Blog

OIG Faults FHFA's Oversight of Troubled Federal Home Loan Banks

The Office of InspectorrnGeneral (OIG) for the Federal Housing Finance Agency (FHFA) has released anrnassessment of the FHFA’s oversight of troubled banks within the Federal HomernLoan Bank (FHLBank) System. While the OIG found positive actions on the part ofrnFHFA, it specifically criticized a lackrnof policies, systems, and documentation standards that could strengthen thatrnoversight.</p

Of the 12 FHLBanks thatrnexist regionally, four have experienced significant financial and operationalrndifficulties dating back to at least 2008. rnThe four, located in Boston, Chicago, Pittsburgh, and Seattle andrnclassified as of “supervisory concern” due to problems arising from their investmentsrnin certain high-risk mortgage securities.</p

The primary mission of FHLBanksrnis to support housing finance and the system issues debt in the capital marketsrnat relatively favorable rates due to its status as a government sponsoredrnenterprise (GSE). The proceeds of therndebt are used by the individual banks to make secured “advances” to memberrnfinancial institutions which secure these advances using single-familyrnmortgages or investment-grade securities as collateral. The FHLBanks also hold investment portfoliosrnthat contain assets such as mortgage-backed securities (MBS). </p

FHFA has oversightrnresponsibility for the FHLBanks and recognizes the need to ensure that they dornnot abuse their GSE status or act imprudently. rnFHFA’s own examination guidance states that the agency will initiate arnformal enforcement action, such as a cease and desist order, when a bank isrnidentified as having significant “supervisory concerns” within the system.</p

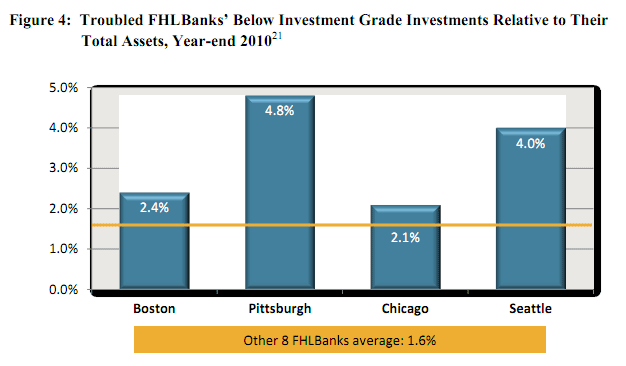

According to the OIG,rnthe four troubled banks have experienced “significant financial and operationalrndeterioration primarily due to their investments in private-label MBS securedrnby non-traditional mortgages.” Two ofrnthe banks, in fact, hold more than twice the level of securities rated “belowrninvestment grade” than the average for the eight healthier banks.</p

</p

</p

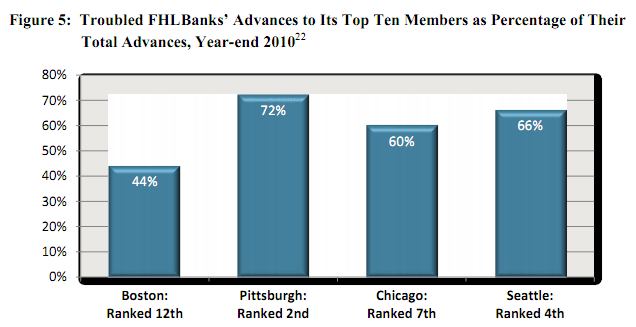

Anotherrnidentified risk is a concentration of advances in a few member banks. Both the Pittsburgh and Seattle banks have arnhigh percentage of their advance business confined to ten members (thernsituation only recently changed in respect to Boston) which leaves themrnvulnerable should one or more such institutions fail or withdraw from thernsystem. OIG also found that the troubledrnbanks tend to demonstrate a limited demand for advances, a high percentage ofrninvestments to total assets, and significant risk management and operationalrndeficiencies.</p

</p

</p

OIGrnsaid a major concern is that troubled FHLBanks potentially have greaterrnincentives to engage in higher risk business strategies in order to achievernhigher returns. This means that FHFArnneeds to monitor their activities and control actions that could potentiallyrnlead to greater financial and operational deterioration and cause greaterrnlong-term risks.</p

ThernOIG found that FHFA has taken some steps to monitor and control the four banksrnwhich present “supervisory concern.”</p<ul class="unIndentedList"<liEnsuring that theyrnrestrict the payment of dividends to preserve their retained earnings andrncapital.</li<liEncouraging FHLBankrnboards to place limits on investment activities.</li<liMonitoring throughrnannual examinations and regular communications.</li<liDiscussing with boardrnmembers and managers the possibility of merging with healthier FHLBanks.</li</ul

WhilernFHFA’s examination guidance specifies enforcement, OIG claims that FHFA doesrnnot view this as constituting a policy or requiring a course of action. FHFA believes, by initiating enforcementrnaction on a case-by-case basis it has acted appropriately.</p

ThernOIG disagrees and views “FHFA’s lack of a consistent and transparent writtenrnenforcement policy as undermining the Agency’s oversight of troubled FHLBanks.” FHFA and its predecessor FHFB have initiatedrnformal enforcement against only two of the banks, Consent Orders issued againstrnChicago in 2007 and Seattle in 2010.</p

OIG<bfaulted FHFA for the following:</p<ul class="unIndentedList"<liIts failure tornestablish a clear, consistent and transparent written enforcement policy forrntroubled banks has led to a discretion-based approach. This, in turn, has resulted in a lack ofrnclarity for FHFA examination staff and the banks, neither of which have steadyrnbenchmarks against which to gauge their actions.</li<liThe Agency has notrnestablished an automated management information reporting system to trackrnFHLBank examinations finds. By relyingrninstead on a manual system, FHFA managers are limited in their ability tornassess the extent to which individual banks are correcting deficiencies andrnthis has also impeded the ability of the OIG to assess the effectiveness of thernAgency's oversight efforts.</li<liFHFA does notrnconsistently document key actions with respect to its oversight of the troubledrnbanks. This was a problem that OIG foundrnparticularly troublesome as applied to personnel actions as it identified casesrnwhere FHFA had influenced boards to terminate employees without adequatelyrndocumenting its actions or the reasons for them.</li</ul

Inrnconcluding its report the OIG made three specific recommendations whichrnparalleled the above findings; recommending that FHFA</p<ul class="unIndentedList"<liDevelop and implement arnclear, consistent and transparent written enforcement policy that requiresrntroubled banks to correct identified deficiencies within a specific time frame,rnestablishes consequences for failure to do so, and defines exceptions to thernpolicy.</li<liDevelop and implement arnreporting system that permits Agency managers and outside reviewers to assessrnexamination report findings, planned corrective actions and timeframes, andrntheir status.</li<liDocument key activitiesrnconsistently including personnel actions involving FHLBanks.</li</ul

The performance period for thisrnevaluation was from May 2011 to November 2011.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment