Blog

Pending Home Sales Rebound from Record Low. What Might Boost Buyer Demand?

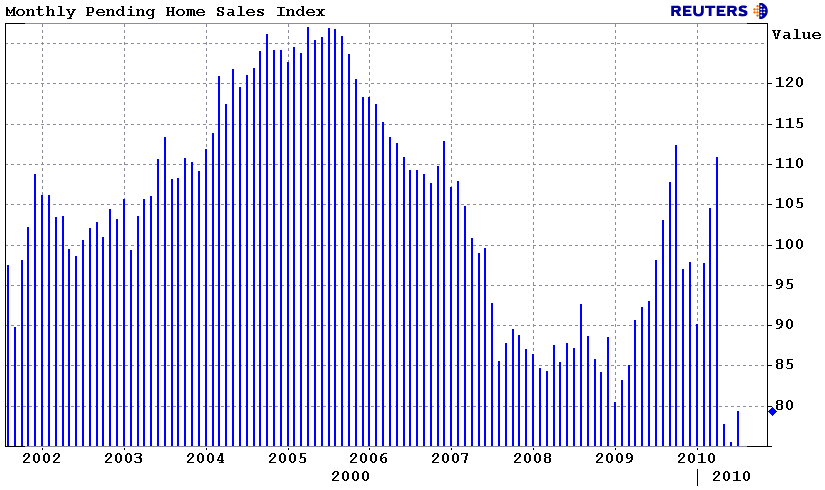

The National Association of Realtors released the Pending Home Sales Index today.

NAR’srn Pending Home Sales Index measures the number of home purchase contractsrn that were signed in the monthly reporting period. Once “pending” salesrn contracts are closed, they are considered an existing home sale. Because the Pending Home Sales index tells us how many contracts were signed, it is consider a forward indicator of existing home sales. A signed contract is not counted as an existing home sale until the transaction actually closes. </p

Excerpts from the Release…</p

Following a sharp drop in the months immediately after expiration of the home buyer tax credit, pending home sales have modestly risen.

The Pending Home Sales Index, a forward-looking indicator, rose 5.2 percent to 79.4 based on contracts signed in July from a downwardly revised 75.5 in June, but remains 19.1 percent below July 2009 when it was 98.1. </p

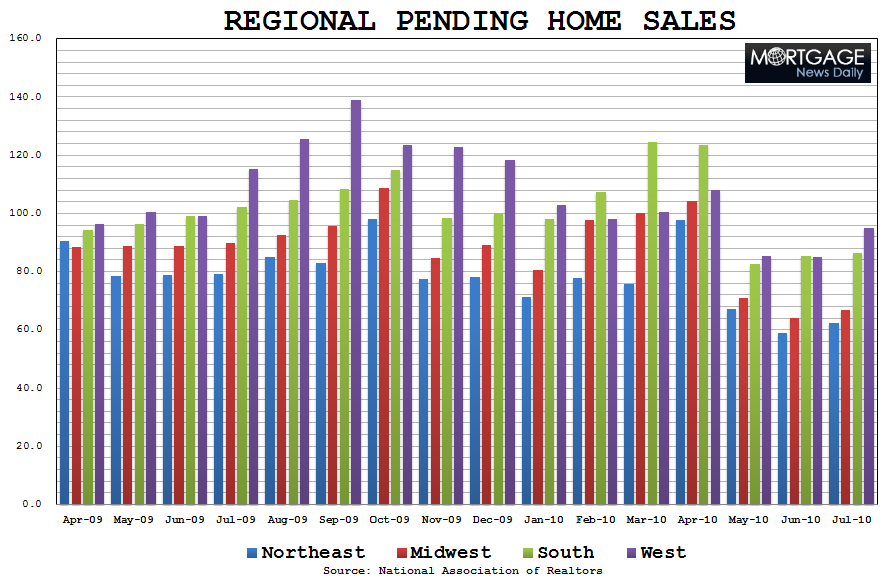

The PHSI in the Northeast rose 6.3 percent to 62.5 in July but is 21.1 percent below a year ago. In the Midwest the index increased 4.1 percent to 66.7 but remains 25.7 percent below July 2009. Pending home sales in the South rose 1.2 percent to an index of 86.3, but are 15.6 percent lower than a year ago. In the West the index jumped 11.6 percent to 95.0 but is 17.6 percent below July 2009.</p

</p

</p

Lawrence Yun, NAR chief economist, cautioned that there would be a long recovery process. “Home sales will remain soft in the months ahead, but improved affordability conditions should help with a recovery,” he said. “But the recovery looks to be a long process. Home buyers over the past year got a great deal, and buyers for the balance of this year have an edge over sellers. For those who bought at or near the peak several years ago, particularly in markets experiencing big bubbles, it may take over a decade to fully recover lost equity.”

Yun added, “Affordability could reach a generational high in the second half of this year because of rock-bottom mortgage interest rates, helped partly by the Fed’s very accommodative monetary policy. The loan underwriting standards are tighter, but home buyers can improve their chances of getting a loan by staying well within their budget.”</p

My only comment: There has been talk circulating that the Administration is considering the re-authorization of the expired homebuyer tax credit. While I believe another tax credit would be taking a step in the wrong direction, I do feel the housing market needs to provide more incentive to buy than record affordability. What the housing market does not need is government officials mentioning that incentives will be implemented “if needed”. Just talking about another homebuyer tax credit could slow sales in the “here and now” as consumers put off purchase plans in hopes they too will be able to benefit from new stimulus measures. There is no time for dilly-dallying here, the negative feedback loop is already in process. The Administration must either squash the idea of more stimulus, with blunt force, or act quickly to implement new measures so buyers can make informed decisions. Either way….communication is key.</p

The right incentive for the housing market: EASE CREDIT GUIDELINES! USE SOME COMMON SENSE IN UNDERWRITING!!

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment