Blog

Housing Survey Finds Uptick in Attitudes toward Housing

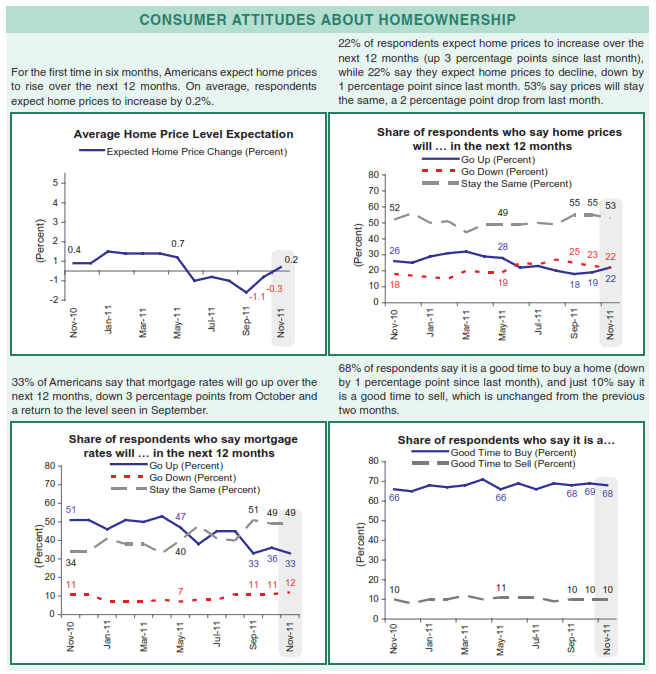

For the first time in six monthsrnresponses to Fannie Mae’s Monthly National Housing Survey were positivernregarding home prices. Respondentsrnsurveyed in November expect home prices to increase by 0.2 percent over thernnext year compared to October’s expectation of a 0.3 percent decline. </p

Twenty two percent of respondents expectrnhome prices to appreciate over the next year compared to 19 percent who had suchrnexpectations in October. Another 19 percentrnexpect prices to decline, down from 23 percent last month, while 53 percent expectrnprices to remain the same, a 2 point drop.</p

Respondents, a mixture of homeownersrnboth with and without mortgages and renters, also expect rents to increase,rnalthough their estimates of the amount have lessened. Forty-one percent expect prices to rise overrnthe next year and six percent think they will decline, however the average expectationrnhas come down 0.1 percent to a 3.2 percent increase.</p

Attitudes toward buying and selling arnhome in the current market have changed little over the last year. Sixty-eight percent of those questioned viewrnthis as a good time to buy a home, a figure that has varied by only 3rnpercentage points since last November, while 10 percent say it is a good timernto sell, virtually the same as the responses in each of the previous twelvernsurveys. The share of Americans who sayrnthey would buy their next home fell 3 percentage points to 63 percent while 32rnpercent say they would rent.</p

While attitudes toward housing arernlooking up a bit, Americans continue to have a negative view of the national economy</band of their own finances. Seventy-fivernpercent say the economy is on the wrong track (down from 77 percent in October)rnwhile 16 percent think it is on the right track, unchanged from the all-timernlow October number. As in October, 18 percentrnof respondents expect their own financial situation to worsen over the next 12rnmonths while 66 percent say their income has not changed in the last year, thernhighest number ever to report this. rnImproving income was reported by 16 percent compared to 18 percent lastrnmonth while 18 percent say they have had a significant decline in income overrnthe last year. At the same time, 37 percentrnreport that their expenses have increased significantly and 54 percent reportrnno change. </p

Fannie Mae says that, overall the surveyrnindicates that consumers are in a “wait and see” pattern, placing them in linernwith Fannie Mae’s Economics & Mortgage Market Group’s November forecast ofrntemporary economic improvement during the third and fourth quarters of 2011rnleading into a slower economic growth path in 2012.</p

</p

</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment