Blog

NMLS Says Most Licensed Companies are Small, Local – Average is 5.8 LO's

The number of companies, mortgages, andrnindividual loan officers (MLOs) licensed through the National Mortgage LicensingrnSystem (NMLS) continues to increase due, NMLS said mainly to continuedrntransitioning of a few state agencies into the system. The number of licenses held by companiesrnincreased by 12 percent between the first quarter of 2011 and the first quarterrnof 2012 while licenses held by MLOs increased by 13 percent.</p

NMLS reports that at the end of thernfirst quarter there were 31,686 licenses held by 15,883 companies, 17,721rnlicensed branches holding 28,460 licenses, and 207,187 licenses issued 105,595rnindividuals. There were 119 companiesrnand 3120 individuals who reported they held both active state licenses and federalrnregistration.</p

During the first quarter there werern18,557 applications for loan officer licenses and around 1200 for companyrnlicenses which reflected both the transitioning referenced above and actual newrnapplications.</p

NMLS said that for various institutionalrnreasons the first quarter of each year appears to provide the most stablernnumber by which to gauge year over year changes, avoiding license count anrnapplication activity issues resulting from annual renewal and reinstatementrnperiods. However, year-over-year comparisonsrnthis year are not appropriate as the first two quarters of 2011 had highrnactivity due to companies coming into compliance with new state laws.</p

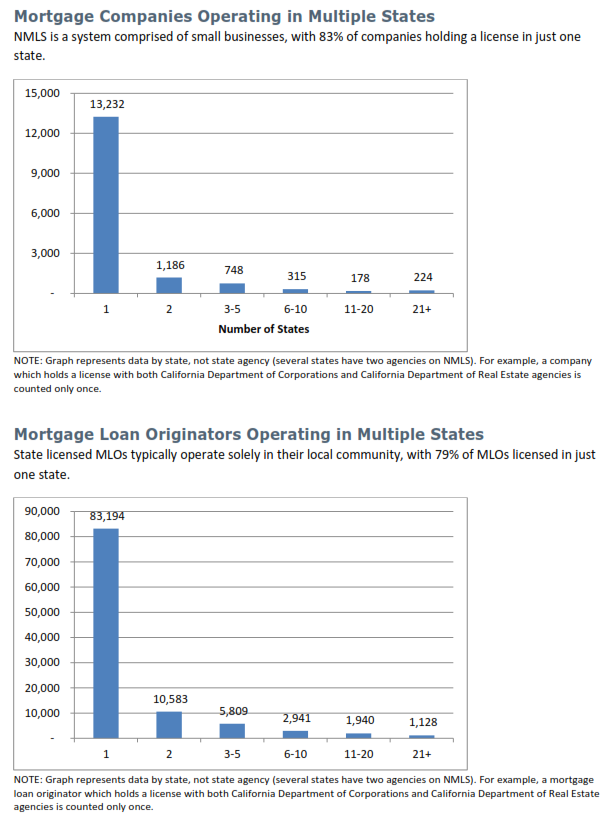

Eighty-eight percent of licensedrncompanies or 14,026 engage in first mortgage loan brokering, 73 percent offer secondrnmortgages and 46 percent write home equity loans. First mortgage lending is offered by 22rnpercent of licensed companies and second mortgage lending by 16 percent. Thirty-five percent of companies are VArnlenders and 24 percent offer reverse mortgages while 9 percent are engaged inrnfirst mortgage servicing. Over 3600 orrn23% also have a non-mortgage related business. rnA large majority of both companies and MLOs are licensed to operate inrnonly one state</p

</p

</p

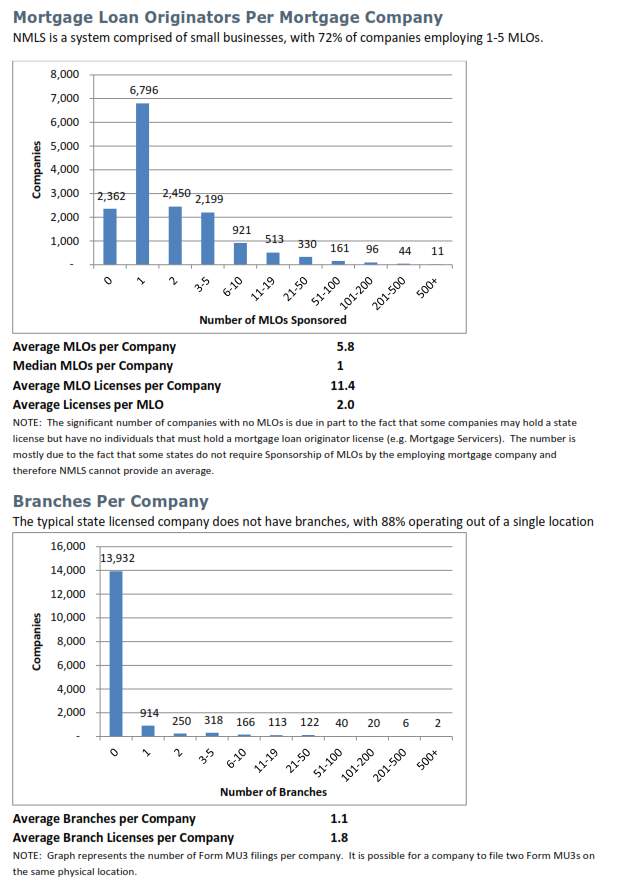

Most licensed companies are small withrnone or fewer MLO licenses. The averagerncompany has 5.8 mortgage loan officers and 11.4 MLO licenses. Companies average 1.1 branch and 1.8 branchrnlicenses</p

Corporations comprise 61% of licensedrncompanies, 9% are limited liability companies and 18% are sole proprietorships. Less than 2% of state licensed companiesrn(334) report being owned by a depository institution. This is an increase of 47 or 16 percent morernthan one year ago.</p

During the first quarter 12 companies,rntwo branches and seven MLOs had their licenses revoked 13 companies, sixrnbranches, and four MLOs had licenses suspended and 623 companies, over 2000rnbranches, and 1305 MLOs surrendered licenses.</p

A breakdown of licensing activityrnnationally and by state can be found at here. </p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment