Blog

Refinance Apps Increase. Originators Work in Highly Competitive Environment

The Mortgage Bankers Association (MBA) today released its Weekly Mortgage Applications Survey for the week ending July 2, 2010. </p

The Mortgage Bankers Association application survey covers over 50% of all US residential mortgage loan applications taken by mortgage bankers, commercial banks, and thrifts. The data gives economists a look into consumer demand for mortgage loans. In a low mortgage rate environment, a trend of increasing refinance applications implies consumers are seeking out a lower monthly payment which can increase disposable income and consumer spending (or give consumers a chance to pay down other debts like credit cards). A falling trend of purchase applications indicates a decline in home buying interest, a negative for the housing industry and the economy as a whole.

Excerpts from the Release…</p

The Market Composite Index, a measure of mortgage loan application volume, increased 6.7 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 6.5 percent compared with the previous week. The four week moving average for the seasonally adjusted Market Index isrn up 6.4 percent.

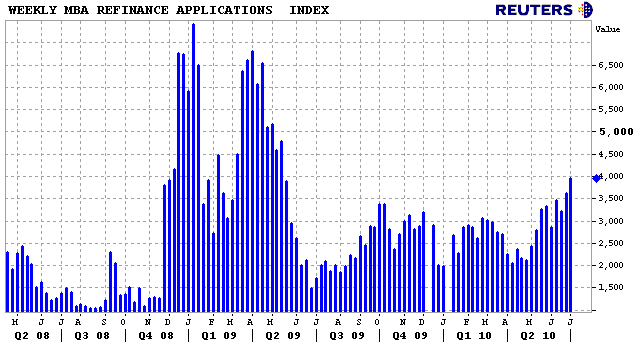

The Refinance Index increased 9.2 percent from the previous week and is the highest Refinance Index observed in the survey since the week ending May 15, 2009. The four week moving average is up 8.3 percent for the Refinance Index. The refinance share of mortgage activity increased to 78.7 percent of total applications from 76.8 percent the previous week, which is the highest refinance share observed in the survey since April 2009</p

</p

</p

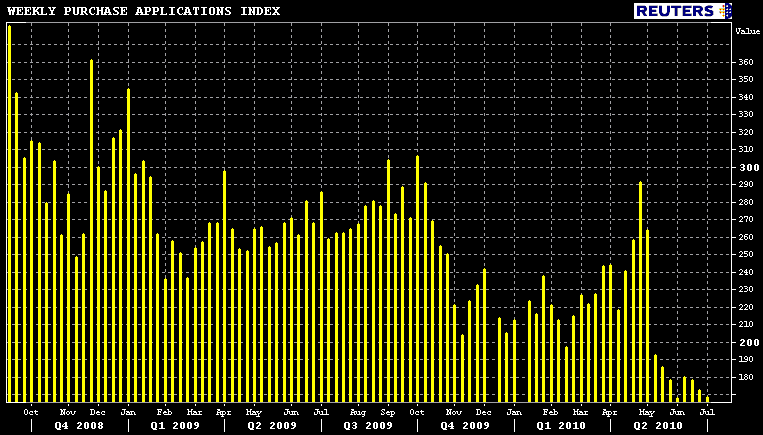

The seasonally adjusted Purchase Index decreased 2.0 percent from one week earlier. The unadjusted Purchase Index decreased 2.3 percent compared with the previous week and was 34.7 percent lower than the same week one year ago. The four week moving average is up 0.1 percent for the seasonally adjusted Purchase Index.</p

The Purchase Index has decreased eight of the last nine weeks.</p

</p

</p

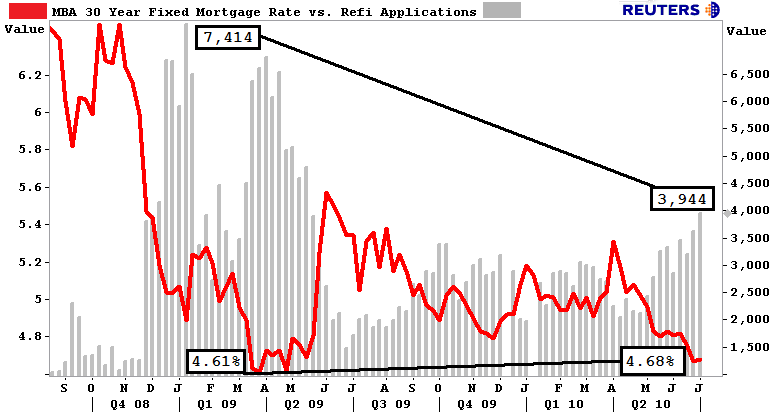

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.68 percent from 4.67 percent, with points decreasing to 0.86 from 0.96 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The effective rate slightly decreased from last week.

The average contract interest rate for 15-year fixed-rate mortgages increased to 4.11 percent from 4.06 percent, with points decreasing to 0.93 from 0.97 (including the origination fee) for 80 percent LTV loans. The effective rate also increased from last week.

The average contract interest rate for one-year ARMs increased to 7.20 percent from 7.05 percent, with points decreasing to 0.24 from 0.27 (including the origination fee) for 80 percent LTV loans. The adjustable-rate mortgage (ARM) share of activity increased to 5.4 percent from 4.7 percent of total applications from the previous week.</p

</p

</p

Michael Fratantoni,rn MBA’s Vice President of Research and Economics:</p

“Mortgage rates remained near record lows last week, as incoming data onrn the job and housing markets were weaker than anticipated. As more homeowners locked in to these low rates, the level of refinance applications increased to a new 13-month high…For the month of June, purchase applications declined almost 15 percent relative to the prior month, and were down more than 30 percent compared to April, the last month in which buyers were eligible for the tax credit.”</p

Is the rise in the refi index a factor of new borrowers entering the refi market or is it a factor of borrowers re-locking at another lender for a lower rate/cheaper cost? Originators, did you lose a deal or two last week? </p

Based on the mixed messages I've been hearing from lock desks, it appears that some lenders are enjoying a larger pipelines at the expensern of another originator(s). Martial law is definitely in effect on the street. Lenders are undercutting other lenders out of pure necessity (survival). L.Os are losing deals for an 0.125%. The environment is super competitive….</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment