Blog

Penalties Levied Against Non-Compliant Loan Servicers

The Departments of Housing and UrbanrnDevelopment and Treasury issued their joint Housing Scorecard for May onrnThursday. The big news is that the Administration is finally moving to penalize servicers who havernconsistently failed to meet the goals of the Making Home Affordable Program, which is designed to helprnhomeowners who have fallen behind on their loan payments.</p

The Scorecard contains results of newrnServicers’ Assessments, which summarize performance for the 10 largest loan servicers. The assessments rely on information fromrnreviews conducted during the first quarter of 2010 on three categories ofrnprogram implementation: identifying andrncontacting homeowners, homeowner evaluation and assistance, and programrnreporting, management, and governance. </p

While allrnten servicers are in need of improvements, fourrnwere identified as needing “substantial improvements”;rnBank of America, J.P. Morgan Chase Bank,rn Ocwen Loan Servicing, LLC; and WellsrnFargo Bank. Program administrators foundrnthat there were extenuating circumstances leading to the negative results inrnthe assessment of Ocwen Loan Servicing (they acquired another servicing portfolio during the testing period), however Bank of America, J.P. Morgan Chase and WellsrnFargo will havernfinancial incentives withheld for this quarter and payments will continue to be withheld until specified improvementsrnare made. </p

To be clear, new fines are not being imposed. Incentive payments are simply being withheld. Servicers receive payments from Treasury for every successful permanent modification they complete under the Home Affordable Modification Program as well for each short sale/deed-in-lieu they complete (pursuant to the Home Affordable Foreclosure Alternative Program). The three companies were reported to havernreceived $24 million in incentive payments last month. New incentive payments will be withheld. In certain cases though, particularly where there is a failure to correct identified problems within a reasonable time, Treasury may also permanently reduce the financial incentives paid out to servicers.</p

Six servicers were identified asrnneeding moderate improvement and no financial penalties were assessed. Those servicers are: American Home Mortgage Servicing, Inc.;rnCitiMortgage, Inc; GMAC Mortgage, LLC; Litton Loan Servicing LP; OneWest Bank,rnand Select Portfolio Servicing. Treasuryrnsaid those servicers that fail to improve in the areas identified will bernsubject to servicer incentive withholding in the future.</p

“While we continue to get tens of thousands ofrnnew homeowners into mortgage modifications each month, we need servicers tornstep up their performance to meet the needs of those still struggling,” saidrnacting Treasury Assistant Secretary for Financial Stability Tim Massad. “Thesernassessments set a new benchmark by providing an unprecedented level ofrndisclosure around servicer performance and will serve to keep the pressure onrnservicers to more effectively assist struggling families.”</p

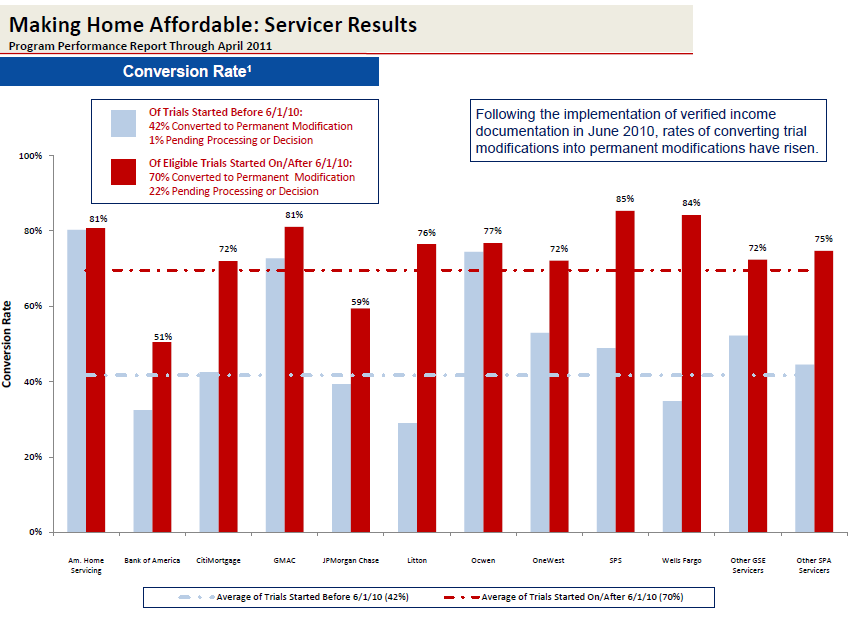

The HAMP report for May indicatedrnthat 20,000 more homeowners entered into a trial modification during the monthrnand 29,000 converted from trial to permanent status. Since the program began 1,588,000 borrowersrnhave entered the program and 699,000 have converted to permanent status. Below is a chart illustrating the conversion rate of individual loan servicers.</p

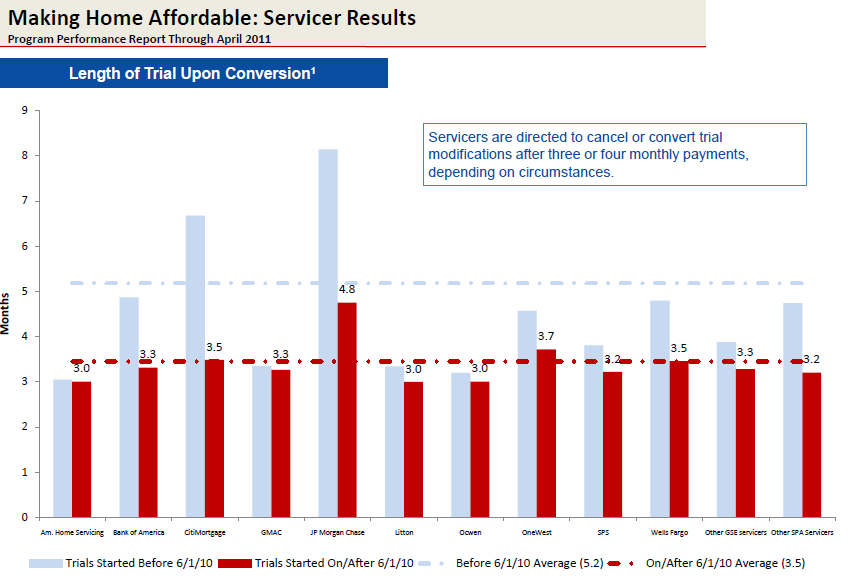

It isrnclear that many of the problems that existed with HAMP early on haverneased. Seventy percent of trialrnmodifications started since June 2010 have been made permanent and the averagernlength of a trial modification beginning after that that date is 3.5 months. Trial modifications started before that daternrequired an average of 5.2 months before converting to permanent status. In May 2010 the number of borrowers who hadrnbeen in the “three month” trial modification period for six months or morernstood at over 190,000. Today that numberrnhas fallen to under 25,000. Below is a chart illustrating the time it takes individual servicers to convert a trial modification to a permanent modification.</p

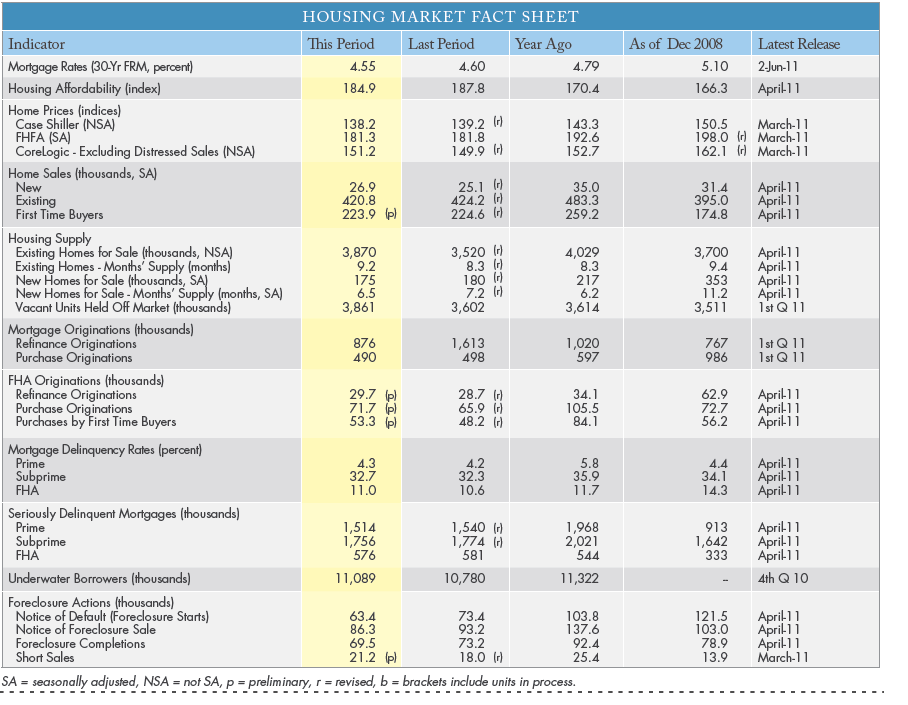

Apart fromrnthe HAMP report, the Housing Scorecard is primarily a recap of informationrncompiled from other sources and generally covered previously by Mortgage News Daily. This includes Census Bureau reports onrnconstruction permitting and housing starts, National Association of Realtors®rndata on sales of existing houses, RealtyTrac foreclosure statistics and thernS&P/Case-Shiller Housing Price Index. </p

New tornthis month’s report is a Housing Scorecard Regional Spotlight which, in thisrnedition highlights recovery conditions in Phoenix, Arizona, one of the citiesrnhardest hit by the housing downturn. rnAccording to Assistant HUD Secretary Raphael Bostic, the administration’srnprograms have assisted over 100,000 families avoid foreclosure in Phoenix. Foreclosures still dominate the market in therncity where sales of distressed homes currently represent 56 percent of allrnexisting sales compared to a national figure of 35 percent.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment