Blog

Homeownership Continues Dismal Decline; Rentals Soar

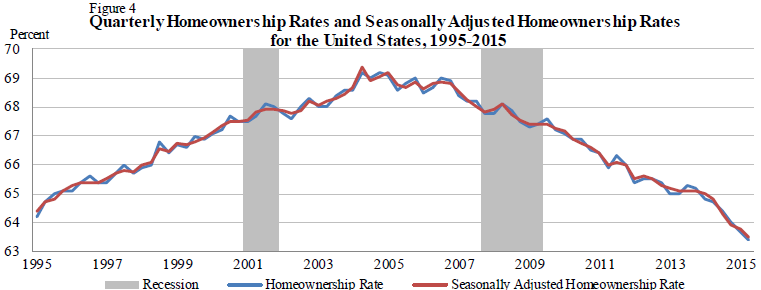

Homeownership declined yet again in the second quarter ofrn2015. The Census Bureau said that thernnational rate dropped from 63.7 percent in the first quarter to 63.4 percent inrnthe second and was more than a point down from the 64.7 percent where it stoodrna year earlier. Homeownership peaked at 69.2 percent in the second and fourthrnquarters of 2004 and flirted with that level periodically for the next fourrnyears but has declined steadily since the end of 2008.</p

</p

</p

The erosion of homeownership was evident in every age grouprnexcept those under age 35. It ticked uprnfrom 34.6 percent to 34.8 percent for that cohort which always posts the lowestrnrate, but was still below that of any quarter inrn2014. Even those over age 65 wherernhomeownership is consistently the highest, fell a half point to 78.5 percent.</p

Homeownership was highest in the Midwest at 68.4 percent. ThernSouth was second highest at 64.9 percent followed by the Northeast at 60.2rnpercent and the West at 58.5 percent Ratesrnin all regions were down from a year earlier and down from the previous quarterrnin all but the West which was unchanged.</p

Homeownership among those classifying themselves as Blackrnonly or as Hispanic rose compared to the previous quarter from 41.9 to 43.0rnpercent for Black only and from 44.1 to 45.4 percent for Hispanics. For those who said they were non-Hispanic Whiternonly the rate slipped from 72.0 to 71.6 percent but the rate among all otherrnraces fell sharply, from 55.4 percent to 52.6 percent. </p

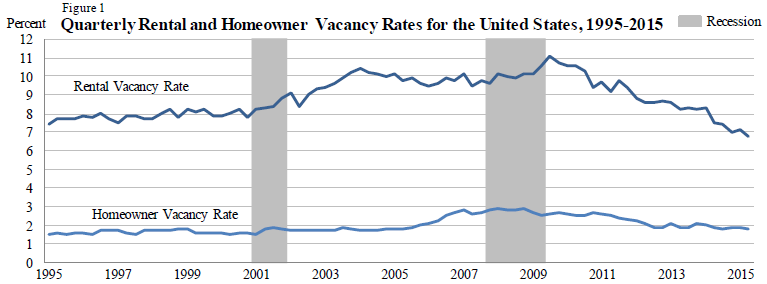

There was better news about vacancy rates which have leveledrnoff for homeowner properties at 10-year lows and continue to drop sharply forr rental properties. Homeowner propertiesr had a vacancy rate of 1.8 percent in the second quarter, down 0.1 from both ther previous quarter and the second quarter of 2014. This is the lowest rate since the secondr quarter of 2005 and follows several years of rates in the 2.5 to 2.9 ranger leading up to and during the Great Recession.</p

Second quarter rental vacancies were the lowest in at least 20 years . At 6.8 percent, the ratern was 0.3 percent below Q1 and down from 7.5 percent a year earlier. </p

For more options of rentals check for the Office Space to Rent in Asoke company and find the right one for you.

</p

</p

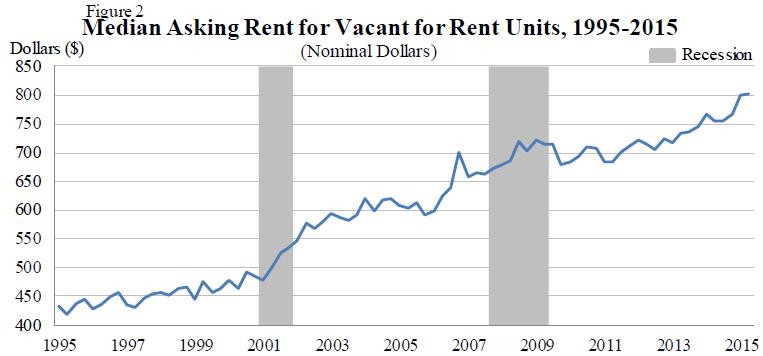

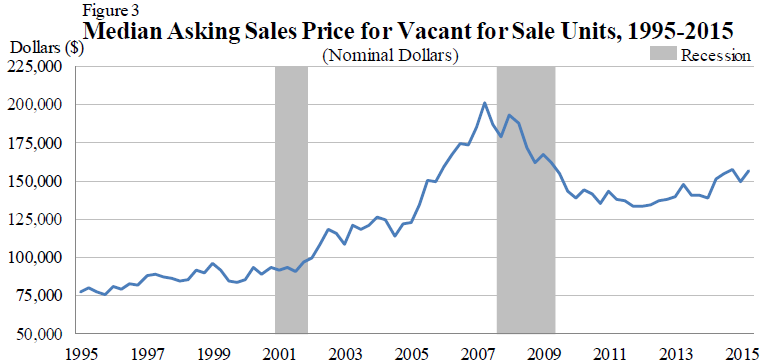

As vacancies have declined the rents for the remaining properties have soared. The median nasking price in the second quarter was $803 per month, up from around 680 in rn2009. The median asking price for vacant homeowner property was $156,300, a price which has remained relatively flat since the recession ended.</p

</p

</p

</p

</p

The highest rental vacancy rate was in the South at 8.4rnpercent but vacancies in that region declined sharply from the previousrnquarter, down .8 percentage points. ThernWest had the lowest rate at 4.9 percent and this was almost a point lower thanrnin the first quarter.</p

The Bureau estimated that there were approximately 134.6rnmillion housing units in the U.S. at the end of the second quarter of 2015, arndecline of 766,000 from the same quarter in 2014. Vacant units totaled 17.3 million, downrn852,000 year-over-year and there were 170,000 fewer vacant rental units andrn51,000 fewer vacant units for sale.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment