Blog

Loan Officer Survey: Credit Standards Tighter, Consumer Demand Falling, Deliquencies Expected to Rise

Bankersrnresponding to the January 2010 Federal Reserve Senior Loan Officer Opinion Survey on BankrnLending Practices indicated that residential loan standards are still contracting. The report also states that consumer demand for mortgage loans continues to decline.

The survey,rnreleased on Monday, addresses changes in loan supply and demand over the lastrnthree months. It also included threernsets of special questions about delinquency rates of loans made to large andrnmiddle market firms, changes in bank policies about commercial real estatern(CRE) loans over the past year, and a third set of questions about the banks' outlookrnover the coming year for the credit quality of a number of categories of loans.rn55 domestic banks and 23 U.S. branches and agencies of foreign banks respondedrnto the questionnaire.

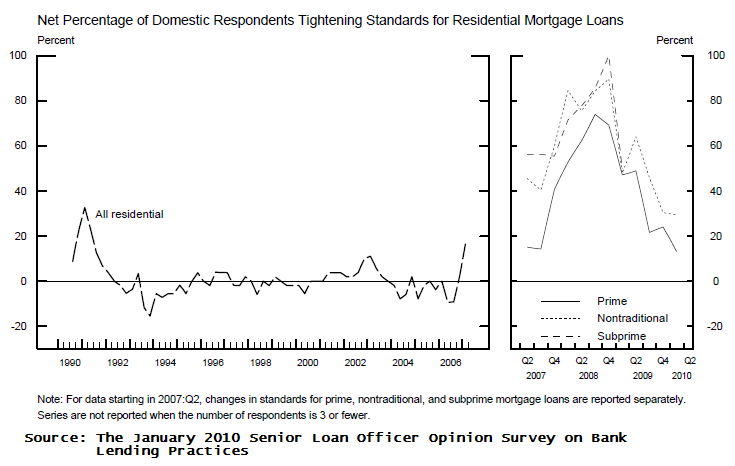

Banksrncontinued to tighten standards on residential lending, especially onrnnontraditional residential real estate loans. 17 percent of banks that makernresidential loans reported they had tightened standards on prime real estaternloans and 30 percent reported such tightening of non-traditional loans.

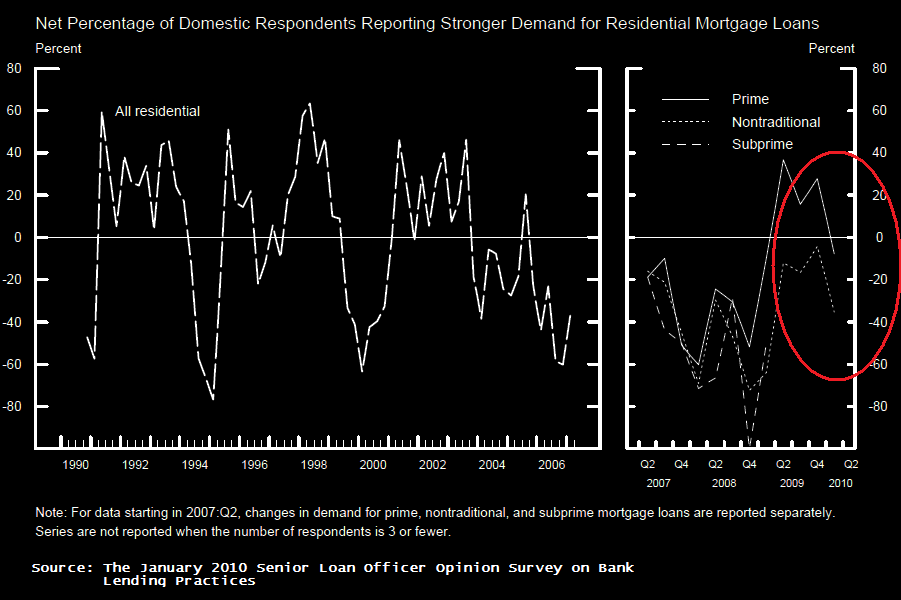

In addition, a moderate net fraction of banks reported weaker demandrnfrom prime borrowers for residential real estate loans. Demand fromrncustomers seeking nontraditional mortgages also weakened further overrnthe survey period. Only a small net fraction of banks reported havingrntightened standards on revolving home equity lines of credit over thernpast three months, but a large net fraction of banks continued to report lower demand for such loans.

Demandrnfor both businesses and households across all major categories of loansrnweakened on net over the past three months. 64 percent of respondents reportedrnthat business inquiries about new or increased credit had stayed about the samernover the last three months while 13 percent reported an increase and 25 percentrna decrease.

A largernproportion of respondents reported that their banks were relatively unchangedrnin their approach to consumer lending. rnOver 80 percent said that their banks policies were unchanged when itrncame to approving applications for installment, consumer, and credit cardrnloans. However, a substantial netrnfraction of banks said they had reduced credit limits on credit cards and hadrnbecome less likely to issue cards to customers who do not meet credit scoring thresholds.rn Respondents to the October 2009 surveyrnhad indicated that they would tighten many of their credit card policies as arnreaction to passage of the Credit CARD Act.

Loanrnterms were seen as being a little more in flux but the net percentages ofrnrespondents who tightened those requirements was lower than in the previousrnquarter. When considering lending to large firms – those with annual sales ofrn$50 million or more – 76 percent reported there had been no change in thernmaximum credit lines, 16 percent reported a tightening in the maximums and 7rnpercent said those terms had eased. Maximum maturity dates were unchanged in 83rnpercent of reports. Only 64 percent of respondents reported no change in therncost of credit lines while over 23 percent reported that these standards hadrntightened somewhat or considerably. Close to 26 percent reported that the spreadrncharged to commercial borrowers had widened over the last three months comparedrnto 58 percent that reported it unchanged. About 10 percent reported they hadrntightened collateral requirements, the remainder reported no change. Figuresrnfor lending to smaller companies varied only slightly from those reported forrnlarge firms.

Banksrnwere also asked a special set of questions about asset quality. In contrast tornresponses in earlier surveys, substantially fewer respondents reported thatrnthey expected widespread deterioration in credit quality in the coming year. Onrnthe household side, a moderate net fraction of banks indicated that therncredit quality of their prime residential mortgages and home equityrnloans would likely deteriorate further in 2010. However, banks expectrnportfolios of most other types of consumer and residential real estaternloans to experience little further deterioration in credit quality thisrnyear—indeed, a moderate net share of banks expect some improvement inrncredit quality in other consumer loans.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment