Blog

Rental Vacancies, Homeownership Rates Rise

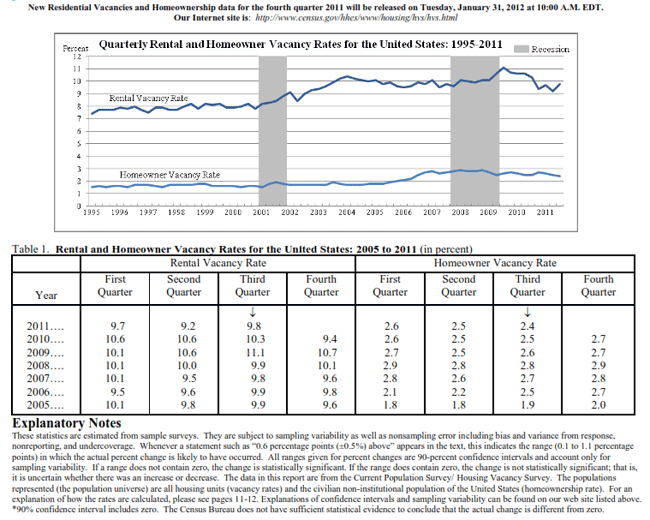

The Homeowner Vacancy Rate declined slightly in the thirdrnquarter while vacancies rose in rental housing according to information reportedrntoday by the U.S. Census Bureau. Rentalrnvacancies are currently at 9.8 percent, up from 9.2 percent in the second quarterrnbut 0.5 percent lower than one year earlier. rnRental vacancies peaked in the third quarter of 2009 at 11.1rnpercent. </p

What are termed homeowner vacancies, i.e. the proportion ofrnthe homeowner inventory that is vacant for sale, fell to 2.4 percent from 2.5rnpercent in both the second quarter and Q3 of 2010. This vacancy number has remained relativelyrnstable throughout the housing crises. </p

There were 132.4 million housing units counted in the thirdrnquarter, an increase of 519,000 since Q3 2010. rnOf that number, 113.5 million were occupied, an increase of 644,000rnunits. 75.2 million of those units werernowner occupied (-244,000) and 38299 were rental units (904,000). A totalrnof 14.2 percent of the housing stock is vacant. rn10.9 percent of all properties are vacant year-round properties, 3.2rnpercent are for rent, 1.4 percent are for sale, and 5.4 percent are being heldrnoff of the market.</p

Rental vacancies are slightly higher in principal citiesrn(10.4 percent) than in the suburbs (9.1 percent) and were lower in the thirdrnquarter of 2011 than in the corresponding quarter of 2010 (10.5 percent.) The change in the suburbs was more dramaticrnwith vacancies dropping to 9.1 percent from 10.1 percent year over year. Vacancies inside of MSAs decreased from 10.3rnpercent to 9.8. Homeowner vacanciesrnranged from 2.3 percent outside of MSAs to 2.6 percent in principal cities andrnall rates were slightly lower than the corresponding numbers in Q3 2010.</p

There was a wide variation among both rental and homeownerrnvacancies rates on a regional basis, and more definitive rates of change. In the Northeast the rental rate was 8.0 percent,rnup from 7.4 percent year-over-year and the homeowner rate was 2.2 (compared torn1.6 percent.) The Midwest rental raternwas 10.5 percent (down from 11.5 percent) and 2.4 percent for homeownerrnproperties (down from 2.6 percent.) Thernrental and homeowner rates were 12.2 percent and 2.5 percent in the Southrncompared to 12.9 percent and 2.8 percent in 2010, and in the West the ratesrnwere 7.3 percent and 2.3 percent compared to 8.1 percent and 2.6 percent.</p

The median asking price for vacant rental housing units in thernU.S. is $700, up slightly from Q2. Medianrnrents peaked in mid-2009 at around $725. rnThe median asking price for a vacant home for sale is approximatelyrn$140,000 down slightly from Q2 but well below the pre-crisis peak of $200,000rnin early 2007.</p

The current homeownership rate is 66.3 percent compared torn65.9 percent in Q2 and 66.9 percent one year earlier. The rate is highest in the Midwest (70.3rnpercent) and lowest in the West (60.7 percent). rnDemographically, the rate rises steadily through each age group, fromrn38.0 percent among those under 35 years to a peak of 81.1 percent among personsrn65 years of age and older. Non-HispanicrnWhites have a rate of 73.8 percent Blacks 45.6 percent, Hispanics 47.6 percentrnand all other races 56.4 percent. Not surprisingly, households with a familyrnincome equal to or greater than the median have a homeownership rate of 81.3rnpercent compared to a rate of 51.3 percent among household with less than arnmedian family income.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment