentive isrnpaid to the servicer. Only threernservicers are meeting this goal</p

</p

</p

There are several subsidiary foreclosurernprevention programs now operating under the aegis of HAMP. The Second Lien Modification Program (2MP) hasrnstarted just over 90,000 second lien modifications. So far these have resulted in thernextinguishment of 20,664 second liens and partial extinguishment of 4,686 liens. Nearly 65,000 borrowers remain in the programrnawaiting action on their liens. Thernaverage fully extinguished loan had a value of $62,106 and the average amountrnof the partial extinguishments is $8,918.</p

Home Affordable Foreclosure Alternativesrn(HAFA) provides borrowers an opportunity to avoid foreclosure through a shortrnsale of property or by giving the lender a deed-in-lieu of foreclosure. To date 85,023 borrowers have entered thernprogram and 60,572 HAFA transactions have been completed, 58,969 through arnshort sale. At present there are 10,911 homeownersrnactive in this program. </p

The Treasury FHA-HAMP Program providesrnassistance to eligible homeowners with FHA insured mortgages. There have been 13,270 trial modificationsrnstarted through the program and 7,853 conversions to permanent status.</p

A final subsidiary program is UP whichrnprovides temporary forbearance to unemployed homeowners. To date 21,863 homeowners have been grantedrnforbearance with some payment required and 3,463 given forbearance with nornpayment.</p

One tool that in the HAMP program,rnalthough its use is not permitted for Freddie Mac and Fannie Mae loans, is principalrnreduction activity (PRA). Servicers havernbeen encouraged by Treasury which has recently tripled previous program incentives,rnto reduce the principal on loans with loan-to-value ratios over 115rnpercent. Principal reduction was notrnwidespread before introduction of PRA but there have now been 122,086 loanrnmodifications where principal reduction has played a role and 92,777 of thesernhave been done under PRA, 3,333 since the June report. The average principal reduction done throughrnPRA is 31.5 percent or $70,124.</p

Servicer assessments for the secondrnquarter found no servicers in need of substantial improvement. This is a far cry from the first few quartersrnthese assessments were conducted when several of the largest servicers were foundrnto be so deficient that their incentive payments were withheld. There were seven servicers in need ofrnmoderate improvement and two, One West Bank and Select Portfolio Servicers thatrnneeded only minor improvement. Servicersrnwho service only for the GSEs or FHA are not subject to the assessments whichrnare conducted by Treasury.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment