Blog

OCC: Mortgage Performance Best Since 2008

Mortgage performance during thernfirst quarter of 2012 was the best in three years according to the Office of Comptrollerrnof the Currency’s (OCC’s) MortgagernMetrics Report. Percentages ofrnmortgages that were 30 to 59 and 60 to 89 days delinquent were at the lowestrnlevel since at least the first quarter of 2008 when Metrics was first published. rnThe percentage of mortgages current and performing at the end of thernquarter was 88.9 percent up 1.1 percent from the previous quarter and 0.3rnpercent from a year earlier. OCC attributed the improvement in performance tornseveral factors including strengthening economic conditions, seasonal effects,rnservicing transfers, and the ongoing effects of both home retention programsrnand home forfeiture actions.</p

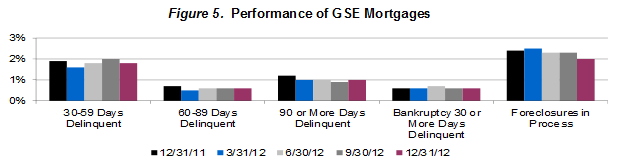

The quality of government guaranteedrnmortgages improved during the quarter with current and performing mortgages atrn85.9 percent of the portfolio compared to 84.2 percent in the previous quarter butrndown from 87.0 a year earlier. Mortgagesrnserviced for the two government sponsored enterprises (GSEs) Fannie Mae andrnFreddie Mac made up 59 percent of servicer portfolios and 93.7 percent of thesernloans were current and performing, a percentage that has changed little overrnthe past year.</p

New foreclosures initiated duringrnthe quarter were down 1.8 percent to 286,951 which OCC said reflected thernemphasis on home retention actions as well as a decrease in delinquencies. Many servicers have also slowed newrnforeclosures in response to changing servicing standards and requirements. </p

Completed foreclosures increased torn122,979-up 5.9 percent from the previous quarter and 2.7 percent from the firstrnquarter of 2011. The inventory of foreclosures in process increased fromrnthe previous quarter to 1,269,921, but is down from 1,308,757 a year ago. Deeds-in-lieu of foreclosure, and short-salesrnbrought the total number of home forfeiture actions to 185,781 during thernquarter, an increase of 1.9 percent from the fourth quarter of 2011 and 8.3rnpercent from a year earlier.</p

Servicers initiated 352,989 homernretention actions during the quarter and have initiated more than 2.2 millionrnsuch actions including modifications, trial-period plans, and payment plansrnover the last five quarters. At the endrnof the first quarter of 2012, 50.7 percent of modifications remained current orrnwere paid off. Modifications made since 2008 that reduced borrowerrnmonthly payments by 10 percent or more performed better (57.6 percent remainedrncurrent) than those that reduced payments by less than 10 percent (36.8rnpercent.) </p

</p

</p

On average, modificationsrnimplemented in the first quarter of 2012 reduced monthly principal and interestrnpayments by $437, which is 31 percent more than modifications implementedrnduring the first quarter of 2011. HAMP modification reduced payments by $588 onrnaverage and those modifications performed better than others, with 68.2 percentrnremaining current compared to 53.4 percent of modifications done by others. OCC said HAMP’s performance reflects thernsignificantly reduced monthly payments, the program’s emphasis on affordabilityrnrelative to borrower income, required income verification, and the successfulrncompletion of a required trial period.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment