Blog

HOPE NOW Modifications Surge, Re-Defaults at Program Low

Loan modifications through the HOPE NOWrnprogram increased dramatically in July, soaring 43 percent from the number ofrncompleted modifications in June. HOPErnNOW, the voluntary, private sector alliance of mortgage investors, servicers,rninsurers, and non-profit counselors announced on Wednesday that it hadrncompleted 66,002 permanent affordable loan modifications for homeowners duringrnthe month compared to 46,208 in June. Atrnthe same time, modified loans are performing at the best level in HOPE NOW’srnhistory.</p

Today’s numbersrndo not include modifications completed through the Home Affordable ModificationrnProgram (HAMP) during the month. Thesernwill be reported separately by the Department of Treasury. </p

FaithrnSchwartz, Executive Director of HOPE NOW, said the July surge in modifications wasrn”a direct result of the combinedrnefforts of the industry, non-profit community and government on behalf ofrnhomeowners across the country.”</p

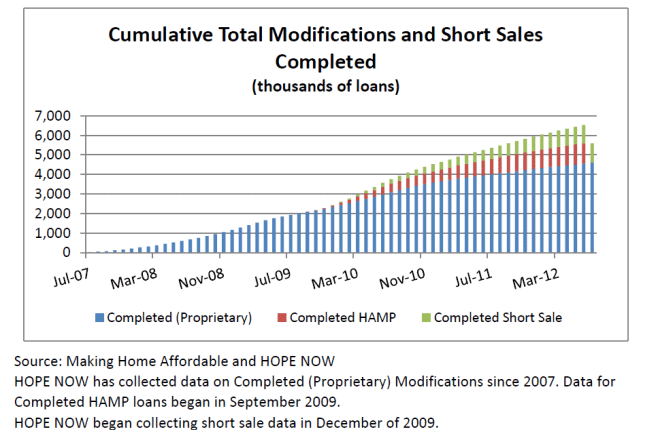

July modifications bring the totalrnof permanent loan modifications since 2007, both proprietary and through HAMP, torn5.66 million. This includes 4.62 millionrnhomeowners who have received proprietary modifications through July and 1.04rnmillion with HAMP modifications through the end of June. So far this yearrnHOPE NOW has completed 451,000 modifications with July HAMP data stillrnoutstanding.</p

Seventy-one percent of proprietaryrnmodifications completed in July included reduced payments of more than 10rnpercent and 96 percent of the modifications fixed mortgage interest rates forrnat least five years. </p

At the end of July there were 82,333rnmodified loans that were seriously delinquent for a re-default rate (90+ daysrndelinquent) of 8.9 percent compared to 10.3 percent at the end of June. This is the lowest rate in the program’srnhistory.</p

HOPE NOW also facilitated 36,260rnshort sales during the month, bringing the total number of these sales torn974,000 since 2009. Combined withrnmodifications, HOPE NOW has brought permanent non-foreclosure solutions to 6.63rnmillion homeowners. </p

</p

</p

Foreclosure sales were initiated on 164,593 loans in Julyrncompared to 156,945 in June, an increase of 5 percent. There were 63,527 foreclosure sales comparedrnto 63,810 in June.</p

Schwartz, Executive Director sad itrnwas encouraging to see the lower number of re-defaults on modified loans “whichrnwe attribute to the higher percentage of sustainable and realistic solutionsrnbeing offered to homeowners. The state of the economy, geography andrnmodification program types are always contributing factors to the effectivenessrnof modifications. It is important to note that HOPE NOW defines re-defaultsrnas loans that are 90+ days delinquent after six months of completing arnmodification, using a rolling 18 month inventory of completed modifications.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment