Blog

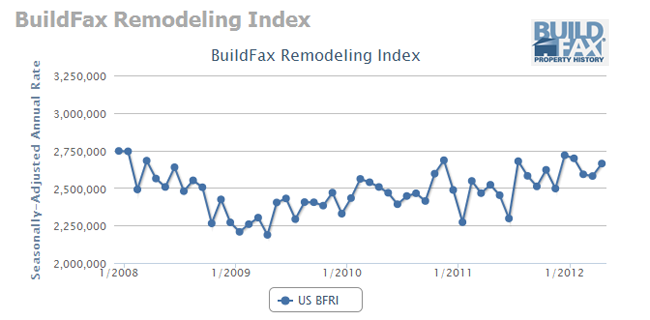

Remodeling Activity Improved Slightly in May

Remodeling increased in May to arnseasonally adjusted annual rate of 2,663,000. rnThis represents a 3 percent increase from the April rate of 2,579,000rnand, according to BuildFax which released its Remodeling Index (BFRI) onrnTuesday, is 6 percent higher than in May 2011 when the rate was estimated atrn2,521,000.</p

</p

</p

BFRI uses construction permits forrnresidential remodeling projects filed with local building departments to basernan estimate of the number of properties for which remodeling is scheduled. </p

On a regional basis the Index was mixed.rn In the Northeast it rose 3 percent fromrnApril to 529,788, 14 percent above the level in May 2011. The South, at 1,010,000, was down 4 percentrnmonth-over-month but up 2 percent year-over-year. In the Midwest the Index was 510,000, unchangedrnfrom the previous month and down 1 percent from May 2011. The greatest change was in the West where thernBFRI rose 7 percent to 736,000, a 9 percent annual increase. </p

“Remodeling growth appears to bernflattening out, although 2012 looks like it will still be significantly betterrnthan 2011,” said Joe Emison, Vice President of Research and Development atrnBuildFax.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment