Blog

Home Buyer Tax Credit Done. Originators Need Product to Close Pending Contracts

The Mortgage Bankers Association (MBA) today released its WeeklyrnMortgage Applications Survey for the week ending April 30,2010.

Michael Fratantoni, MBA's VicePresident of Research and Economics says:

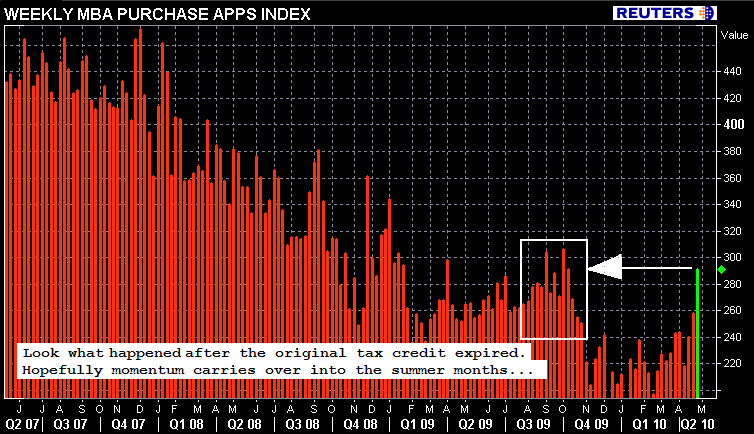

“Purchase application activity continued to increase in the last weekrn ofrn the homebuyer tax credit program…Purchase applications were up 13percent over the previous week and almost 24 percent over the lastmonth, driven by significant increases in both conventional andgovernment purchase applications. We also saw the Government share ofapplications for purchasing a home increase to over 50 percent of allpurchase applications last week, which is the highest in two decades.”

The survey covers over 50 percent of all US residential mortgage loanrnapplications taken by mortgage bankers, commercial banks, and thrifts. This data gives economists a look into consumer demand for mortgageloans. A rising trend of purchase mortgage applications indicates anincrease in home buying interest, a positive for the housing industryand the economy as a whole.

From the Release….

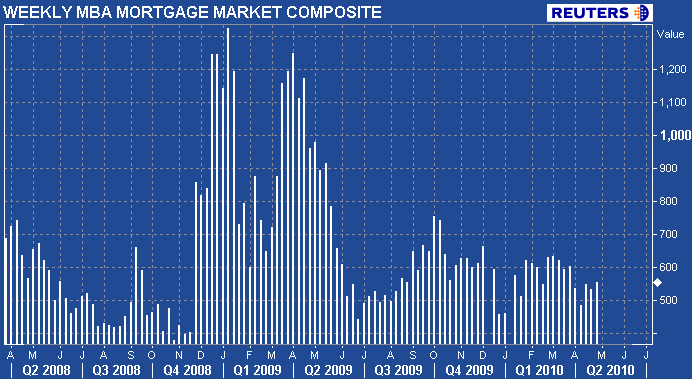

The Market Composite Index, a measure of mortgage loan applicationrnvolume, increased 4.0 percent on a seasonally adjusted basis fromoneweek earlier. On an unadjusted basis, the Index increased 5.1percentcompared with the previous week. The four week moving average fortheseasonally adjusted Market Index isup 0.9 percent.

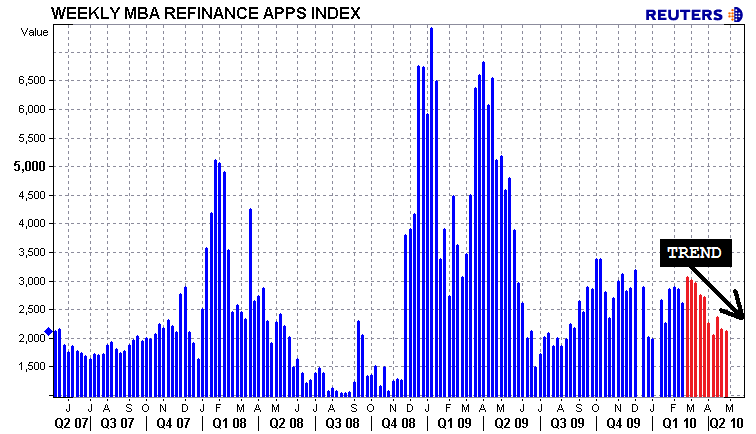

The Refinance Index decreased 2.1 percent from the previous week.rn The four week moving average is down 1.5 percent. The refinance share ofrn mortgage activity decreased to 51.9 percent oftotal applications from 55.7 percent the previous week. This is thelowest refinance share observed in the survey since the week endingJulyrn 3, 2009.

The seasonally adjusted Purchase Index increased 13.0 percentfromone week earlier. The four week moving average is up 5.0 percent for thern seasonallyadjusted Purchase Index. This is the third consecutive weeklyincreasein purchase applications and the highest Purchase Index recorded in thesurvey since the week ending October 2, 2009.

The Conventional Purchase Index increased 9.4 percent from theprevious week while the Government Purchase Index increased 16.7percent. The unadjusted Purchase Index increased 14.1 percentcomparedwith the previous week and was 10.3 percent higher than the same periodone year ago.

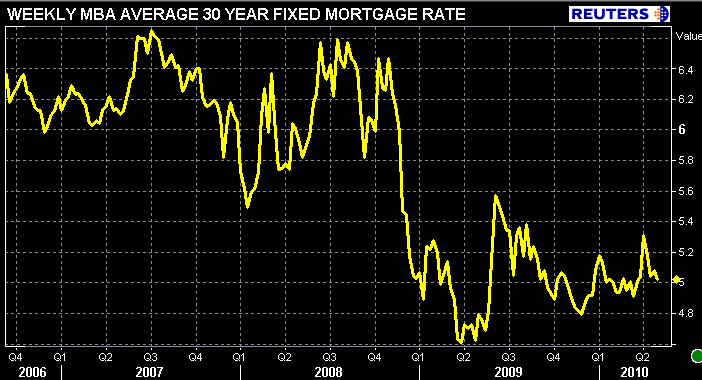

The average contract interest ratefor 30-year fixed-rate mortgages decreased to 5.02 percent from 5.08percent, with points increasing to 0.92 from 0.91 (including theorigination fee) for 80 percent loan-to-value (LTV) ratio loans. Theeffective rate decreased five basis points from last week.

Theaverage contract interest rate for 15-year fixed-rate mortgagesdecreased to 4.34 percent from 4.38 percent, with points decreasingto0.80 from 0.93 (including the origination fee) for 80 percent LTVloans. The effective rate decreased six basis points from last week.

Thern average contract interest rate for one-year ARMs remained unchanged at7.03 percent, with points decreasing to 0.28 from 0.30 (including theorigination fee) for 80 percent LTV loans. The adjustable-rate mortgage(ARM) share of activity increased to 6.3percent from 6.0 percent of total applications from the previous week.

The homebuyer tax credit officially expired on April 30, pendingbuyers have until the end of Juneto close on their contract. While most of these borrowers shouldrn have already submitted a loan app, there is the chance mortgageapplications run higher in the weeks ahead as last minute buyers fliplenders, rate shop, and attempt to qualify elsewhere after an Approve/Ineligiblern or the dreaded Refer with Caution/IV. Plus there is thepotential that “Shadow Buyers” boost demand. READ MORE ABOUT SHADOW BUYERS

Lawrence Yun, NAR chief economist at the NAR is cautiouslyoptimistic…

“Clearly the home buyer tax credit has helped stabilize the market.In the months immediately following the expiration of the tax credit, wern expect measurably lower sales,”

“Later in the second half ofthe year, and into 2011, home sales will likely become self-sustainingif the economy can add jobs at a respectable pace, and from a return ofbuyer demand as they see home values stabilizing.”

THE TRUE TEST OF HOUSING's STABILIZATION WILL COME THIS SUMMER AND NEXTrnFALL

To play their part, mortgage professionals need good product (more95% MI) and aggressive pricing aimed at creditworthy borrowers(reduction in certain LLPAs). Don't get your hopes too high for jumboproduct though, the broad based resurgence of the non-agency mortgagemarket is still a ways off. Let's get the GSEs back on track first.

Consumers must pay close attention to their local market (realtorhelp) and start the loan application process early to avoid thepotential for hangups in the underwriting process. READ MORE

The ducks are on the pond…now we gotta bring 'em home.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment