Blog

NMLS Reports Individual and Company Licenses Increase from 2011

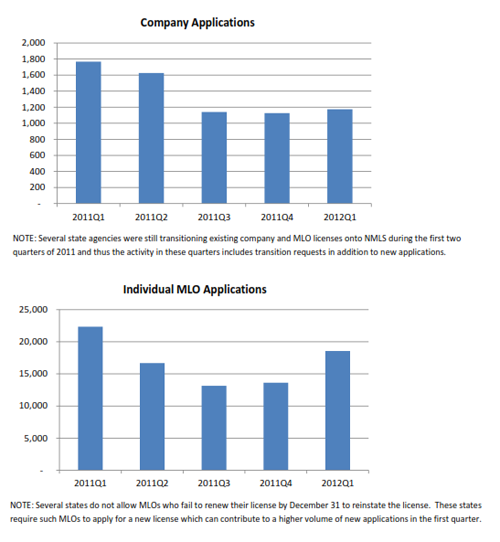

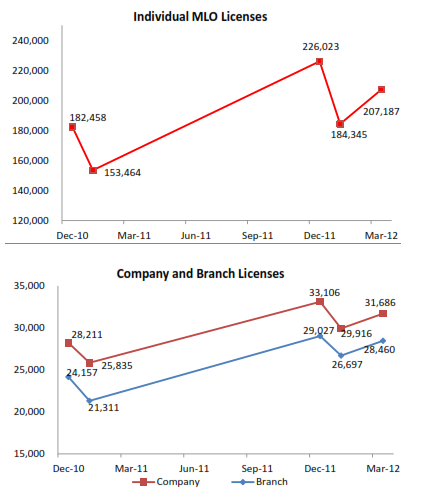

The number of companies and mortgagernloan originators (MLOs) licensed through the National Mortgage Licensing Systemrn(NMLS) increased by 6 percent and 5.5 percent respectively between the end ofrnthe first quarter of 2011 and the end of the first quarter of 2012 NMLSrnreported today. Much of the increase inrnnumbers occurred because several state agencies were still transitioning theirrnlicensing function to NMLS during later quarters of 2011, the first year that allrnstate mortgage regulatory agencies utilized NMLS to manage mortgage loanrnoriginator (MLO) licenses, rather than new entries into the market. </p

NMLS was created by the Conference of StaternBank Supervisors and the American Association of Residential MortgagernRegulators in 2008. It is the legalrnsystem for licensing non-depository financial services for 53 participatingrnstate agencies and the sole system of licensure for MLOs under the SAFE Act. </p

At the end of the first quarter of 2012rnthere were 31,686 licenses issued to 15,883 unique companies and 28,460rnlicenses given to 17,721 branch offices. rnA total of 207,187 individual licenses were held by 105,595 persons.</p

The number of licenses held by companiesrnincreased by 12 percent and the number held by MLOs increased by 13 percentrnfrom one year earlier. Again, some ofrnthese increases were the result of the transitioning referenced above, but therngreater increase in the number of licenses versus the numbers of people orrncompanies holding licenses is largely the result of an expansion by companiesrnand individuals into additional states.</p

</p

</p

NMLS says that the best time to viewrnlicensing numbers and year-over-year changes is at the end of the first quarterrnof each year. The number of licensesrndrops at the end of December each year because many companies do not renewrntheir licenses. The number then climbsrnthroughout the year as new parties enter the system and existing licenseesrnexpand their footprint. For these andrnother reasons the end of the first quarter presents the most stable snapshot ofrnthe industry.</p

</p

</p

The average number of originators perrncompany at the end of the quarter was 5.8 and the median was one. Seventy-two percent of the companies had fewerrnthan five originators and only about 150 had more than 100. Eighty-eight percent of licensed companiesrnoperated out of a single branch and there were 68 mega-companies with more thanrn50 branches.</p

Companies and loan originators typicallyrnoperate in only one state. Eighty-three percentrnof companies and 79 percent of MLOs hold one state license; 12 percent ofrncompanies and 10.6 percent of individuals hold two to five. More than 224 companies and 1,128 individualsrnare licensed in 21 or more states.</p

The largest business activity reportedrnby company licensees is first mortgage loan brokering (88 percent) with secondrnmortgage brokering the second most common activity (73 percent) and brokeringrnhome equity loans third (46 percent). Other business activities reported includernissuing VA loans (35 percent), reverse mortgage loans (24 percent), and firstrnmortgage lending (22 percent). rnTwenty-three percent report they also engage in non-mortgage relatedrnbusinesses.</p

Corporations hold 61 percent of therncompany licenses with limited liability companies (LLCs) and solernproprietorship’s holding 19 percent and 18 percent respectively. Less than 2 percent of state licensesrncompanies (334) report being owned by a depository institution. This is 47 more institutions than reportedrnthis a year ago.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment