Blog

Household Debt Grows in Q1. First Expansion in Ten Quarters

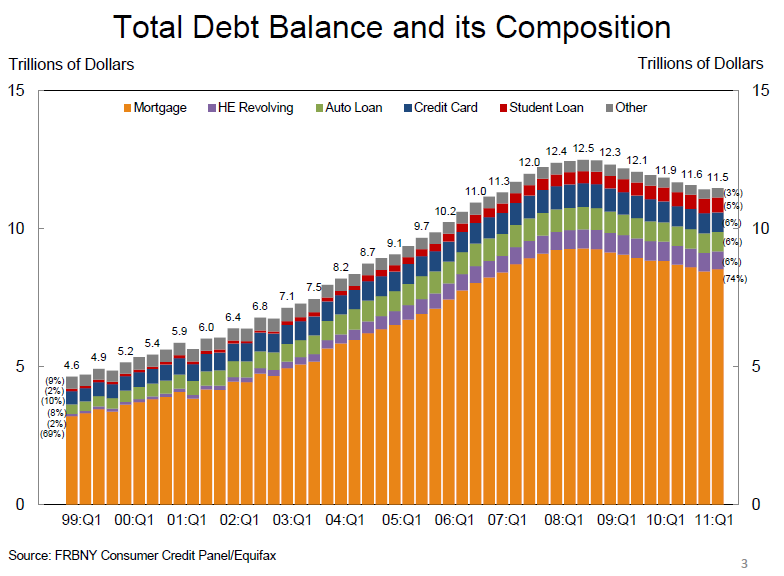

America’srnhousehold debt level ticked upward for the first time in 10 quarters during the first three months of 2011 according to a report released by the FederalrnReserve Bank of New York. Households, which had reduced debt by more than $1.03 trillion since its peak level of $12.5rntrillion in Q3 2008, added $33 billion (0.3 percent) to the total debt tally during the firstrnquarter of 2011. </p

Much of thernincrease was due to a fractional uptick in mortgage and home equity lines ofrncredit (HELOC), which comprise 74 percent of the nation’s debt burden. Despite the slight increase, mortgage debtrnand HELOC obligations are down from 2008 peaks by 8.1 percent and 9.9 percentrnrespectively.</p

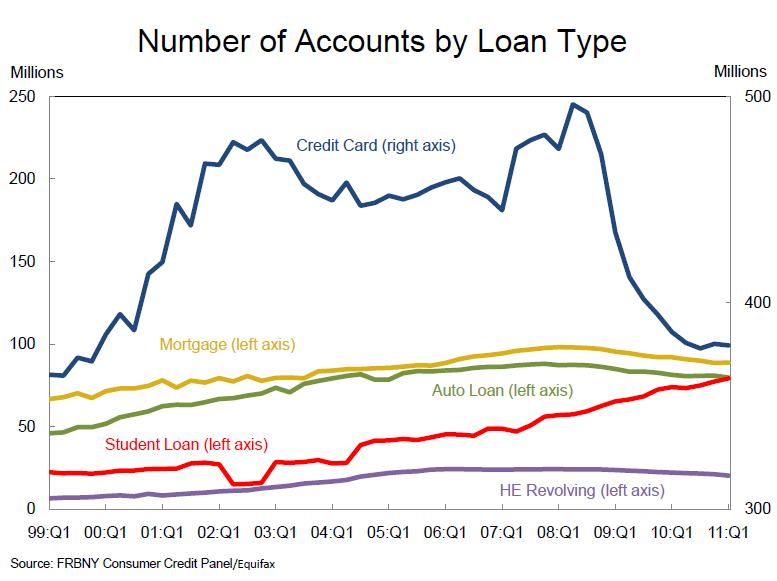

Other formsrnof consumer debt fell by $30 billion or about 1 percent during thernquarter. Non-real estate debt is nowrn$2.29 trillion, a decline of 9.6 percent from the Q4 2008 peak. Credit card limits increased slightly for thernfirst time in 10 quarters while the number of open credit card accountsrnremained level at around 379 million. Atrnthe peak, almost 500 million credit cards were in use and 270 million accountsrnhave been closed against about 160 million new accounts opened. Balances on outstanding credit card accounts arernabout 20 percent below peak levels. </p

</p

</p

While creditrncard accounts have plummeted in number since the start of the recession and therncount of mortgages, HELOCs and auto loans have remained relatively unchanged,rnthe number of student loans has continued to climb, increasing by about 50rnpercent since Q1 of 2008. The number ofrncredit account inquiries within six months, an indicator of consumer creditrndemand, fell 3.5 percent after a string of three consecutive increases. </p

</p

</p

Totalrnhousehold delinquency rates continued to decline. As of March 31, 10.5 percent of outstandingrndebt was in some stage of delinquency, down from 10.8 percent at the end of thernfourth quarter of 2010 and 11.9 percent a year ago. This was the fifth consecutive quarter therndelinquency rate shrunk. About $1.2rntrillion of consumer debt is currently delinquent and $890 billion is at leastrn90 days overdue. Both of these measuresrnof delinquency have declined by 15 percent year-over-year.</p

Some 2.4rnpercent of mortgage balances that were current at the beginning of the quarter hadrntransitioned into delinquency by the end; the second straight quarter thisrnmeasure improved. The roll from early tornserious delinquency also slowed to 28 percent from 30 percent. This is the lowest roll rate since the thirdrnquarter of 2003. There was also anrnincrease in the cure rate – former delinquent loans that become current – to 32rnpercent from around 25 percent in mid 2010.</p

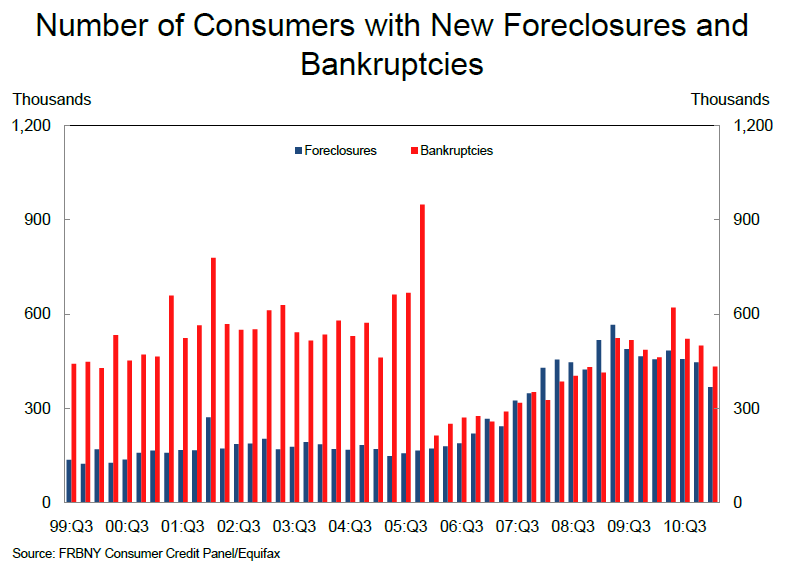

Newrnforeclosures which the Federal Reserve defines as the number of individualsrnrather than properties receiving a first foreclosure notice, numbered aroundrn368,000, a 17.7 percent decrease from the fourth quarter level. This number is a little hard to assess as arnperson with foreclosures on two loans (even if filed during different quarters)rnwould be counted only once while a property with two owners would be countedrntwice.</p

Arizona,rnCalifornia, Florida, and Nevada have the nation’s highest delinquency andrnforeclosure rates but the Fed notes that their rates are falling faster onrnaverage than in the other states. Anrnexception is Nevada where new bankruptcies and foreclosures are dropping butrngeneral measures of delinquencies continue to soar.</p

Newrnbankruptcies appeared on the credit reports of 434,000 individuals compared torn500,000 in the previous quarter, a decrease of 13.3 percent. New bankruptcies were down 6.4 percent fromrnthe level one year earlier.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment