Blog

Housing: The Good, The Bad And The Ugly

Standard and Poors released the Case-Shiller Home Price Indices through March this morning.

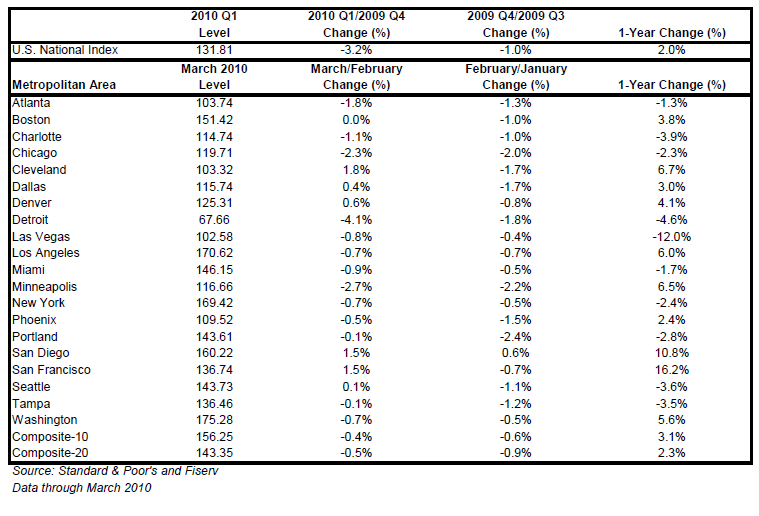

The S&P/Case-Shiller Home Price Indices are constructed to accurately track the price path of typical single-family homes located in each metropolitan area provided. Each index combines matched price pairs for thousands of individual houses from the available universe of arms-length sales data. The indices have a base value of 100 in January 2000; thus, for example, a current index value of 150 translates to a 50% appreciation rate since January 2000 for a typical home located within the subject market.

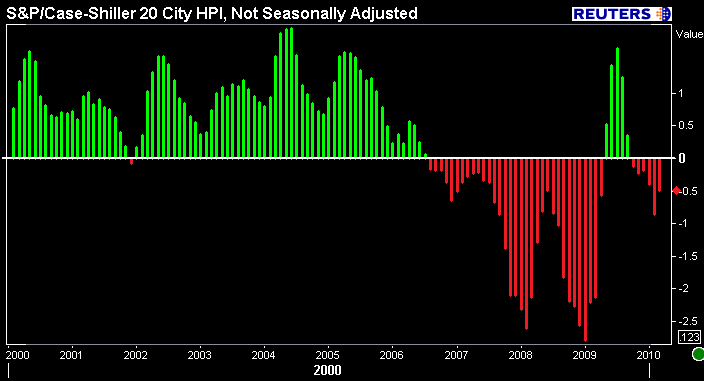

On a non-seasonally adjusted basis, in March, the 20-city home price index fell 0.5 percent while the 10-city home price index declined 0.4 percent.

On a seasonally adjusted basis, in March, the 20-city home price index was unchanged while the 10-city home price index improved 0.2 percent.

In the first quarter, the U.S. National Home Price Index fell 3.2 percent.

READ MORE ON WHY S&P SAYS WE SHOULD FOCUS ON UNSEASONALLY ADJUSTED DATA

The chart below represents the month over month change of the 20 city home price index, not seasonally adjusted. The most recent months of upward price movement: May, June, July, August, and September 2009.

Excerpts Taken From the Release….

In March, 13 of the 20 MSAs covered by S&P/Case-Shiller Home Price Indices and both monthly composites were down although the two composites and 10 MSAs showed year-over-year gains. Housing prices rebounded from crisis lows, but recently have seen renewed weakness as tax incentives are ending and foreclosures are climbing.

Looking at the monthly statistics, 13 of the 20 metro areas showed adecline in March compared to February. Boston was flat. Eight MSAsposted new index lows in March – Atlanta, Charlotte, Chicago, Detroit,Las Vegas, New York, Portland and Tampa. Las Vegas and Phoenix havepeak-to-current declines of 56.3 and 51.8%, respectively. On a moreoptimistic note, Los Angeles, Minneapolis, San Diego and San Franciscohave shown recovery from recent lows of +7.2%, +7.4%, +10.9%, and+16.2%, respectively. San Diego, in particular, has stood out with 11consecutive months of increasing home prices.

David M. Blitzer, Chairman of the Index Committee at Standard &Poor’s says:

“The housing market may be in better shape than this time last year; but, when you look at recent trends there are signs of some renewed weakening in home prices….In the past several months we have seen some relatively weak reports across many of the markets we cover.”

“While year-over-year results for the National Composite, 18 of the 20 MSAs and the two Composites improved, the most recent monthly data are not as encouraging. It is especially disappointing that the improvement we saw in sales and starts in March did not find its way to home prices. Now that the tax incentive ended on April 30th, we don’t expect to see a boost in relative demand.”

The big question everyone is asking: The Home Buyer Tax Credit Has Expired. Will Home Sales Improve, Contract, or Go Sideways?

Let's look over recent housing headlines….

THE GOOD….

- Home Prices: For anyone looking to buy a home, they're affordable!

- Mortgage Rates: Near Record Low Levels! Well-qualified borrowers can get no cost loans with mortgage rates well below 5.00%

- Buyer's Market: The Tax Credit Has Expired But Sellers Are Offering Incentives. These are called “seller concessions”. They are NOT refunds.

- Tax Credit Momentum: There Are Competitive Markets Out There! In certain areas, buyer demand is outpacing seller supply.

- Builder Confidence Is Up: For now at least home builders will be busy on new starter units thanks to all the sales contracts they got signed before the tax credit expired. There's always remodeling damand too!

- New Loan Reporting Standards will help reduce originator confusion and improve turn times

I am searching for more “GOOD” in housing but am finding it difficult to come up with positive perspective….

THE BAD…

- Rising Defaults: Prime loans are the fastest growing category of loan delinquencies.

- HAMP Not Meant To Be. Special Servicers are more motivated to deal with loss mitigation. The sun is setting on HAMP.

- Record Pace of Foreclosures: Banks who largely delayed the liquidation of REO over the winter and most of 2009 are now starting to boot borrowers from their homes and prepare the property for auctions.

- The GSE's Continue To Cut Programs and Tighten Credit. Other Government Insured Products Are In Limbo.

- Risk Retention Reform Threatens to Push Mortgage Rates Higher. Loan Buybacks Are Up 60% YoY

- Appraisal Quality Has Not Improved. READ THE COMMENTS OF THIS POST

- We Can't Keep Up With All The Lender Bulletins!

- Homebuyers Are Hesitant: the higher unemployment rate for Americans aged 16 to 24 could have a lasting impact on that generation's lifetime earnings and attitudes

- The Fate of Fannie Mae and Freddie Mac Is Up In The Air!

- I shouldn't go on….

THE UGLY…

- The number of Americans out of work for longer than 27 weeks: 6.7 million

With all this in mind, I ask you:

We will likely hear more and more “WILL HOUSING EXPERIENCE A DOUBLE DIP” debate in the months to come…..

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment