Blog

OIG Finds FHLBanks Corrected Foreign Credit Exposure, more Supervision Needed

The Office of the Inspector Generalrn(OIG) of the Federal Housing Finance Agency (FHFA) issued a report this morningrnthat was mildly critical of the FHFA’s oversight of Federal Home Loan Banks (FHLBanks)rngranting of unsecured credit to European banks. OIG said that extensions of unsecured creditrnin general increased by the FHLBanks during the 2010-2011 period, even as thernrisks for doing so were intensifying.</p

FHFA regulates the FHLBanks and hasrncritical responsibilities to ensure that they operate in a safe and soundrnmanner. FHFA’s OIG initiated anrnevaluation to assess the regulator’s oversight of the Banks unsecured creditrnrisk management practices.</p

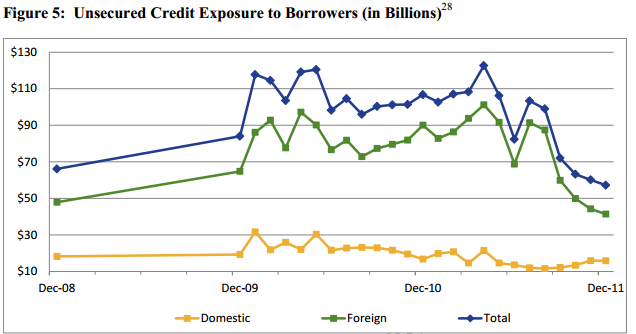

Unsecured credit extensions to Europeanrninstitutions and others grew from $66 billion at the end of 2008 to more thanrn$120 billion by early 2011 before declining to $57 billion by the end of thatrnyear as the European sovereign debt crisis intensified. During this period extensions of unsecuredrncredit to domestic borrowers remained relatively static but extensions tornforeign financial institutions fluctuated in a pattern that mirrored thernFHLBanks’ total unsecured lending. Thatrnis, it more than doubled from about $48 billion at the end of 2008 to $101rnbillion as of April 2011 before falling by 59 percent to slightly more than $41rnbillion by the end of 2011.</p

</p

</p

FHFA OIG also found that certainrnFHLBanks had large exposures to particular financial institutions and thernincreasing credit and other risks associated with such lending. For example, one FHLBank extended more thanrn$1 billion to a European bank despite the fact that the bank’s credit ratingrnwas downgraded and it later suffered a multibillion dollar loss.</p

During the time period in question OIGrnfound there was an inverse relationship between the trends in lending tornforeign financial institutions and the Banks advances to their own members. Since mid-2011 the extensions to foreignrninstitutions have declined sharply but the advances have continued theirrnlongstanding decline. OIG said itrnappears that some FHLBanks extended the unsecured credit to foreignrninstitutions to offset the decline in advance demand and that they curtailedrnthose unsecured extensions as they began to fully appreciate the associatedrnrisks.</p

At the peak of the unsecured lending,rnabout 70 percent of the FHLBank System’s $101 billion in unsecured credit tornforeign borrowers was made to European financial institutions and 44 percentrnwere to institutions within the Eurozone. rnAbout 8 percent of unsecured debt ($6 billion) was to institutions inrnSpain, considered by S&P to be even riskier than the Eurozone as a whole.</p

</p

</p

Some banks within the FHL System hadrnextremely high levels of unsecured credit extended to foreign borrowers. The Seattle Bank’s exposure to foreignrnborrowers as a percentage of its regulatory capital was more than 340 percentrnin March 2011; Boston was at 300 percent, and Topeka 360 percent. All three had declined substantially by thernend of 2011 but Seattle and Topeka remained above 100 percent.</p

OIG said that the vast majority of thernBanks’ extensions of unsecured credit appeared to be within current regulatoryrnlimits (although OIG said these limits may be outdated and overly permissive),rnsome banks did exceed the limits and OIG found the three banks (which for somernreason it treated anonymously) definitely did so and blamed that on a lack ofrnadequate controls of systems to ensure compliance.</p

OIG reviewed a variety of FHFA internalrndocuments during the 2010-2011 period during which it found the Agency hadrnexpressed growing concern about the Banks’ unsecured exposures to foreignrnfinancial institutions. But, even thoughrnFHFA identified the unsecured credit extensions as an increasing risk in earlyrn2010, it did not prioritize it in its examination process due to its focus onrngreater financial risks then facing the FHLBank system especially their privaternlabel mortgage-backed securities portfolios. rnIn 2011, however, FHFA initiated a range of oversight measures focusingrnon and prioritizing the credit extensions in the supervisory process andrnincreasing the frequency with which the Banks had to report on that part ofrntheir portfolios.</p

OIG believes that FHFA’s recent initiativesrncontributed to the significant decline in the amount of unsecured credit beingrnextended by the end of 2011.</p

The final findings issued by OIG in itsrnreport are:</p<ol

To correctrnthese deficiencies, OIG recommends that the Agency:</p<ul class="unIndentedList"<liFollow up on any potential evidence of violations ofrnthe existing regulatory limits and take action as warranted;</li<liDetermine the extent to which inadequate systems andrncontrols may compromise the Banks' capacity to comply with regulatory limits;</li<liStrengthen the regulatory framework by establishingrnmaximum exposure limits; lowering existing individual counterparty limits; andrnensuring that the unsecured exposure limits are consistent with the System'srnhousing mission.</li

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment