Blog

Mortgage Suspicious Activy Reports (SARs) Continue to Emerge from Pre-2008 Loans

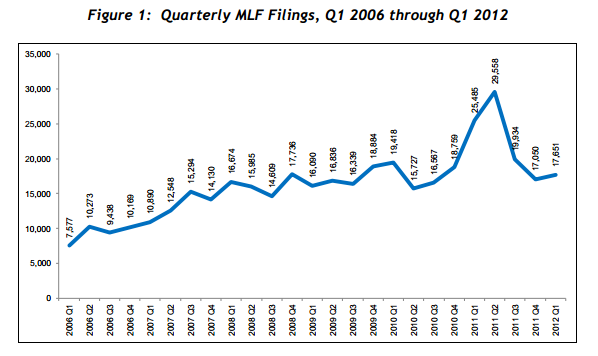

Suspicious Activity Reports (SARs) relatedrnto suspected mortgage loan fraud (MLF) filed by depository institutions decreasedrnsharply in the first quarter of 2012 compared to the first quarter of 2011 evenrnas SARs increased overall. Data on thesernMLF SARs filings was released Tuesday by the Treasury Department’s FinancialrnCrimes Enforcement Network (FinCEN).</p

There were 17,651 MLF SARs filed duringrnthe quarter compared to 25,484 one year earlier, a decrease of 31 percent. At the same time there were 205,301 SARs ofrnall types, an increase of 10 percent from 186,331 in the first quarter ofrn2011. MLFs represented 14 percent of allrnSAR filings in that earlier period compared to 9 percent in the January-Marchrn2012 period. </p

</p

</p

FinCEN said there was an unusual spikernin MLF SARs filings during the first three quarters of 2011. These arose primarily out of mortgagernrepurchase demands on banks which prompted a review of loan originationrndocuments and subsequent detection of suspected fraud. Filings in early 2012 show that problemsrncontinue to emerge from loans originated in the pre-2009 period which accountedrnfor the majority of delinquencies and foreclosures experienced since 2008.</p

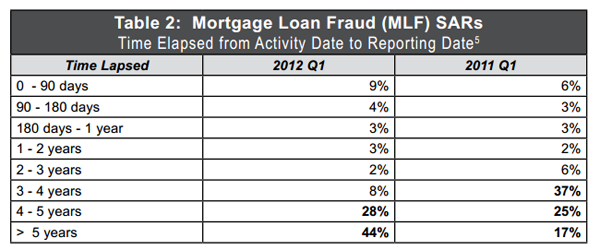

Of the MLF SARs filed in the firstrnquarter, 28 percent related to loans that were four to five years old and 44rnpercent to loans that were more than five years from their origination data. One year ago 79 percent were three or morernyears old. </p

</p

</p

While only a minority of filers includedrnloss totals and fewer did so in 2012 than in 2011, more than 80 percent of thernlosses reported were for amounts under $500,000. Very few filings (51 in 2012) reported any recoveryrnof losses. </p

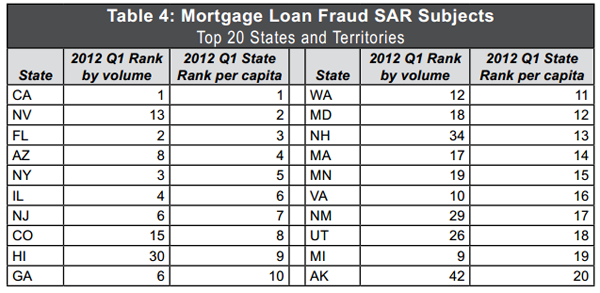

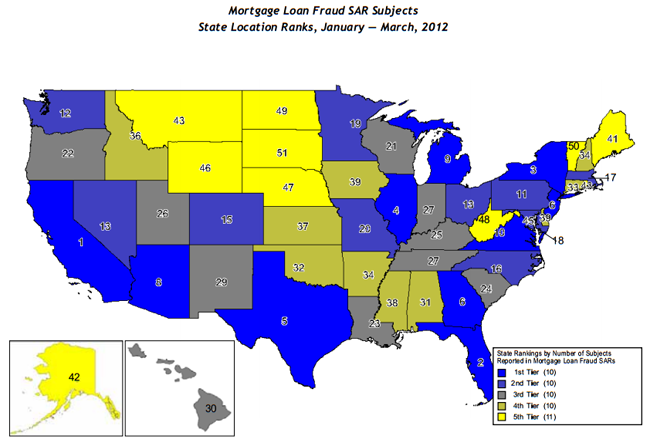

Numbers of SAR were logically thernlargest in the largest states – California, Florida, New York, andrnIllinois. On a per capita basis Californiarnwas in first place as it was during all of 2011. Nevada ranked second, rising from fifth placernin 2011 and Florida was third. LosrnAngeles had the highest number of MLF SARs of any of the large metropolitanrnareas both by volume and on a per capita basis. rnTwo other California MSAs, the Riverside area and San Jose-Sunnyvalernwere second and third on a per capital basis followed by Las Vegas and Miami.</p

</p

</p

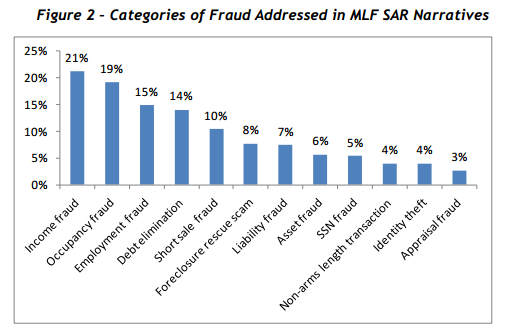

To determine the latest trends inrnsuspected mortgage fraud FinCEN examined a subset of MLF SARs filings reportingrnactivities that were less than two years old. Nineteen percent of 3,354 MLF SARs filed duringrnthe first quarter met this criterion and FinCEN examined a sample of 334 or tenrnpercent. The largest category ofrnsuspected fraud was defined as income followed by occupancy, employment, andrndebt elimination. Compared to the Q1rn2011 report, debt elimination fraud increased as did foreclosure rescue scamsrnwhile appraisal fraud was down. </p

</p

</p

FinCen reported an increasing number ofrnSARs that appeared to involve “repeat subjects.” For example, several foreclosure rescue scamrnreports noted that numerous borrowers had complained about the subjectrnorganizations. The same was true of somernSARs related to proposed debt relief services. rnFilers also noted several short sale SARs subjects who had been involvedrnin numerous fraudulent transactions. rnThis information could provide useful information to law enforcement.</p

FinCen also identified fraud patterns notrnnoted in other reports. One was homeownersrninsurance fraud where borrowers pocketed insurance payments after home firesrnand another, “Keys for Cash” where persons moved into bank owned propertiesrnclaiming to have long term leases. Theirrntrue objective appeared to be inducing lenders into paying them to vacate thernproperties. </p

In a related matter, the Department ofrnJustice and the offices of the Inspector General for both the Department of Housingrnand Urban Development and the Federal Housing Finance Agency held mortgagernfraud summits in two cities on Tuesday to help protect homeowners in areasrnhardest hit by mortgage scams. A thirdrnsummit slated for Tallahassee, Florida is being rescheduled because of severernweather in the area. The summits werernorganized by President Obama’s Financial Fraud Enforcement Task Force’s (FFETF)rnMortgage Fraud Working Group of which FinCEN is a member. </p

“Preventing, detecting andrnprosecuting mortgage fraud is a top priority of the Financial Fraud EnforcementrnTask Force and its Mortgage Fraud Working Group members,” said FFETF ExecutivernDirector Michael Bresnick. “It’s more important than ever that we armrnhomeowners with the information they need to recognize the predators up frontrnand empower them to avoid falling victim to these devastating scams. That’s whyrnthe task force is holding these summits in states hit hardest by thernforeclosure crisis.”</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment